- Technical trade USD setups we’re tracking into the start of the week / month

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

Major Event to Drive US Dollar Price Action into the May Open

The US Dollar Rally is trading near the yearly highs into the close of April trade with major event risk on the horizon. The economic docket is loaded this week with the FOMC, BoE and Non-Farm Payrolls (NFP) on tap- expect volatility into the monthly open. In this webinar we review updated technical setups on DXY, EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CHF, EUR/CHF, USD/CAD, USD/JPY, Gold and Crude Oil (WTI).

Why does the average trader lose? Avoid these Mistakes in your trading

Key Levels in Focus

DXY – Key topside resistance objectives at 98.52 & 98.69 – areas of interest for price exhaustion IF reached. Support at 97.71 with bearish invalidation raised to the 2018 high-day close at 97.42.

EUR/USD – Looking for possible exhaustion on a final low towards 1.1060s. Initial resistance at 1.1186/92 – near-term bearish invalidation at 1.1242/45.

GBP/USD – Sterling testing BIG slope support – initial resistance at 1.2958/68 with near-term bearish invalidation lowered to 1.3000. A break below Friday’s low would shift the focus towards 1.2788/98.

AUD/USD – Daily doji off the yearly low-day close at 7005 in Aussie has produced a recovery back above the yearly open at 7042. Could get a larger rebound here but border risk is lower while below the median-line around 7090s. A break of the lows exposes 6955.

Gold – Price recovery extended into confluence resistance on Friday at 1288. Near-term risk is lower with 1275/76 and the low-day close at 1272 both areas of interest for possible exhaustion – IF the broader price move is higher. Key resistance at 1292/93.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

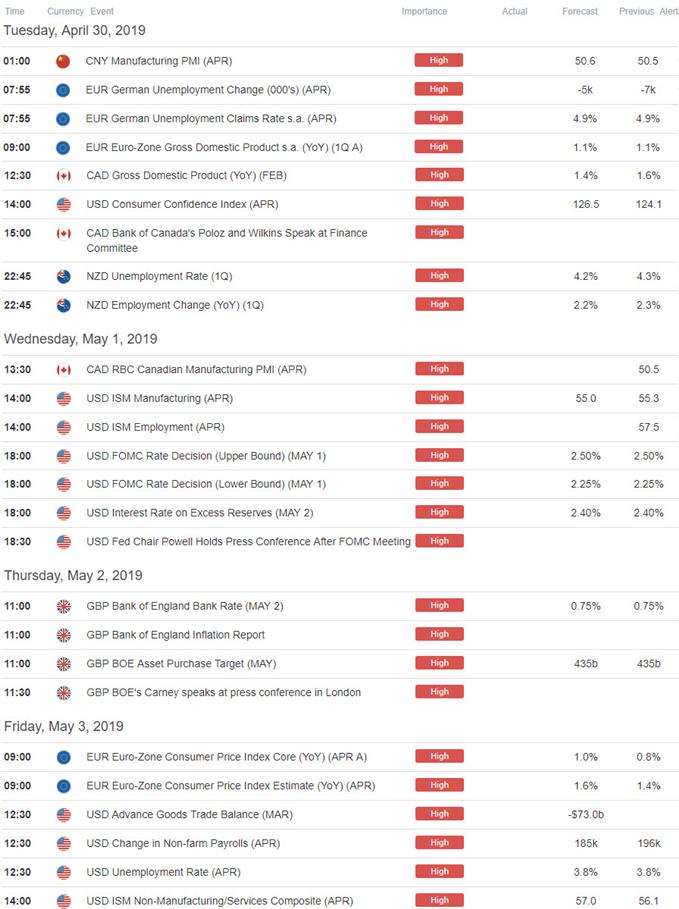

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- Sterling Price Outlook: GBP/USD Bears Grind into Trend Support

- Aussie Price Outlook: AUD/USD Collapse Targeting 70 Support

- Gold Price Outlook: XAU Offers a Glimmer of Hope at Fresh 2019 Lows

- Kiwi Price Outlook: New Zealand Dollar Recovery could be Short-Lived

- Canadian Dollar Price Outlook: USD/CAD Eyes Breakout as Loonie Coils

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex