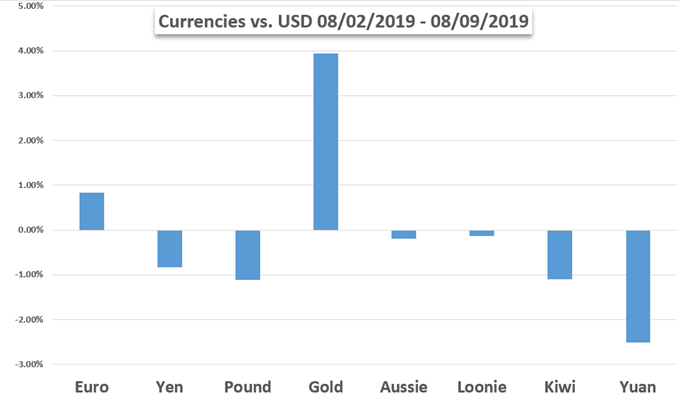

There was a healthy mix of fundamental fuel this past week, but scheduled event risk and themes like systemic growth gave way to the more headline-worthy trade wars. That is likely to remain the case moving forward even if there are few opportunities for linear escalation of this systemic financial threat. While countries may not ‘win’ from this fight, certain assets can…

US Dollar Price Outlook Eyes Trade War, Data Induced Fed Cuts

The US Dollar stumbled last week and is at risk of further downside if US-China trade tensions worsen and high-impact economic data due for release disappoints which stand to accelerate Fed rate cut bets.

Rising ECB Rate Cut Odds Can’t Hold Down the Euro

The fact of the matter is, the Euro’s appeal may simply boil down to the current market environment being a situation analogous to the notion that it is one of the ‘cleaner shirts in the dirty laundry.’

AUD Braces for Escalating Trade War Tensions, Employment Data

The Australian Dollar may face increased selling pressure if local jobs data disappoints against the backdrop escalating tensions in the US-China trade war.

GBPUSD Rate Vulnerable to Slowing UK Inflation, Retail Sales

Fresh data prints coming out of the UK may do little to heighten the appeal of the British Pound amid the growing threat of a no-deal Brexit.

Crude Oil Prices at Risk as US-China Trade War Sours Growth Bets

Crude oil prices look vulnerable to deeper losses after hitting a seven-month low as US-China trade war escalation sours the outlook for global economic growth.

Gold Price Weekly Forecast: Bullish Breakout Remains In-Play

Gold is currently consolidating just under $1,500/oz. after hitting a six-and-a-half year high of $1,511/oz. earlier this week. Positive fundamentals remain but markets don’t move in a straight line.

Dow Jones, DAX 30, FTSE 100 Forecasts for the Week Ahead

As trade wars and monetary policy look to maintain their position at the helm, markets will be offered insight on another major theme that could rattle fragile sentiment.