EURO FORECAST – TALKING POINTS

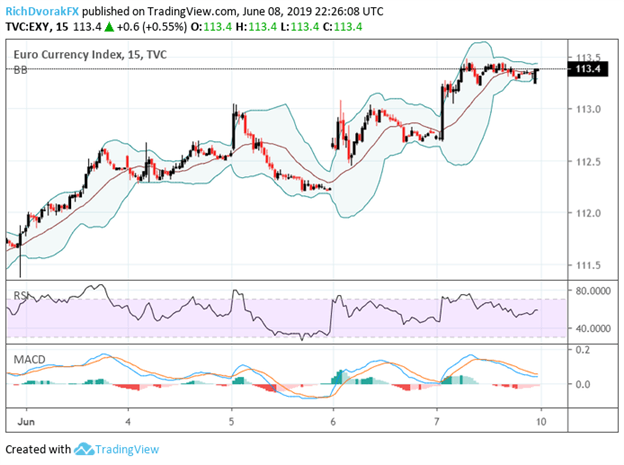

- EUR has climbed roughly 1.5 percent so far this month according to the Euro Currency Index (EXY) and could push higher

- ECB projected confidence with its firm stance on rates along with upward revisions to 2019 GDP growth and inflation estimates

- See real-time trader positioning in EURUSD for insight on biases of market participants with IG’s Client Sentiment Tracker

Last week’s ECB meeting echoed recent strength in the Euro as President Mario Draghi and the Governing Council communicated a firm stance on monetary policy. The central bank stated that it “now expects the key ECB interest rates to remain at their present levels at least through the first half of 2020.” The language crushed rate trader’s expectations that the ECB would lower rates by the end of the year which were pricing in a 47.5 percent probability prior to last Thursday’s press statement.

EURO CURRENCY INDEX (EXY) PRICE CHART: 15-MINUTE TIME FRAME (MAY 31, 2019 TO JUNE 07, 2019)

The ECB also revealed details of its third round of targeted long-term refinancing operations (TLTROs) such as that itsthird phase of loan offerings, which was announced on March 7, will assess a 10-basis point premium over the key lending rate. TLTRO-III will begin September 2019 and end March 2021, with each quarterly offering having a two-year maturity. The ECB states that TLTROs aim to help "preserve favorable bank lending conditions and the accommodative stance of monetary policy."

Also, Euro rates likely gained ground last week owing to the ECB’s surprising 0.1 percent upward revision to both 2019 GDP growth and inflation estimates to 1.2 percent and 1.3 percent respectively. Although, longer-term outlook turned darker with the central bank lowering its expectations for 2020 economic growth to 1.4 percent from an already-bleak 1.6 percent amid rising risks to global trade.

The relatively hawkish guidance to the ECB's accommodative policy stance contrasts the string of dovish moves by other major central banks like the RBA who cut rates earlier last week. Meanwhile, market expectations for the Federal Reserve to ease policy have amassed quickly in response to growing uncertainty over US trade policy with China and Mexico in addition to worsening economic data like last Friday’s NFP report.

EURUSD PRICE CHART VERSUS GERMAN BUND AND US TREASURY YIELDS

With a firm stance communicated by the ECB and dovish leaning by the Fed, the spread between German Bunds and US Treasuries looks to continue its climb higher, which could boost demand for the Euro and keep EURUSD bid. Next week should be relatively quiet for the Euro, however, with few events and data readings on deck according to the DailyFX Economic Calendar. The Sentix Eurozone Investor Confidence gauge for June will be released Tuesday at 8:30 GMT while April's Euro Area Industrial Production is due Thursday at 9:00 GMT. Also, ECB President Draghi will give a speech in Frankfurt on Wednesday at 8:15 GMT.

Euro headwinds include the risk that Chair Powell and FOMC members reel in the market's expectations that the Fed will cut rates soon, which would likely send EURUSD snapping back lower. In addition, the Japanese Yen could find strength and drag EURJPY down if market sentiment sours and appetite for risk ebbs stemming from deteriorating global growth prospects and rising uncertainty from trade wars. As for EURGBP, BOE Governor Mark Carney has stated that rates in the UK could head higher if the British economy continues to perform in line with the central bank's outlook and is a theme that could limit upside in the Euro against the Pound Sterling. Meanwhile, EURAUD could threatens to head lower if inspiring Aussie jobs data is reported next week.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter