Sterling FX-Pairs Technical Analysis

Q1 Trading Forecasts for a wide range of Currencies and Commodities, including GBPUSD and EURGBP with our fundamental and medium-term term technical outlook.

GBPUSD volatility is on the rise and is expected to stay elevated ahead of the three Brexit votes in w/c March 12. The current one-week volatility implies a range of more than 200 pips which should warn traders that moves may become sharp around next week’s votes. GBPUSD remains stubbornly robust despite this week’s modest losses with sell-offs attracting buyers, as the recent series of higher lows and higher highs remain intact. The pair are back at lows seen two-weeks go but are still over six big figures higher than the 2019 low of 1.2435. The uptrend remains in place with Fibonacci resistance at 1.3177 the initial target. To go higher, Brexit fundamentals need to turn positive. To the downside, support between 1.2930 and 1.2890.

Looking for a fundamental perspective on Crude oil? Check out the Weekly Crude Oil Fundamental Forecast.

GBPUSD Daily Price Chart (April 2018 - March 8, 2019)

Becoming a Better Trader � Rules to Trade by | Webinar

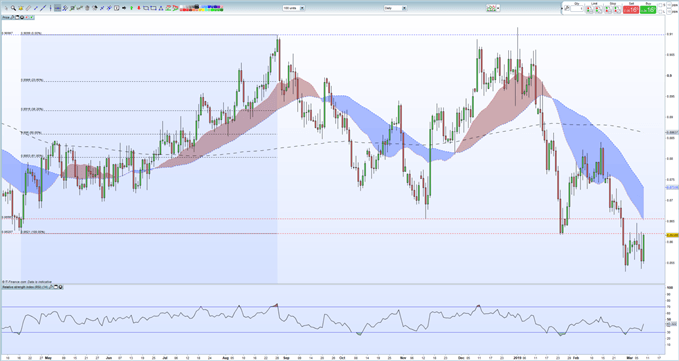

EURGBP is bouncing off Thursday’s post ECB lows but the recent series of lower highs remains in place for now. Tuesday’s weekly high at 0.8646 remains the first test for the pair, followed closely by the 20-day moving average and nd old horizontal low around 0.8655. The RSI indicator suggest the pair are moving out of oversold territory which may underpin slightly higher prices. In the medium-term the two recent lows at 0.8535 and 0.8529 remain in sight and if broken decisively would open the way up to the May 2017 swing-low at 0.8384.

EURGBP Daily Price Chart (April 2018 - March 8, 2019)

Interest Rates and the Foreign Exchange Market

DailyFX has a vast amount of resources to help traders make more informed decisions. These include a fully updated Economic Calendar, and a raft of constantly updated Educational and Trading Guides

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1

Other Weekly Fundamental Forecast:

Australian Dollar Forecast – AUD/USD, AUD/NZD Downtrend May Pause. AUD/JPY Targets New 2019 Low

Oil Forecast – Crude Oil Price Falls From 2019 High On Economy Fears, US Dollar Strength