- Aussie weakness continued as a very visible theme throughout this week, with a bit of support showing up on Thursday and Friday.

- AUD/USD tested a big level of long-term support at the price of .7000.

- AUD/JPY set a fresh 2019 high just last week; but a stark contrast has shown in near-term price action in the pair.

- AUD/USD Bears Challenge the Big Figure at .7000

AUD/USD Technical Price Forecast: Bullish

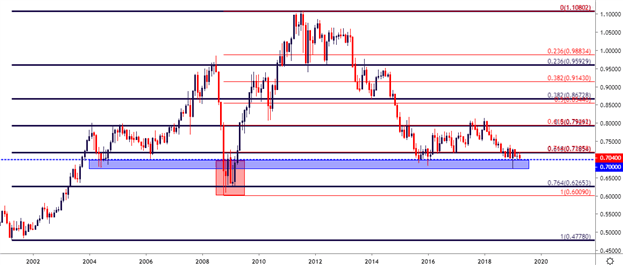

Just last week, AUD/USD was carrying bullish breakout potential as prices tested a key Fibonacci level at two-month highs. This price is at .7206, and this is the 76.4% retracement of the 2008-2011 major move in the pair; and more important than any theoretical justifications, this price helped to set support in the latter-portion of last year, and resistance in the early-portion of this year.

AUD/USD Weekly Price Chart

Chart prepared by James Stanley

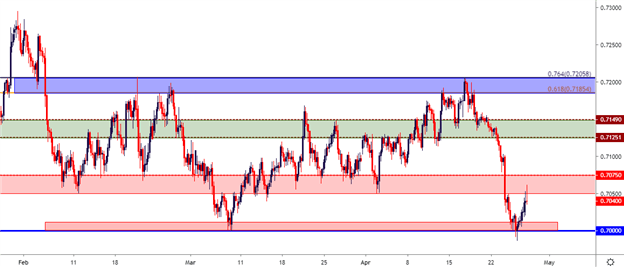

That resistance inflection last week initially led to a cautious move lower. But bears stayed on the attack this week as the US Dollar broke-out to fresh 22-month highs, and prices in AUD/USD folded all-the-way back down to the support side of the multi-month range around the .7000 big figure. This psychological level was crossed briefly during Thursday trade but, at this point, buyers have been able to push prices back-above, indicating a hold of support, at least for now.

AUD/USD Four-Hour Price Chart

Chart prepared by James Stanley

AUD/USD: Will Long-Term Support Allow for Range-Fill in Shorter-Term Themes?

The allure of support at the .7000 level is not a new scenario in AUD/USD. This price has come into play as support in a number of environments since price action rallied above in 2003. And most of these scenarios have carried the same general response of buyers helping to hold the lows at-or-around this level, with the notable exception of the financial collapse in 2008 when prices pushed below and remained for around six months. This level was tested through again in the early-part of this year but, similarly, buyers responded to push back-above.

AUD/USD Monthly Price Chart

Chart prepared by James Stanley

AUD/JPY Snaps Back from Fresh 2019 Highs, Builds Evening Star on the Weekly Chart

AUD/JPY Technical Price Forecast: Bearish

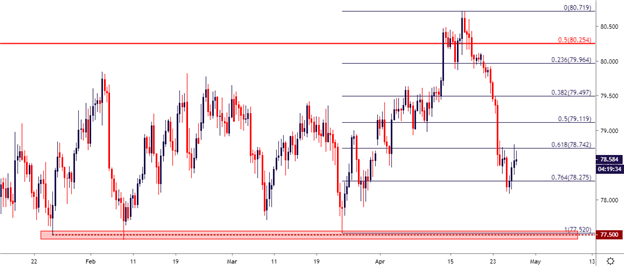

A similar bearish move played out in AUD/JPY this week, accented by an additional amount of Yen-strength than what was seen in AUD/USD above. Last week saw AUD/JPY tip-toe up to a fresh 2019 high with prices rallying above the 80-level. This began to open the possibility of bullish trend strategies, but a stark contrast showed this week as Yen-strength came into favor and held through the bulk of this week’s trade. AUD/JPY is now trading very near the lows that held through the past three months, taken from around the 77.50 level.

AUD/JPY Eight-Hour Price Chart

Chart prepared by James Stanley

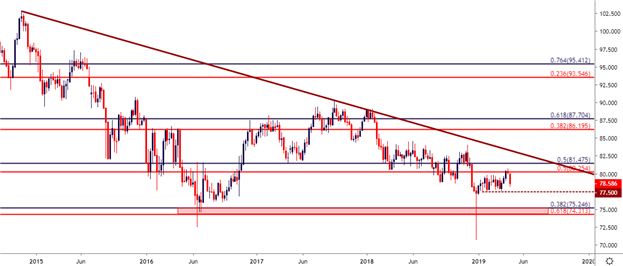

The backdrop here, however, is a bit different than what was looked at above, and the key difference is proximity to longer-term support. As shown in the AUD/USD price chart above, prices in the major pair have had a tendency to cauterize support around the .7000 big figure. But in AUD/JPY – considerable space exists below current range support that can keep the door open for bearish continuation potential. From the weekly price chart below, this zone is highlighted around the 75.00 psychological level.

If the Aussie is to remain weak, or should risk aversion themes become more prominent, the downside in AUD/JPY could be an attractive theme, more so than what’s present in AUD/USD at the moment given that big area of long-term support that came into assist with this week’s lows.

AUD/JPY Weekly Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX