US Dollar Price Forecast Talking Points:

- The ONE Thing:The US Dollar remains in an uptrend rising 5.5% over the last year, and is about to enter a month with favorable seasonal trends. US Dollar weakness did appear after a strong NFP, but the broad trend appears favorable.

- Seasonality is hard to ignore in markets, and May seasonal trends are clear, it’s tough to be short the DXY. USfundamentals appear set to turn higher in the US Dollar’s favor after the Fed revealed a view that low-inflation should be waited out, and not fought with lower rates.

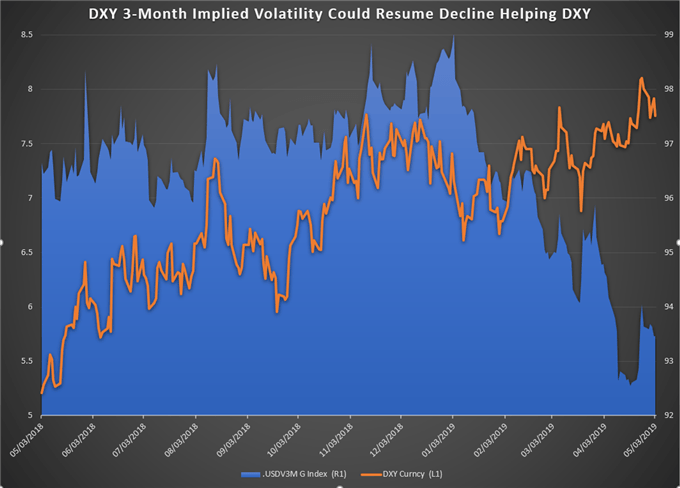

- US Dollar 3M Volatility, which has been inversely correlated to DXY looks set to resume its decline into May, a historically favorable month for DXY gains.

Technical Forecast for US Dollar / DXY: Bullish

Traders tend to be myopic. They tend to overweight today’s price action or the last three days of price action and tend to discount the broader picture. A trader who looks at Friday’s price action is likely confident that DXY weakness has arrived. However, a trader looking at the last year of price action would have a hard time agreeing with that conclusion.

However, the broad picture sets the stage for a strengthening USD with a Federal Reserve that communicated less intent than perceived to cut rates, as we head into a month that is surprisingly US Dollar positive.

Overall: DXY up ten of the last twelve years - Average gain 1.47%

- USDNOK up ten of the last twelve years - Average gain 2.18%

- GBPUSD down nine straight years - Average loss 2.43%

- EURUSD down eight of the last nine years - Average loss 2.74%

- AUDUSD down seven of the last nine years - Average loss 3.75%

- NZDUSD down seven of the last nine years - Average loss 2.43%

- USDCAD up seven of the nine years - Average gain 2.09%

- USDCHF up five of the last seven years - Average gain 1.81%

- USDJPY up six of the last twelve years - Average gain 0.44%

Data source: Bloomberg

Looking above, the propensity for Dollar strength seems to lean favorably for the month of May.

Technical Insight: US Dollar Bears Own the Burden of Technical Proof

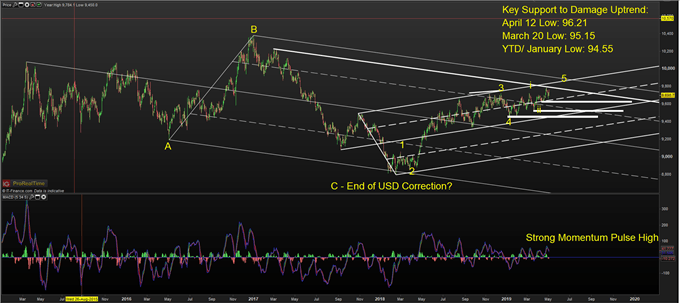

Chart Source: ProRealTime charting, IG UK Price Feed. Created by Tyler Yell, CMT

Last week, the US Dollar Index traded to the highest level since the summer of 2017. Traders should note that a pullback within the broader scope is seemingly more likely to be profit taking bulls, and not newly minted bears.

The chart above looks to three key support levels from 2019 pivots amid a momentum burst per the MACD (5,34,5) that hit the highest level since November 2018. A pullback, therefore, should not be a surprise, especially given the low volatility environment, which tends to see profitable trades closed out with the look to re-enter a more cost-effective entry later via a pullback as opposed to riding or adding to the trade in hope for a further extension.

The chart below provides some additional insight.

US Dollar Weighted Implied Volatility May Align with DXY Melt-Up

Source: Bloomberg

An additional insight can be gleaned from the 3M implied volatility of the US Dollar in a weighted fashion similar to the US Dollar Index weightings of:

| EURUSD @ 57.6% | USDJPY @ 13.6% |

|---|---|

| GBPUSD @ 11.9% | USDCAD @ 9.1% |

| USDSEK @ 4.2% | USDCHF @ 3.6% |

Since 2019, traders have seen lower volatility, and at the same time, a strong US Dollar. Should this trend of low volatility continue, which summer is famous for providing in FX and broader markets, we could see the melt-up continue further as long as the support levels above continue to hold.

We’ll see.

Follow the DailyFX Podcasts on A Platform That Suits You

iTunes: https://itunes.apple.com/us/podcast/trading-global-markets-decoded/id1440995971

Stitcher: https://www.stitcher.com/podcast/trading-global-markets-decoded-with-dailyfx

Soundcloud: https://soundcloud.com/user-943631370

Google Play: https://play.google.com/music/listen?u=0#/ps/Iuoq7v7xqjefyqthmypwp3x5aoi

---Written by Tyler Yell, CMT

Tyler Yell is a Chartered Market Technician. Tyler provides Technical analysis that is powered by fundamental factors on key markets as well as trading educational resources. Read more of Tyler’s Technical reports via his bio page.

Communicate with Tyler and have your shout below by posting in the comments area. Feel free to include your market views as well.

Talk markets on twitter @ForexYell

Other Weekly Technical Forecast

Australian Dollar (AUD) Outlook: AUDUSD Still Looking Into The Abyss?

Crude Oil Weekly Technical Forecast: Support May Soon Lead to Rally

Pound Surge Has GBPUSD Range to Run, But Resistance Coming in Elsewhere