New Zealand Dollar Fundamental Forecast: Bearish

NZD Fundamental Outlook – Swedish Election, ECB, EUR/USD, NZD/USD, Trade Wars

- Pro-risk New Zealand Dollar depreciated as emerging markets flirted bear market territory

- Swedish election could reduce the urgency for ECB to hike in 2019, sending EUR/USD lower

- China vulnerable to US tariffs, Japan could be next. Trade war fears could hurt NZD/USD

Have a question about what’s in store for New Zealand Dollar next week? Join a DailyFX Trading Q&A Webinar to ask it live!

The pro-risk New Zealand Dollar headed for another week of declines, depreciating against its major counterparts as trade war fears weighed on global benchmark stocks such as the S&P 500. Emerging markets were also pressured as they flirted with bear market territory. The MSCI Emerging Markets ETF index dropped almost 20 percent from its peak back in January.

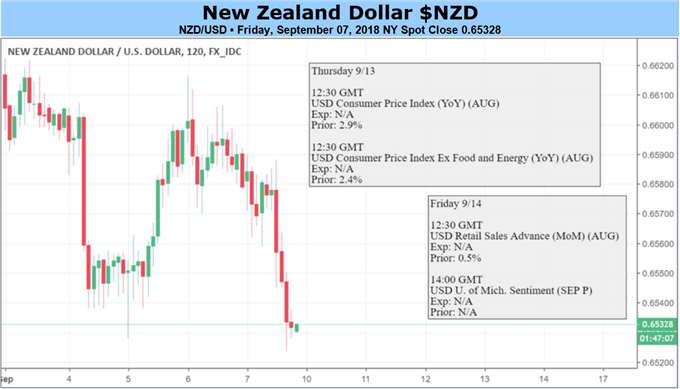

Next week offers a plethora of event risk for NZD, though most of it does not stem from home. New Zealand’s economic docket is rather lackluster, there may be some near-term volatility on credit card spending data. In the meantime, RBNZ dovish monetary policy bets could brew. Overnight index swaps are pricing in a 20% chance of a cut by February 2019.

The focus rather could stem from more political and trade war risks. In the case of the former, markets will be closely watching the Swedish election over the weekend. There, Eurosceptic nationalism could find a voice in the new cabinet which poses a risk to EUR/USD and stocks. The nation bloc is already pressured to a certain extent by economic nationalism from Italy.

An outcome that results in the Eurosceptic Swedish Democrats gaining in popularity could also potentially reduce urgency for the ECB to raise rates in 2019. The central bank’s next interest rate announcement with updated economic projections is on Thursday. If the Euro falls on a more cautious ECB, then USD could quickly find itself rallying at its expense. This could thus pressure Kiwi Dollar lower.

Threats of trade wars are still prominent and may continue weighing on emerging markets and stocks. At the time of this writing, the hearing period for US tariffs on Chinese goods ended. The Trump administration could very well pursue additional $200b in levies on China. Recently, it was reported that Mr. Trump may target Japan next. Neither scenario bodes well for the sentiment-sensitive New Zealand Dollar.

The fundamental NZD/USD forecast remains bearish.

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Check out our 3Q forecasts for the US Dollar and Equities in the DailyFX Trading Guides page

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the New Zealand Dollar is viewed by the trading community at the DailyFX Sentiment Page