Fundamental Australian Dollar Forecast: Bullish

- The prognosis of lower US rates continues to support the Greenback

- The Aussie has props of its own, not least in ongoing labor market strength

- It’s hard to see a near-term AUDUSD reversal, unless US data make rate cuts less likely

Find out what retail foreign exchange traders make of the Australian Dollar’s prospects right now, in real time, at the DailyFX Sentiment Page

The Australian Dollar gained on its US big brother last week, a process largely but by no means solely driven by broad weakness in the latter.

The prime mover, obviously, is the expectation that the Federal Reserve will shortly begin to cut interest rates once again, whether or not it opts to do so at its next scheduled monetary policy conclave on July 31.

The Aussie does have some domestic support however.

Australia’s Jobs Miracle Endures

Labor market data released on July 18 showed an underwhelming headline net increase of just 500 jobs for June. However, there was a lot more cheer in the detail which showed an encouraging surge in full-time work as well as a steady participation rate. Investors know that the Reserve Bank of Australia places special emphasis on these numbers when it meets to set rates. The latest figures show that Australia’s enviable record of strong job creation endures.

Moreover there is a suspicion that, after back to back monthly rate cuts in June and July, the RBA has done all it intends to do on that front. Unless there is absolutely no sign that inflation is picking up, further cuts may be unlikely given the astonishing indebtedness of Australian consumers, understandable though it is after years of record-low borrowing costs.

The coming week is likely to see continued emphasis on the ‘USD’ side of the AUDUSD pair, with Fed commentary at its usual premium. Domestically markets will get a look at July’s timely Purchasing Managers Indexes for Australia.

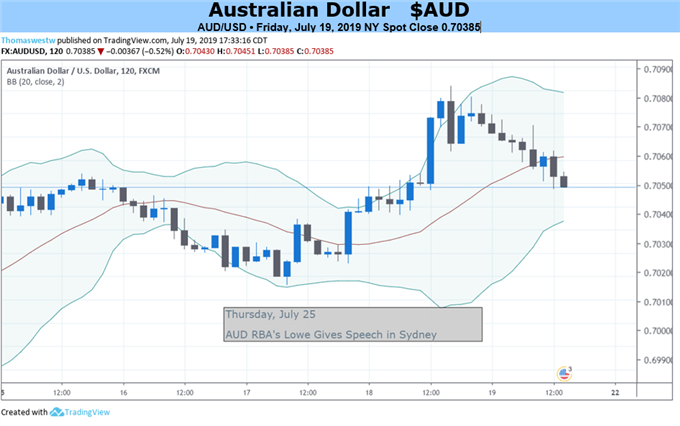

Two RBA Leaders Due to Speak

There’s also a speech from RBA Governor Philip Lowe due, on Thursday. Assistant Governor Christopher Kent will speak on Tuesday.

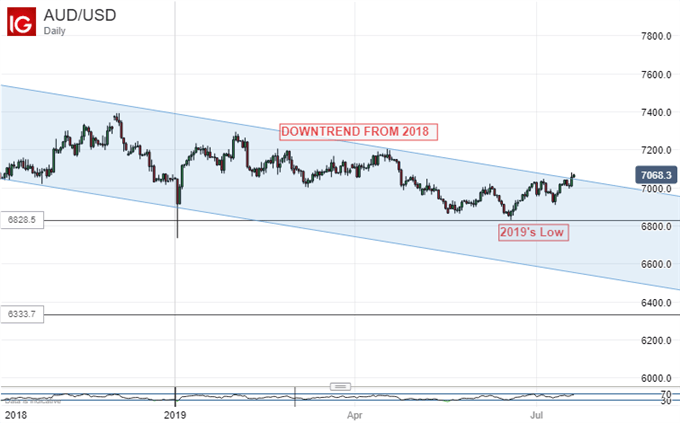

It’s possible that either or both of them will have something to say about the Australian Dollar’s recent bounce from its 2019 lows. A resurgent currency won’t be much help when it comes to juicing inflation, as it will keep the price of imports down.

However, given that the underlying source of this bounce has been broad US Dollar weakness, they seem unlikely to fight it too hard. The RBA is notably pragmatic about such things.

On balance then, the Aussie looks likely to continue to gain, unless the US data round puts near-term rate cuts there in doubt. It’s a bullish call this week.

Australian Dollar Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!