AUD FUNDAMENTAL FORECAST: BEARISH

- Australian Dollar may face increased selling pressure next week

- US-China trade war tensions are likely to continue bruising AUD

- RBA hinted using “unconventional” tools to boost CPI, job growth

See our free guide to learn how to use economic news in your trading strategy !

The Australian Dollar may get bruised this week if local jobs data falls short of expectations and provides even greater impetus for the Reserve Bank of Australia (RBA) to slash interest rates. Furthermore, US-China trade tensions are rapidly escalating and could further deteriorate in the coming week. Beijing has a number of policy measures in its economic arsenal it may be willing to use now that relations have worsened.

Last week was a turbulent period for markets. After US President Donald Trump threatened to impose an additional 10 percent tariff on $300 billion in Chinese goods, Beijing responded with halting all US-based agricultural imports. Furthermore, China angered the US after it set the daily reference rate for USDCNY at 6.9225, dangerously close to the 7.00 psychological barrier. Then, later in the week, it passed this level.

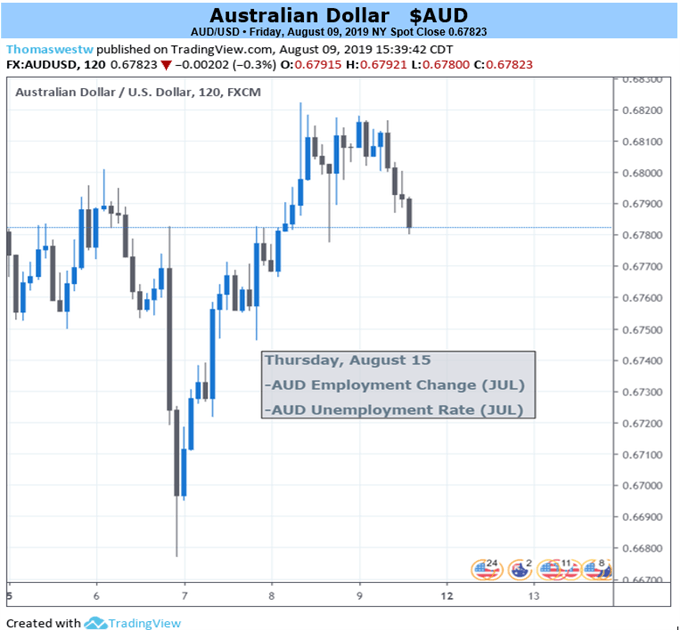

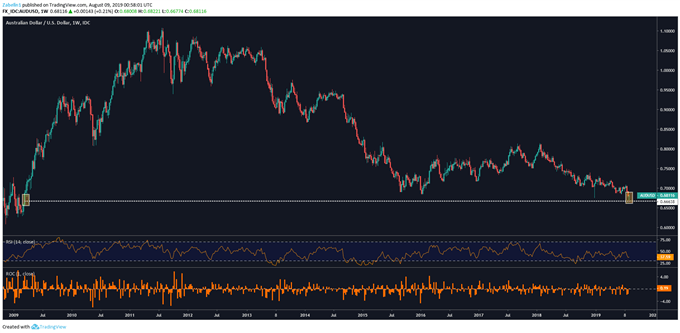

AUDUSD Falls to Lowest Point Since March 2009 Amid Escalating Trade War Tensions

AUD chart created using TradingView

Early into Friday’s trading session, RBA Governor Philip Lowe said that further rate cuts may be warranted and even hinted at implementing “unconventional” policy measures to boost inflation and job growth. This is not unlike the Reserve Bank of New Zealand that also indicated it is willing to consider adopting non-orthodox policy tools to meet its objectives. This preceded their decision to slash rates by 50bps last Wednesday.

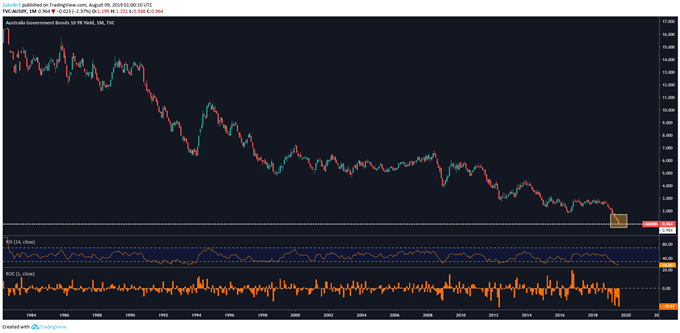

Australian 10-Year Bond Yields Reach a New Low at 0.964 Percent

AUDUSD chart created using TradingView

Central banks in both developing and developed economies have not only been cutting rates but have been surprising more dovish and easing more than median estimates had indicated. Increasing political risk out of Europe and inter-regional trade tensions in Asia could further dampen sentiment and weigh on growth and investment. In this world, it is likely the cycle-sensitive AUD will find it hard to gather upside momentum.

AUD TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter