Japanese Yen Technical Price Forecast: USD/JPY Weekly Trade Levels

- Japanese Yen technical trade levels update – Weekly Chart

- USD/JPY breakout marks six-weeks / rips to fresh multi-year highs – resistance ahead

- Support 112.40, 111.60/98 (critical)- Key resistance at 114.55/92, 116

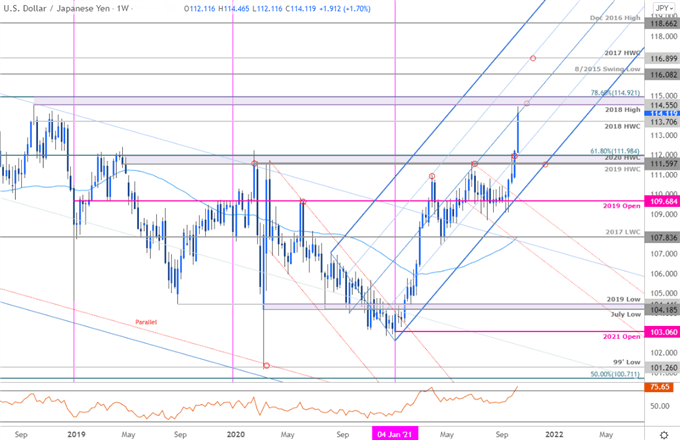

The US Dollar surged nearly 5% against the Japanese Yen since the September lows in USD/JPY with a six-week rally ripping to fresh three-year highs on Friday. While the broader focus remains constructive, the immediate rally may be vulnerable in the weeks ahead as the breakout approaches the first major resistance hurdle in price. These are the updated targets and invalidation levels that matter on the USD/JPY weekly price chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Yen technical setup and more.

Japanese Yen Price Chart – USD/JPY Weekly

Chart Prepared by Michael Boutros, Technical Strategist; USD/JPY on Tradingview

Notes: In last month’s Japanese Yen Weekly Price Outlook we highlighted that USD/JPY breakout was imminent as price coiled into, “uptrend support here (near ~109.07) just ahead of the Fed and the focus is on the weekly close with respect to this trendline... Ultimately a breach / close above the 61.8% retracement at 110.53 would be needed to mark resumption of the broader uptrend towards 111.60s again.” The US Dollar ripped higher into the October open with USD/JPY rallying nearly 3% month-to-date.

The advance is now approaching a major resistance zone just higher at 114.55/92- a region defined by the 2018 swing high and the 78.6% Fibonacci retracement of late-2016 decline. Note that the median-line also converges on this threshold over the next few weeks and further highlights the technical significance of this key pivot zone. Weekly support now rests back at former resistance around the 112-handle with broader outlook constructive while within this formation. A topside breach from here exposes subsequent resistance objectives at the August 2015 swing low at 116.08 and the 2017 high-week close at 116.90.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: The USD/JPY breakout has extended into the first major resistance hurdle at 114.55/95. From a trading standpoint, a good region to reduce long-exposure / raise protective stops – losses / pullbacks should be limited to the 25% parallel (currently near ~112.40s) IF price is heading higher on this stretch with a weekly close above this key threshold needed to keep the immediate long-bias viable. I’ll publish an updated Japanese Yen Price Outlook once we get further clarity on the near-term USD/JPY technical trade levels.

Japanese Yen Trader Sentiment – USD/JPY Price Chart

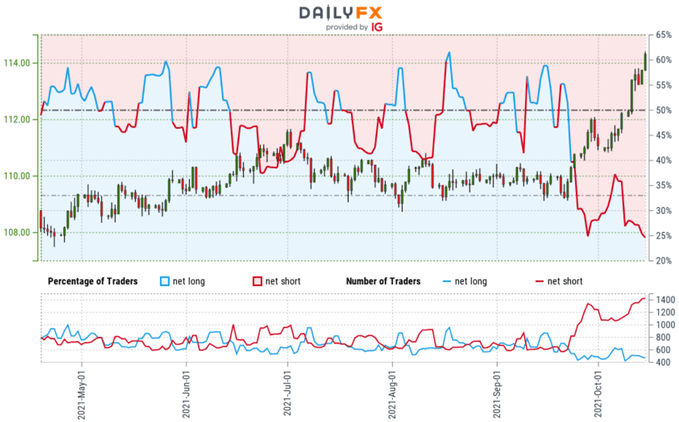

- A summary of IG Client Sentiment shows traders are net-short USD/JPY - the ratio stands at -2.67 (27.27% of traders are long) – typically bullish reading

- Long positions areunchanged than yesterday and 11.67% lower from last week

- Short positions are 11.36% lower than yesterday and 9.84% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. Traders are less net-short than yesterday but more net-short from last week. The combination of current positioning and recent changes gives us a further mixed USD/JPY trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 2% | 0% |

| Weekly | 12% | -16% | -6% |

---

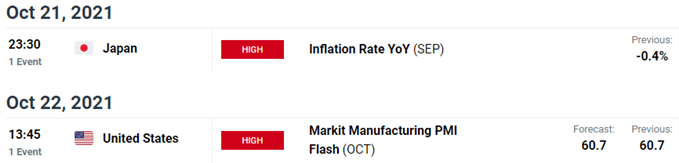

Key US / Japan Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

- US Dollar Index (DXY)

- Crude Oil (WTI)

- Canadian Dollar (USD/CAD)

- Euro (EUR/USD)

- Gold (XAU/USD)

- Sterling (GBP/USD)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex