US Dollar Technical Price Outlook: DXY Weekly Trade Levels

- US Dollar technical trade level update – Weekly Chart

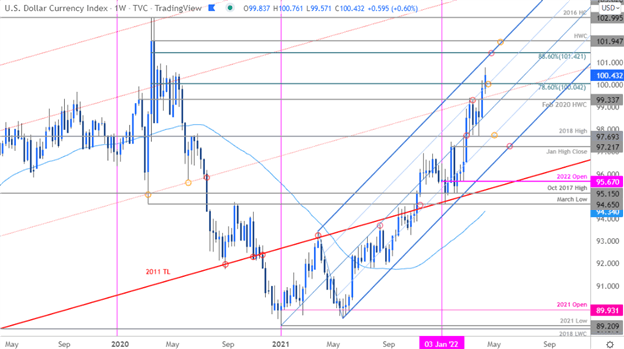

- USD breakout extends for a second week to fresh yearly high – look for stabilization at ~100

- DXY support 99.33, 97.69, 97.21(key) – Resistance 101.42, 101.94 (critical)

The US Dollar Index surged more than 0.6% this week with DXY registering fresh yearly highs on a second consecutive weekly rally. The advance takes the index above the 100-psychological barrier and we’re looking for stabilization around this threshold over the next few weeks. These are the updated technical targets and invalidation levels that matter on the US Dollar Index weekly price chart. Review my latest Strategy Webinar for an in-depth breakdown of thisDXY technical setup and more.

US Dollar Index Price Chart – DXY Weekly

Chart Prepared by Michael Boutros, Technical Strategist; US Dollar Index on Tradingview

Notes: In my last US Dollar Weekly Price Outlook we noted that DXY was testing the upper bounds of the uptrend while noting that, “A breach higher from here keeps the focus on the 78.6% retracement of the 2020 decline at 100.04- look for a larger reaction there for guidance IF reached.” A breach this week accelerated higher with the index now attempting to close well above ahead of the extended holiday break. Does this breakout have staying power?

Initial weekly resistance now eyed at the 88.6% Fibonacci retracement of the 2020 decline at 101.42 and the 2020 high-week close at 101.94- both areas of interest for possible topside exhaustion IF reached. Initial weekly support now back at the February 2020 high-week close at 99.33 backed by the median-line – losses should be limited to this slope IF price is indeed heading higher. Subsequent support at the 2018 high at 97.69 with broader bullish invalidation raised to the January high-close at 97.21.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: The US Dollar breakout has extended to fresh yearly highs and a weekly close above 100 is needed to keep the immediate advance viable. From a trading standpoint, be on the lookout for an exhaustion high on a stretch towards the upper parallel – a good zone to reduce portions of long-exposure / raise protective stops. Ultimately, a pullback may offer more favorable opportunities closer to uptrend support. Keep in mind we head into an extended holiday break- expect thin liquidity conditions for the next few days- stay nimble here. I’ll publish and updated US Dollar Price Outlook once we get further clarity on the near-term DXY technical trade levels.

Previous Weekly Technical Charts

- Gold (XAU/USD)

- Euro (EUR/USD)

- Crude Oil (WTI)

- Canadian Dollar (USD/CAD)

- Australian Dollar (AUD/USD)

- S&P 500, Nasdaq, Dow

- Japanese Yen (USD/JPY)

- British Pound (GBP/USD)

--- Written by Michael Boutros, Technical Strategist with DailyFX

Follow Michael on Twitter @MBForex