Equity Analysis and News

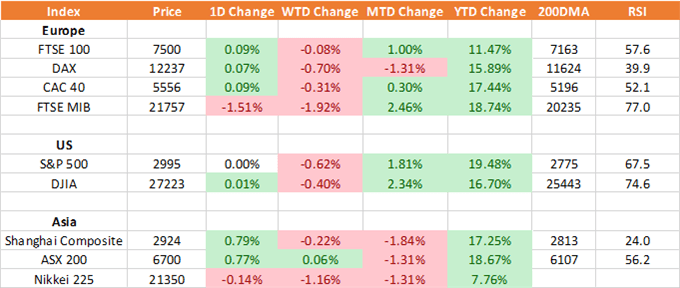

Source: Thomson Reuters, DailyFX

DAX | ECB to Signal Stimulus is on the Way

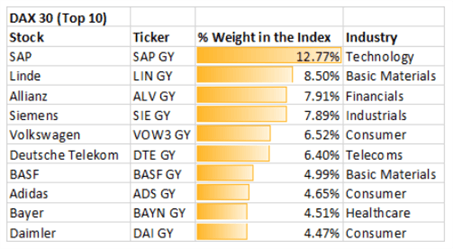

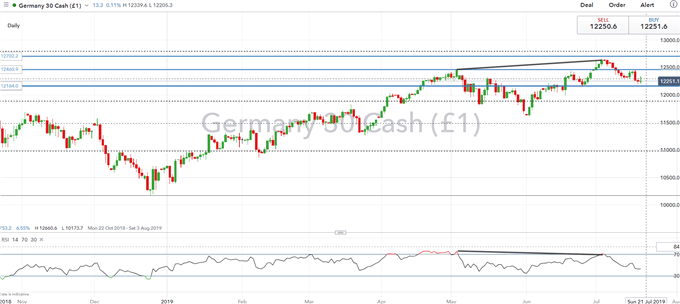

Investors will be eyeing the latest ECB meeting, which is likely to remain dovish as Draghi and Co. signal fresh stimulus measures is on the way. Data in the Eurozone has continued to disappoint, most notably that of Germany, next week’s PMIs should give us a clue as to whether the slowing momentum is set to continue. Sticking with the ECB, the question will be whether the central bank alludes to a package of stimulus measures of simply a rate cut. Given that the Draghi typically overdelivers on the dovish side, the base case is for a package of easing measures to be signaled for a move in September. Although, keep in mind that money markets are pricing in a 50/50 chance of a rate cut as soon as July. Elsewhere, the DAX will also take its cue from several earnings with BASF, Volkswagen and Deutsche Bank to report.

(Impact of earnings on stock markets)

DAX Price Chart: Daily Time Frame (Oct 2018 – Jul 2019)

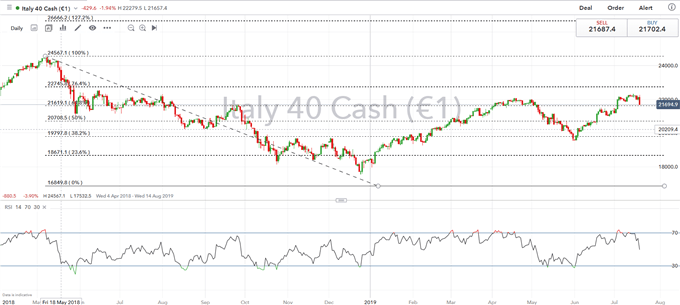

FTSE MIB | Are Italy Heading for Snap-Elections?

It has been made no secret that there are notable differences between the both the League and 5 Star party, however, these differences have seemed to boil over with both Deputy PM Salvini and Di Maio suggesting that the coalition could breakdown, thus raise the likelihood the Italy could face a snap-election. Subsequently, if noise continues to grow louder with regard to a potential election, uncertainty could begin to weigh on the broader market with the Bund-BTP vulnerable to widening.

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX