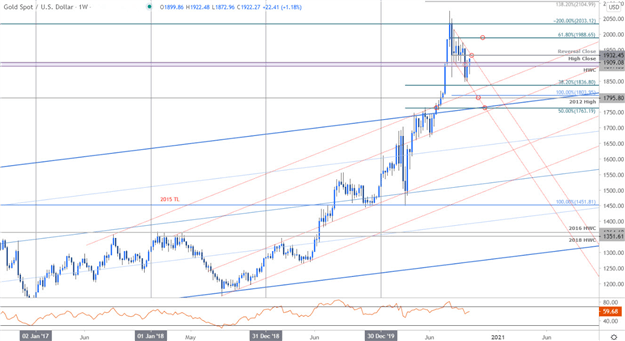

Gold Technical Price Outlook: XAU/USD Weekly Trade Levels

- Gold price updated technical trade levels - Weekly Chart

- XAU/USD rebound now approaching multi-week downtrend resistance– 1932 critical

- New to Gold Trading? Get started with this Free How to Trade Gold -Beginners Guide

Gold prices are poised to mark a second consecutive weekly advance with XAU/USD rallying more than 1.3% to trade at 1925 ahead of the New York close on Friday. The recent advance keep price within the confines of the broader August decline however and the focus is on a reaction just higher near downtrend resistance. These are the updated targets and invalidation levels that matter on the gold weekly charts. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more.

Gold Price Chart - XAU/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; Gold on Tradingview

Notes: In last month’s Gold Weekly PriceOutlook we noted that XAU/USD had, “broken lower and while the broader technical structure is constructive, the risk remains for a deeper correction before resumption… look for topside exhaustion on recoveries ahead of 1932 IF price is indeed heading lower.” Gold registered a low at 1848 before rebounding with the recovery now approaching a technical confluence at channel resistance / August weekly-reversal close at 1932- looking for a reaction up here.

A topside breach / close above would be needed to keep the rally viable with such a scenario exposing subsequent resistance objectives at the 61.8% Fibonacci retracement at 1988 and the record high-week close at 2034. Support unchanged at 1836 and the 2020102 high /. 100% extension at 1795-1803- both levels of interest for possible downside exhaustion IF reached.

Bottom line: Gold prices have rebounded off channel support with the recovery now approaching downtrend resistance- look for inflection on a test of 1932 for guidance. From a trading standpoint, a good zone to reduce long-exposure / raise protective stops- be on the lookout for topside exhaustion into channel resistance IF prices is still heading lower. Ultimately, a larger correction may offer more favorable opportunities closer to uptrend support. A topside breach would likely fuel an accelerated rally here- stay nimble. Review my latest Gold Price Outlook for a closer look at the near-term XAU/USD technical trading levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Gold Trader Sentiment – XAU/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-long Gold- the ratio stands at +3.01 (75.09% of traders are long) – bearishreading

- Long positions are9.42% lower than yesterday and 8.60% lower from last week

- Short positions are11.07% higher than yesterday and 13.67% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

---

Previous Weekly Technical Charts

- Euro (EUR/USD)

- Australian Dollar (AUD/USD)

- Canadian Dollar (USD/CAD)

- British Pound (GBP/USD)

- Gold (XAU/USD)

- Crude Oil (WTI)

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex