US Dollar Price Action Setups Talking Points:

- The US Dollar broke its impasse with a strong bullish push during Friday trade.

- Next week brings the Thanksgiving holiday in the US but a number of items remain of interest on the economic calendar.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

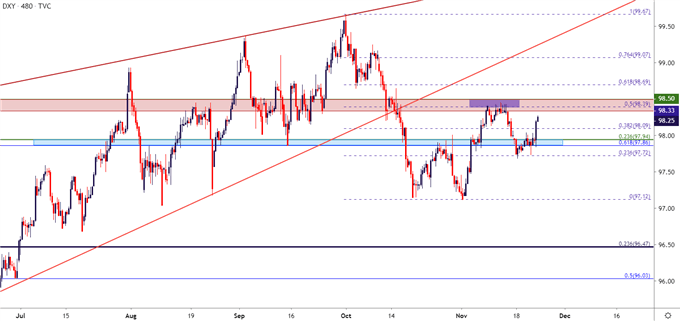

The US Dollar put in a move of strength on Friday that produced the entirety of this week’s gains for the Greenback. After the currency put in a sideways move from Monday-Thursday, USD bulls returned after a couple of positive data prints out of the US for PMI’s and U of Mich. Sentiment. After a quick jump-higher during thinned Friday trade the US Dollar made a stretch towards a key zone of resistance that had previously come-in to help hold the November highs. This shows at the same zone that held highs in April and May of this year and runs from 98.33-98.50 in DXY.

Next week brings a slightly different backdrop for the US Dollar: Thursday is Thanksgiving in the US and Friday is ‘Black Friday,’ meaning many desks will be lightly-covered and liquidity is expected to be diminished. Nonetheless, a number of headline items remain of interest on the economic calendar with both Tuesday and Wednesday bringing high-impact items out of the United States. Below, I look at two setups on either side of the US Dollar, looking for short-side swings against the British Pound and perhaps even the Euro to go along with themes of USD-strength against commodity currencies such as AUD/USD and perhaps USD/CAD.

US Dollar Eight-Hour Price Chart

Chart prepared by James Stanley; US Dollar on Tradingview

EUR/USD Heads Back to 1.1000 – Will Buyers Step in Again?

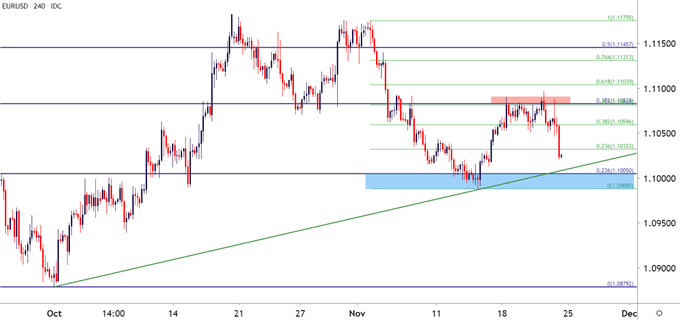

The first half of November was marked by both a strong US Dollar and a weak Euro, helping to push the world’s most popular currency pair down to the key 1.1000 level for a support test. That took place last week, and buyers responded with a strong bullish push that took prices back up to a confluent resistance area on the chart just inside of the 1.1100 handle. But that late-week surge of US Dollar strength has brought EUR/USD bears back into the mix, and price action in the pair has posed a clear push back down towards support.

For next week, I want to look for support to play-in off of a higher-low: There are two levels of relevance in this area, with the 23.6% marker of the June-October move at 1.1005 and the November swing-low at 1.0988. A push into this region on Monday, combined with respect of that prior swing-low, opens the door for bullish swing setups with stops lodged below the 1.0988 price. This can be accompanied with initial targets around the 1.1050 level, at which point stops can be adjusted to break-even, after which secondary targets could be sought at prior resistance of 1.1083.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley; EURUSD on Tradingview

GBP/USD: Cable Crumbles Back to Prior Week’s Low

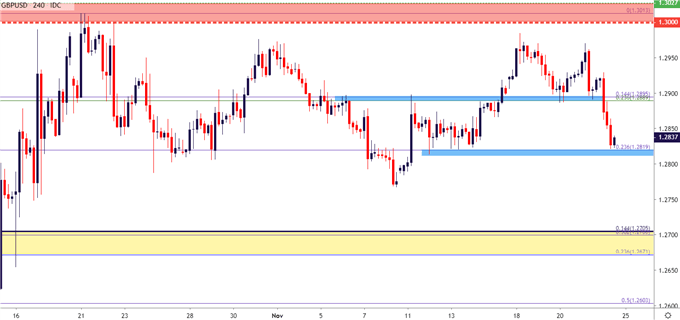

Also of interest and perhaps more actionable on the short-side of the US Dollar is GBP/USD. I looked at this one a few times this week, first as a support play off of the 1.2900 area. That setup filled-in fairly quickly and price action pushed right back up towards the 1.3000 big figure. But, similar to what happened on two other occasions over the past month, buyers slowed the approach before 1.3000 could come into play, and prices folded thereafter.

I had looked into the setup again on the Thursday webinar, warning that another revisit to the 1.2900 support area may not be so kind and, instead, cast the look for support to a prior level of interest that was in play in the prior week. This runs around 1.2819, which is the 23.6% retracement of the October bullish breakout. Buyers have stepped in ahead of a test of that level so far today, and a hold of support above this price through the Sunday open keeps the door open for bullish strategies in GBP/USD.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

AUD/USD: Bearish Scenarios Remain of Interest

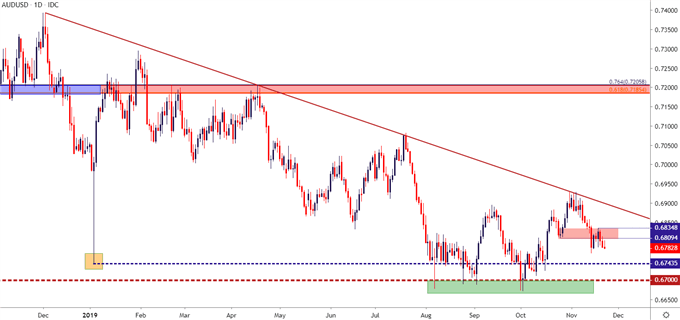

On the long side of the US Dollar, AUD/USD remains of interest. In late-October a longer-term trendline came into play to help hold the highs in the pairs, and this led into a sell-off in the first half of November. But, as USD weakness began to come into play last week, that bearish move in AUD/USD began to stall and has since posed a range-bound move over the past week.

Current price action is in an undesirable spot for fresh short positions given proximity to longer-term support; but a pullback to the resistance zone running from .6810-.6835 can quickly reopen the door for bearish strategies in the pair, and this could be one of the more attractive ways of moving forward with USD-strength given the current backdrop.

AUD/USD Daily Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

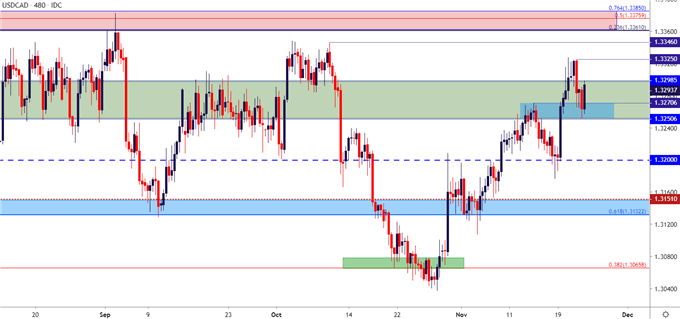

USD/CAD: Scope for Further Gains After Bulls Re-Take Control?

It’s been a strong week in USD/CAD as the pair pushed up to a fresh monthly high. I had previously kept USD/CAD in a spot for short-side swings but given the market’s response so far this month and perhaps more to the point, over the past week, there may be more room to run on the upside.

For USD/CAD, a hold of support above the 1.3250-1.3270 zone keeps the door open for bullish strategies next week, initially targeting a re-test of the 1.3325 area followed by secondary target potential around 1.3345. After that, longer-term resistance comes into view in the 1.3361-1.3385 zone.

USD/CAD Eight-Hour Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

To read more:

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX