Philippine Peso, Indonesian Rupiah, Philippine Central Bank, Bank of Indonesia - Talking Points

- Philippine Peso and Indonesian Rupiah gained after central bank rate decisions

- Rate cuts were paused as policymakers looked forward to an economic rebound

- Market optimism and capital flowing into emerging markets may sink the USD

Over the past two days, the Philippine and Indonesian central banks held monetary policy announcements. This is as the Philippine Peso (PHP) and Indonesian Rupiah (IDR) appreciated against the US Dollar.

Starting with the former, Bangko Sentral ng Pilipinas (BSP) left its benchmark overnight borrowing rate unchanged at 2.25% as expected. This marked a pause following persistent easing since the end of last year when rates were at 4.00%. This break occurred despite the nation entering a technical recession for the first time in almost 30 years. In the second quarter, growth slipped -16.5% y/y versus -9.4% anticipated.

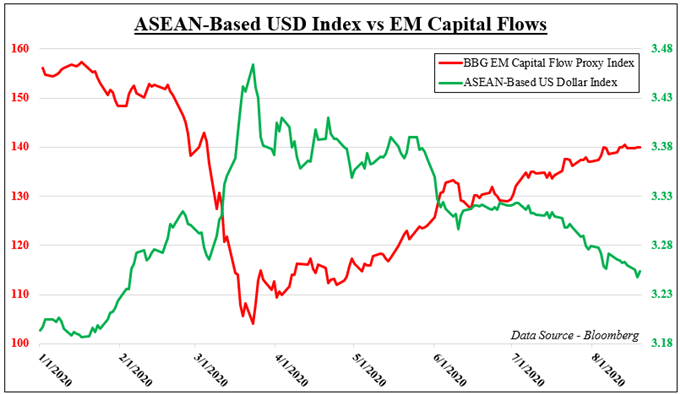

The pause may have been a combination of rising inflation expectations and both local and external economic recovery expectations. The latter could be contributing to capital flowing back into emerging markets again, see chart below. For ASEAN currencies like PHP and IDR, capital flows can be a key fundamental factor that drives their performance. These inflows have been denting demand havens like the US Dollar.

Philippine Central Bank Highlights:

- The real estate loan limit was raised to 25% from 20%

- These new limits mean 1.2 trillion Pesos in additional liquidity

- The outlook for global economic growth remains subdued

- The Monetary Board sees early signs of an economic recovery

- The inflation outlook for 2020 was raised to 2.6% from 2.3% prior

Meanwhile, the Bank of Indonesia also followed a similar path as the BSP. The central bank left the benchmark 7-day reverse repo rate unchanged at 4.00% as anticipated. This also marked a pause after easing by 25 basis points in July. Gains in IDR could be attributed to the commitment from the Bank of Indonesia to intervene and defend the Rupiah, as expected.

Governor Perry Warjiyo added that recent weakness in IDR has been due to technical factors and that there is scope for it to gain further. On the bright side, the central bank sees the economy improving starting in the third quarter as domestic growth is anticipated to be better in the second half of this year.

Bank of Indonesia Highlights:

- The global economy is showing recovery signs after 2Q pressure

- Financial market uncertainty remains high

- The 2020 current account gap is seen below 1.5% GDP

- The IDR remains stable

- The central bank will continue market intervention to defend the currency

- The Rupiah remains undervalued

- The Bank of Indonesia is to stay in a quantitative path

- The central bank will maintain loose monetary policy

A combination of aggressive monetary and fiscal stimulus globally to help combat the economic shock of the coronavirus outbreak has been helping to keep market mood upbeat. The United States, which is the world’s largest economy, has seen the S&P 500 stock market index recently touch an all-time high. Investors often look to the US as a bellwether for global economic health. This optimism may keep boosting ASEAN FX.

For USD/PHP and USD/IDR technical analysis, check out my latest update and feel free to follow me on Twitter @ddubrovskyFX for ASEAN FX news

ASEAN-Based USD Index Versus Emerging Market Capital Flows

*ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter