Gold Technical Price Forecast: XAU/USD Weekly Trade Levels

- Gold price updated technical trade levels - Weekly Chart

- XAU/USD snaps three-week losing streak- focus is on breakout of 1738-1791 range

- New to Gold Trading? Get started with this Free How to Trade Gold -Beginners Guide

Gold prices are poised to snap a three-week losing streak with XAU/USD up nearly 0.4% in early US trade on Friday. The advance comes on the heels of a third failed attempt to break below a key support zone we’ve been tracking for months now and the battle-lines are drawn heading into October. These are the updated targets and invalidation levels that matter on the XAU/USD weekly technical chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more.

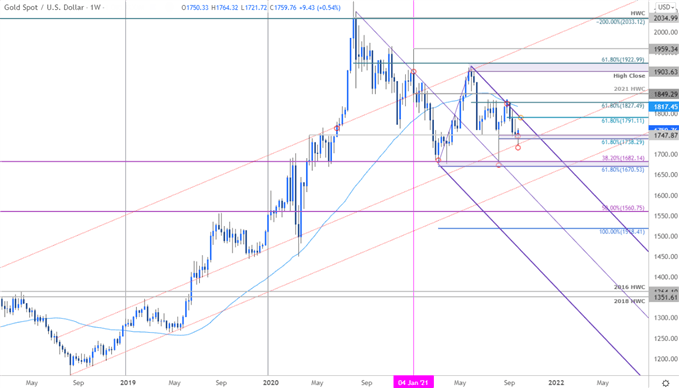

Gold Price Chart - XAU/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; Gold on Tradingview

Notes: In my last Gold Weekly PriceOutlook we noted that the XAU/USD had, “plunged nearly 5% off the Monthly high with the sell-off now probing key weekly support here at 1738/47- looking for a pivot here…” Price registered an intraweek low at 1721 before recovering with gold set to close the week just above this key support zone. Is an exhaustion low in place?

Initial weekly resistance is eyed with at the upper parallel / the 61.8% Fibonacci retracement of the September decline at 1791- a breach above this threshold would be needed to alleviate downside pressure with such a scenario exposing the 52-week moving average and the 61.8% retracement of the broader June decline at 1824. Ultimately a close above the yearly high-week close at 1849 is needed to mark resumption of the broader uptrend in gold. Weakness below this week’s low would be technically damaging for the bulls with such a scenario likely to threaten another accelerated bout of selling towards critical support at the Fibonacci confluence / yearly lows at 1670/82.

Bottom line: Gold has failed a third attempt to close below key support at 1738/47 – the immediate focus once again is on possible inflection off this mark into the October open. From a trading standpoint, look for losses to be limited to this week’s low IF price is heading higher with a close above 1791 needed to fuel a larger recovery. Review my latest Gold Price Outlook for a closer look at the near-term XAU/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

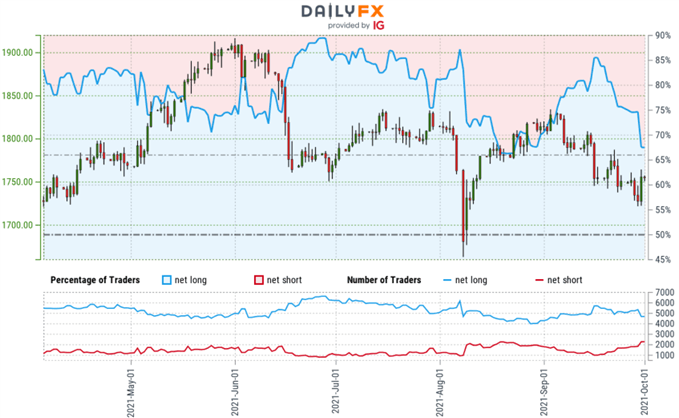

Gold Trader Sentiment – XAU/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-long Gold- the ratio stands at +2.13 (68.03% of traders are long) – typically bearishreading

- Long positions are7.30% lower than yesterday and 7.37% lower from last week

- Short positions are10.82% higher than yesterday and 29.89% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

---

Previous Weekly Technical Charts

- US Dollar Index (DXY)

- Sterling (GBP/USD)

- Japanese Yen (USD/JPY)

- Australian Dollar (AUD/USD)

- Canadian Dollar (USD/CAD)

- Sterling (GBP/USD)

- Crude Oil (WTI)

- Euro (EUR/USD)

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex