Australian Dollar, Reserve Bank of Australia Monetary Policy Meeting Minutes, Talking Points:

- RBA minutes proclaimed the central bank still ready to adjust policy as needed after two straight rate cuts

- Focus remains clearly on the labor market

- Investors don’t have long to wait for the next official look at that

Join our analysts for live, interactive coverage of all major economic data at the DailyFX Webinars. We’d love to have you along.

The Australian Dollar was steady Tuesday following the release of monetary policy meeting minutes from the Reserve Bank of Australia which suggested that while still-lower interest rates are not imminent, much will depend on the labor market.

The RBA cut the key Official Cash Rate to a new record low of 1% at the meeting in question on July 2, in the process giving borrowers only the second back-to-back monthly reductions since 2012.

The minutes said policymakers remain ready to adjust policy ‘as needed’ to support growth. The RBA remains convinced that plentiful spare capacity remains in the labor market, despite years of very low interest rates by historical standards, and that capacity was likely to remain for some time.

It also said that lower rates would keep the Australian Dollar lower than would otherwise be the case, noting the global shift towards easier monetary policy and ongoing trade tensions.

All up this was a rather ‘steady as she goes’ set of minutes, with the RBA likely to await more data to gauge the effects of this year’s policy action, particularly on stubbornly weak inflation. AUDUSD investors clearly didn’t find much to trouble them in either the headlines or the detail.

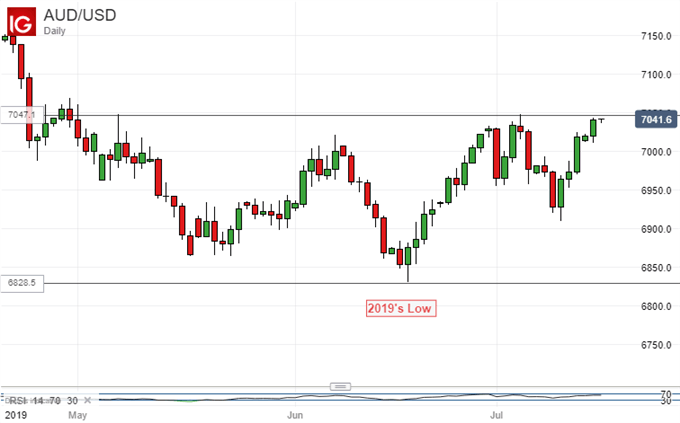

On its daily chart AUDUSD continues to rise from the 2019 lows reached back in mid-June. Much of its vigor can be accounted for by general pressure on the US Dollar. Markets are pretty certain that lower US interest rates will come in short order, possibly as soon as this month.

Australian Dollar, Reserve Bank of Australia Monetary Policy Meeting Minutes, Talking Points:

The currency may also have seen some relief that this week’s official Chinese growth numbers were no worse than expected, while June’s retail sales and industrial production data beat forecasts. Futures markets also price in only one further cut to Aussie interest rates over the next eighteen months, and even that may be a stretch if inflation shows signs of life in the interim.

The next big domestic risk event for the currency will of course be Thursday’s release of official Australian employment figures. An as-expected rise of only 9,000 jobs for June could see some of those rate cut bets increased. The jobless rate is expected to remain steady at 5.2%, with something close to that level appearing to be a floor for this cycle, despite the RBA’s belief that there remains much spare capacity to be taken up.

Australian Dollar Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!