Fundamental Australian Dollar Forecast: Bearish

Australian Dollar Talking Points:

- AUD/USD remains mired despite strong economic numbers

- There’s now a clear disconnect between these and interest rate expectations

- This trend won’t lift in the coming week

Find out what retail foreign exchange traders make of the Australian Dollar’s prospects right now, in real time, at the DailyFX Sentiment Page

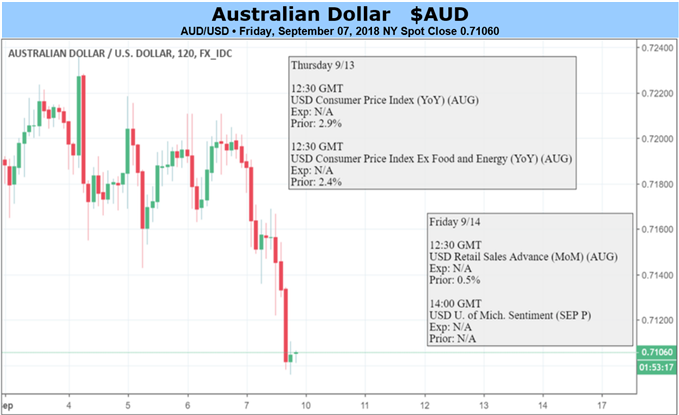

Last week’s blockbuster second-quarter growth report failed to stop the Australian Dollar from plumbing new, 20-month depths against its big US brother.

That seems a little harsh of the market when the 3.4% annualized rise in Gross Domestic Product was not only ahead of market forecasts, but also the best showing since the fall of 2012.

So why couldn’t the Australian Dollar glean more support than it did?

Well, all GDP data are open to charges of being too historic to matter in the frenetic, second-to-second world of foreign exchange. There is some truth here too.

What price second quarter data when we’re close to the end of the third? There’s also a broad suspicion that this year has been a bit front-loaded in global growth terms, with a slowing Chinese economy, seemingly endless trade spats and worries about emerging markets likely to make the second half much tougher.

Then there are some more specific Australian problems. None of them is new. Inflation remains stickily low, consumer debt remains stickily high. Indeed the markets still do not think that record-low interest rates are going anywhere for at least another year. With US rates still very likely to rise, the Aussie remains in a very tough place.

This week will not change that, but it will bring official employment data out of Australia. If job creation holds up then the Aussie could get a little bounce but, as we saw in the case of last week’s growth data, those bounces tend not to last. There was another one when the Reserve Bank of Australia was perhaps a little less dovish than markets had feared in its post-rate-decision statement. But that didn’t last either.

Given that gloomy trade headlines, too, are all-but assured thanks to the Trump White House’s apparently renewed focus on Japan, as well as China and Western Europe, as a trade-surplus ‘sinner,’ it is very hard to see any reason why the Aussie Dollar’s travails should halt this week.

So it is yet another bearish call.

Resources for Traders:

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!

Other Fundamental Forecast:

New Zealand Dollar Forecast - NZD/USD Prices May Fall on Swedish Election and as ECB Sinks Euro

Japanese Yen Forecast - The Japanese Yen Moves into the Tariff Conversation

Oil Forecast – Trade Wars and an Emerging Market Crisis Likely To Keep Oil Volatile

British Pound Forecast – Positive Momentum Will Continue to Drive Sterling Higher

Gold Forecast - Gold Prices Vulnerable to Sticky U.S Core CPI, Retail Sales