EURUSD Technical Highlights:

- Will last week’s break bring with it more momentum or get reversed?

- Days to come will tell a lot; support levels to keep an eye on with more weakness

Check out the Euro Q1 Forecast to see our analysts’ intermediate-term fundamental and technical outlook.

Will last week’s break bring with it more momentum or get reversed?

The pattern the past few months in these times of extraordinarily low volatility has been for moves in the Euro, in both directions, to look like they want to build on momentum only to reverse. We are about to find out if this latest installment of weakness can last or will those who just sold be kicking themselves as another breakdown turns out to be false.

If the pattern is to change then EURUSD can’t burst higher in the coming days, it can bounce around a bit, but it can’t rip and take back with it the Thursday dagger down day. If only a minor bounce happens then the trend of quick reversals may be over, and a sustainable downdraft may be in the works in the days/weeks ahead.

Should we see a strong recapture of Thursday’s move it won’t turn the picture bullish, but it does keep the same trading approach on the table. Sell rallies, buy dips. We should know a lot more about whether the Euro is on the move or not in the days to come.

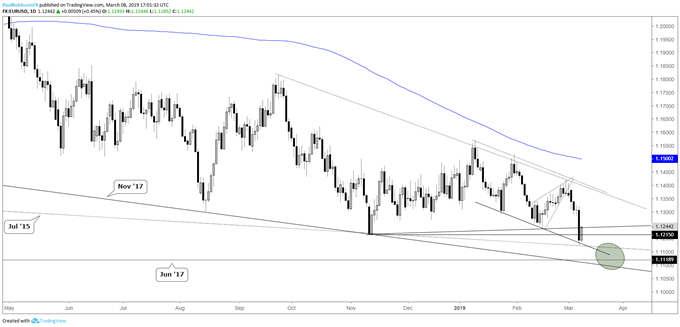

In the event of more weakness below the Jan-current underside channel line and Jul 2015 t-line, the area around 11100 will become the next important spot to watch price action, where the trend-line running lower from November 2017 intersects with a minor swing-low created during June of that same year. A decent number of support lines running through the vicinity just below, but broader trend forces and pent up volatility ready to pop may be enough to help the Euro soon slice through…

Traders are heavily long EURUSD, see the IG Client Sentiment page to find out how changes in positioning can act as a signal for price direction.

Looking for a fundamental perspective on EUR? Check out the Weekly EUR Fundamental Forecast.

EURUSD Daily Chart (Support levels to watch)

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

Other Weekly Fundamental Forecast:

Australian Dollar Forecast – AUD/USD, AUD/NZD Downtrend May Pause. AUD/JPY Targets New 2019 Low

Oil Forecast – Crude Oil Price Falls From 2019 High On Economy Fears, US Dollar Strength

British Pound Forecast – Charts Keeping Positive Bias

US Dollar Forecast – Dollar Traders On Alert After EURUSD's 1.1200 Slip Pushes DXY to Ceiling

Gold Forecast – Gold Chart Shows Prices Flirting with $1,300 Again After Anti-Risk Bid