Fundamental Forecast for CAD: Neutral

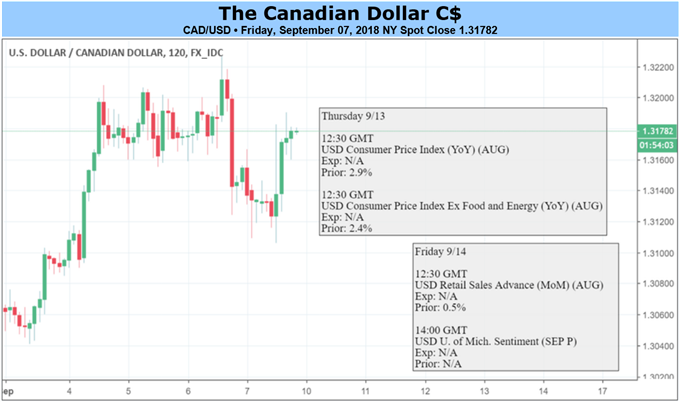

USDCAD Analysis and Talking Points:

- Canadian Dollar Awaits NAFTA Outcome

- Widening US-Canadian 2yr Spreads Pushes USDCAD to Better Levels

See our Q3 CAD forecast to learn what will drive the CAD through the quarter.

Widening US-Canadian Bond Spreads Lifts USDCAD

The past week saw the Canadian Dollar weaken towards 1.32 against the greenback with much of the same factors contributing to the weakness. US-Canadian 2yr rate differentials continue to widen with the spread back above 60bps and thus moving in favour of USD buying vs CAD. Elsewhere, US data has outperformed relative to Canada amid strong NFP and ISM reads, while ongoing NAFTA discussions continue to cloud the outlook for the Loonie. The Bank of Canada provided a relatively balanced statement, leaving the door open for a hike in October.

US and Canadian 2yr Bond Spreads

CAD Awaits NAFTA Outcome for Direction

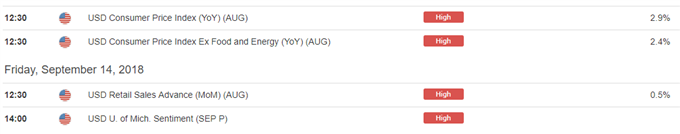

As we look towards next week, the Canadian Dollar may see somewhat of a quieter week from the data front with a lack of tier 1 data to drive price action in the CAD. However, USDCAD may experience some volatility from the USD side with CPI due. Direction in CAD will likely depend on the tone regarding the ongoing NAFTA discussions with focus on whether an agreement can be reached.

Source: DailyFX

USDCAD PRICE CHART: DAILY TIMEFRAME (January-September 2018)

USDCAD Technical Levels

Resistance 1: 1.3180-1.32 (Resistance Area)

Resistance 2: 1.3290 (July high)

Support 1: 1.3115 (23.6% Fibonacci Retracement)

Support 2: 1.3080-90 (Trendline support)

CAD TRADING RESOURCES:

- See our quarterly CAD forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

https://www.dailyfx.com/free_guide-tg.html?ref-author=mcqueen

Other Fundamental Forecast:

New Zealand Dollar Forecast - NZD/USD Prices May Fall on Swedish Election and as ECB Sinks Euro

Japanese Yen Forecast - The Japanese Yen Moves into the Tariff Conversation

Oil Forecast – Trade Wars and an Emerging Market Crisis Likely To Keep Oil Volatile

British Pound Forecast – Positive Momentum Will Continue to Drive Sterling Higher

Gold Forecast - Gold Prices Vulnerable to Sticky U.S Core CPI, Retail Sales

Australian Dollar Forecast – Australian Dollar Still Short Of Buy Signals Despite Strong Data

Chinese Yuan Forecast - Yuan Awaits China's Retaliation on US Tariffs, PBOC's Guidance