US Dollar Talking Points:

- It’s been a quiet week in the US Dollar after a riveting first half of Q4.

- The October sell-off looms large as the early-November bounce in the US Dollar caught resistance at the 50% marker of that prior move. Next week brings some items of interest on the economic calendar, can USD bears make an entrance back into the equation?

- DailyFX Forecasts are published on a variety of markets such asthe US Dollar or the Euro and are available from the DailyFX Trading Guides page.

A Busy Holiday Week Awaits

Next week brings a holiday in the United States with Thanksgiving on Thursday. The following day is ‘Black Friday’ which means that many US markets will be open for only half of the day and likely, a number of traders or market makers will be taking that day off for vacation. Despite this, the economic calendar for next week is rather busy with a series of high-impact releases scheduled for each day Tuesday-Friday. The big US releases take place on Wednesday morning with specific focus on the release of Core PCE, the Fed’s preferred inflation gauge. The big question is one of USD trends and whether that release or those data points can spur a break in the recent impasse that’s shown in US Dollar price action.

DailyFX Economic Calendar: Tuesday, Wednesday High Impact Releases

Data taken from DailyFX Economic Calendar

US Dollar Catches Support but Can Buyers Drive the Next Trend?

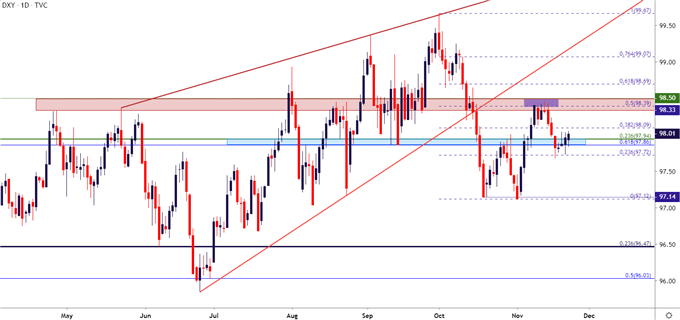

As looked at in yesterday’s webinar the US Dollar has been relatively quiet so far this week. After a strong sell-off in October led to a bullish bounce in the first half of November, price action has remained fairly tame as traders look for the next trend in the Greenback. This can be a difficult area to stage directional approaches but some key levels do exist nearby that can assist with the matter. Resistance played-in last week at a familiar area on the chart, taken from the 98.33-98.50 spot on DXY. This is the same area that caught the top April and May of this year, coming back into play to cap the early-November bounce in the USD.

The bigger question here is whether sellers find motive to re-enter the equation to test the three-month-lows holding just above the 97.00 handle, providing an element of continuation to the October sell-off. At this point, the November bounce found resistance at the 50% marker of that major move, which syncs well with the 98.33-98.50 zone, keeping the door open for intermediate-term bearish strategies.

US Dollar Daily Price Chart

Chart prepared by James Stanley; US Dollar on Tradingview

To read more:

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX