Equity Analysis and News

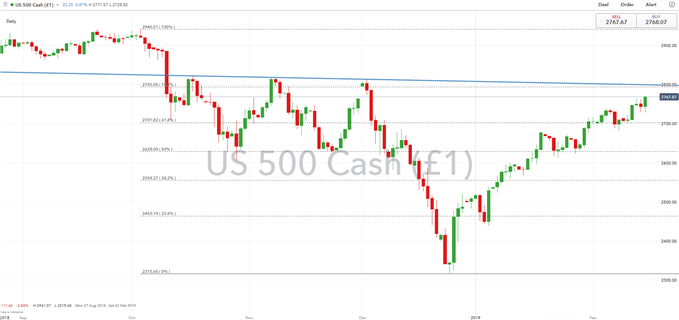

S&P 500 | Topside Resistance Situated at 2800

After a strong week of gains, in which the S&P 500 rose over 2% on the week, the index is now eyeing key topside resistance at 2800. Previous attempts to make a firm break had been rejected. As such, there is a risk of a potential pullback. However, a closing break above leaves scope for a test of 2900. Near term support is situated at 2730-40.

Looking for a fundamental perspective on Equities? Check out the Weekly Equities Fundamental Forecast.

S&P 500 Price Chart: Daily Time Frame (Aug 2018 – Feb 2019)

DAX | Bounces Off Rising Trendline

The DAX has seen somewhat of a corrective bounce from the rising trendline, which in turn brings the 2019 highs in focus (11390). However, provided that the DAX holds below 11500, the index continues to remain in the broader downtrend from the 2018 peak. Price action has been relatively neutral with the DAX ranging from 11000-11300 over the past two weeks. Given the risks of US auto tariffs on the EU risks a tilted for a potential a break of the range to the downside, which in turn exposes a move towards 10800.

DAX Price Chart: Daily Time Frame (Aug 2018 – Feb 2019)

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Other Weekly Technical Forecast:

Australian Dollar Forecast – AUD/USD Eyes Resistance, AUD/NZD Resumes Fall, GBP/AUD May Bounce

Oil Forecast – The 2019 Crude Bull Market Has Arrived

British Pound Forecast – GBPUSD & EURGBP

US Dollar Forecast – Dollar Within Reach of Two-Year High but Reversal Pressure High

Gold Forecast – Gold Prices Stopped Short of Resuming Dominant Uptrend, Watch RSI

Euro Forecast – Euro Flirting with Support Break

Equity Forecast – Technical Outlook: S&P 500, DAX