Canadian Dollar Talking Points:

- USD/CAD is testing above the 1.3300 level, but an imposing series of longer-term resistance levels sit overhead.

- Last week USD/CAD saw drive from both BoC Deputy Governor Carolyn Wilkins and BoC Governor Stephen Poloz, the latter of which sounded optimistic with the former sounding more dovish. The big question at this point is whether enough CAD-weakness can develop that can take out the five-month-highs in USD/CAD. Until then, the potential for short-side swings remains. On a shorter-term basis, bullish momentum in USD/CAD may remain workable.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

USD/CAD Bulls Continue to Push the November Rally

The November rally in USD/CAD is continuing as we start the final week of the month; and with the Thursday holiday markets will likely be fairly active in the lead-up to the long weekend. In USD/CAD, price action has mounted back-above the 200 Day Moving Average following the Friday pullback. At that point, prices pulled back to find support around the 1.3250 psychological level, after which bulls returned to push prices back up towards a big zone of resistance sitting overhead.

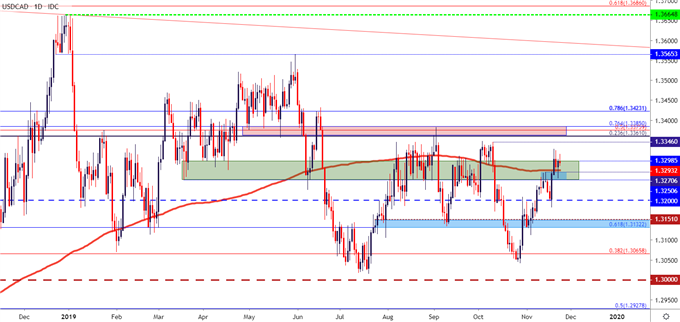

USD/CAD Daily Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

Can USD/CAD Bulls Take-Out Resistance

In a forty-pip range just overhead is an imposing series of resistance levels lurking in USD/CAD. This is the same zone that caught swing-highs in August, September and October, each time a bullish advance being stopped in its tracks before sellers came back into the matter. At around 1.3345 is the October swing-highs, and from 1.3361-1.3385 is a group of confluent Fibonacci levels that marks September and current five-month-highs in the pair.

This can be a difficult area to establish longer-term bullish exposure in USD/CAD given the top-end target potential up to those resistance areas, and as looked at in this week’s FX Setups, traders can look for a pullback in the effort of containing risk while setting up attractive risk-reward ratios upon revisits to resistance.

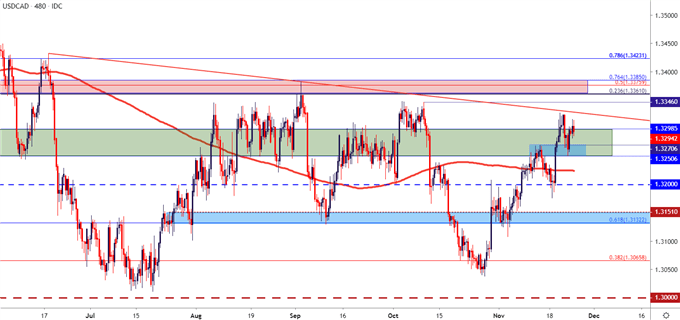

USD/CAD Eight-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

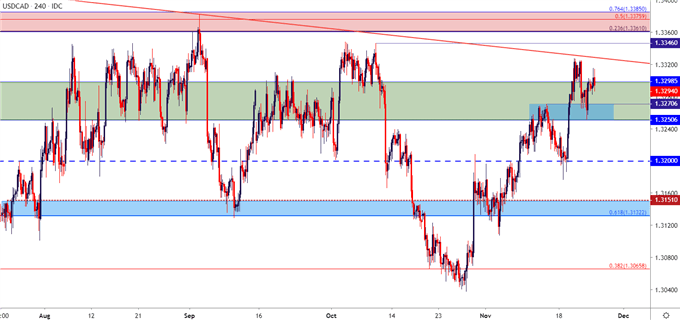

USD/CAD Near-Term Strategy

This is quite similar to last week when short and intermediate term views differed. On a short-term look, bullish momentum remains strong and could remain workable. The one drawback would be proximity to support/resistance, making risk-reward ratios upon re-tests of that longer-term resistance considerably less attractive. As looked at coming into this week, defense of and development of a higher-low above that 1.3250 inflection keeps the door open for short-term trend strategies, looking for a revisit to 1.3445.

USD/CAD Two-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

On an intermediate-term basis, proximity to those resistance areas can be approached with the aim of short-side swings, looking for price action to again top-out around this range of prices similar to what had happened in August, September and October. For this approach, traders would likely want to await some element of confirmation for topping, such as an evening star formation on the four-hour chart or perhaps even just a bearish pin bar, similar to what showed-up on the daily chart in early-September trade.

Alternatively, if buyers cannot hold the lows and price action tests below the 1.3250 swing from last Friday, the door for short-side scenarios could quickly re-open again, looking for re-tests of 1.3200, 1.3132-1.3150 and then 1.3065.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX