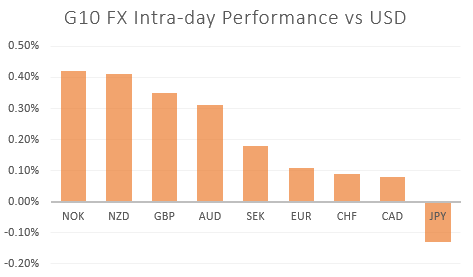

MARKET DEVELOPMENT – GBP/USD Choppy, AUD/USD and NZD/USD Outperform

DailyFX 2019 FX Trading Forecasts

GBP: The Pound is broadly firmer this morning following the UK Supreme Court decision to rule that Boris Johnson’s suspension of parliament was deemed unlawful. Parliament is set to recovene tomorrow, however, while a no-deal Brexit risk in the short-term has eased, this is yet another challenge to the PM’s authority, while the political uncertainty is set to continue. Ultimately a choppy reaction in the Pound, which is likely to remain volatile in the run up to the EU Summit on October 17-18. Failure to reach a palatable deal with the EU that will pass parliament will likely see an extension to Article 50 with a general election to follow.

AUD / NZD: High beta currencies underpinned on continued fresh trade optimism with the Australian Dollar given an added boost following less dovish than expected comments from RBA Governor Lowe, which in turn reigned in market pricing of an October rate cut (55% from 80%. Elsewhere, NZD traders will be focusing on the RBNZ rate decision. As it stands, markets are currently 22% priced in for a 25bps cut at the September meeting and 80% priced in for a November rate cut. However, commentary from RBNZ Governor Orr at last months Jackson Hole Symposium hinted that they were willing to wait-and-see following their surprise 50bps cut in August. The stance has also been reiterated from the RBNZ’s shadow board who had largely agreed that another rate cut is not required at this present stage. With this in mind, a neutral RBNZ could see a move lower in the cross, breaking below 1.0700. Of note, bearish positioning in NZD is at extreme levels, which in turn raises the risk of a sharp rally in the currency.

Source: DailyFX

WHAT’S DRIVING MARKETS TODAY

- “Gold Price Eyes Fresh Higher High, Silver Price Retains Latest Rally” by Nick Cawley, Market Analyst

- “DAX 30 & CAC 40 Charts: Ready to Turn Lower?” by Paul Robinson, Currency Strategist

- “UK Supreme Courts Rules PM Johnson's Prorogation as Unlawful, GBP/USD Rise Reversed” by Justin McQueen, Market Analyst

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX