EURUSD Technical Highlights:

- Euro may bounce a bit/consolidate before lower

- Levels to watch on top and bottom-side

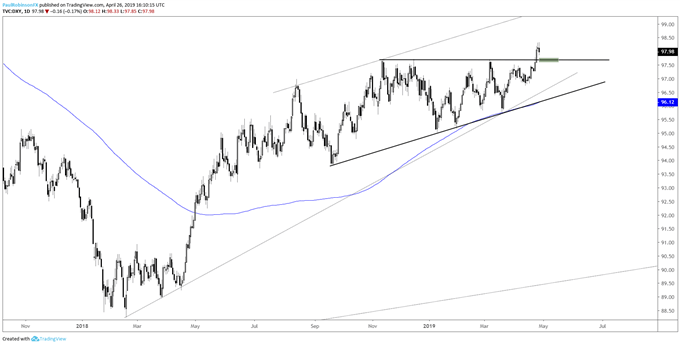

- DXY breakout is sustainable above 9771

Check out the DailyFX Trading Guides page for intermediate-term forecasts, educational content aimed all experience levels, and more!

Euro may bounce a bit/consolidate before lower

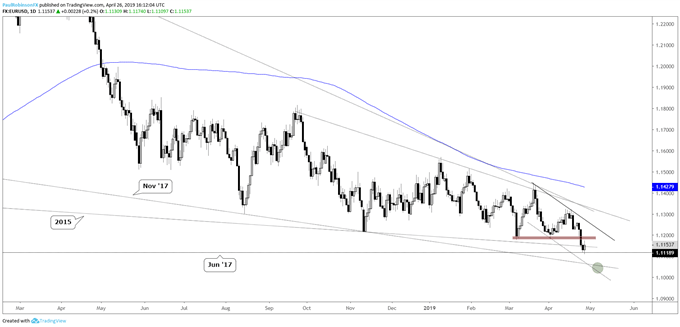

Last week, the Euro took a spill to lows not seen in almost two years, but found a few buyers near a couple of levels of support which might keep a bid in it temporarily. A trend-line from 2015 and a minor swing low from 2017 were touched to end the week.

EURUSD may bounce around a bit, digesting its most recent set of losses, but as long as it doesn’t start immediately showing real power to the upside then further losses are anticipated. Trading through the March and April lows should prove problematic. If the Euro does, then look for a trend-line from last month to keep an advance in check.

Looking lower, there is some support to consider, but given that the angle of these lines runs with the trend there looks to be a better than average chance they don’t provide a significant bid. The November 2017 under-side trend-line is the biggest concern, followed by a parallel to the March trend-line.

Low volatility has kept the Euro moving lower in gradual fashion. If in the coming sessions a drop below 11000 can unfold, putting the Euro clearly below noted support, this could change with an uptick in volatility.

In the event of a drop below 11000, a gap-fill from the French election down at 10724 will be targeted. It’s been on my mind for a while, and I do believe it will get filled at some point, but of course the path to doing so is still uncertain. Next week may help provide more conviction that it could come sooner rather than later.

Check out the IG Client Sentiment page to find out how changes in positioning in major markets could signal the next price move.

EURUSD Daily Chart (Levels, lines to watch)

The DXY broke out strongly last week above the 9771 level, triggering a mostly developed ascending wedge pattern. The Euro is ~57% of the weighting of this index; so goes the Euro goes the DXY for the most part. As long as 9771 isn’t breached on a daily closing basis, then I will give the breakout the benefit of the doubt. A retest of the breakout may occur here shortly and offer a solid risk/reward proposition for Dollar bullish bets.

US Dollar Index (DXY) Daily Chart (Bullish above point of breakout)

Australian Dollar Forecast - Aussie Price Forecast: AUD/USD, AUD/JPY Near Critical Support

Crude Oil Forecast –Favorable Forces Remain Despite Sharp Drop

British Pound Forecast – GBPUSD Rate to Stage Larger Rebound on Hawkish BOE Forward Guidance

US Dollar Forecast - US Dollar Weekly Price Outlook: Rally at Multi-year Trend Resistance

Gold Forecast – Gold Prices Earn Biggest Week Rally in Three Months, Is this a Reversal?

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX