US Dollar Index and USD/CHF Elliott Wave talking points:

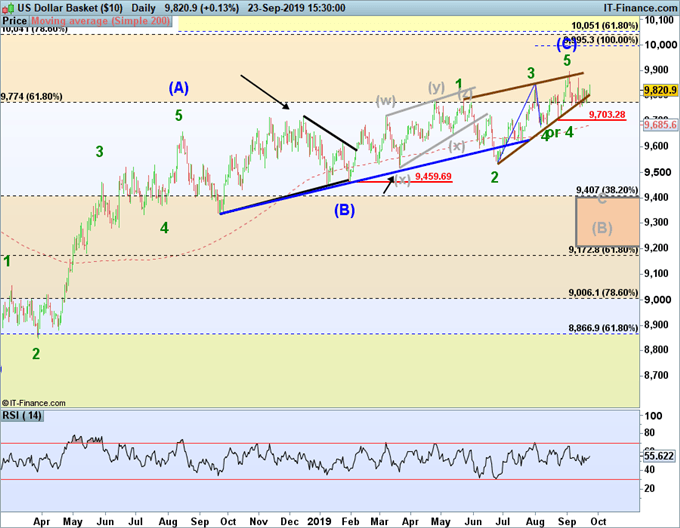

- DXY in terminal wave of a bull market that started February 2018

- USD/CHF carved an Elliott wave ending diagonal pattern hinting at a move lower towards .9660

- USDCHF bear pattern in play so long as the pair remains below .9984

US Dollar Index (DXY) in a terminal wave

US Dollar Index appears near a terminal point in the bull market that began February 2018. This advance has taken shape as a corrective structure and therefore we will be on the look out for a top forming. We can count the minimum waves in place for a meaningful high so it is possible DXY may begin correcting lower to 92-94 and possibly down into the mid-80’s.

One USD market that has carved a clean pattern to this point is USDCHF.

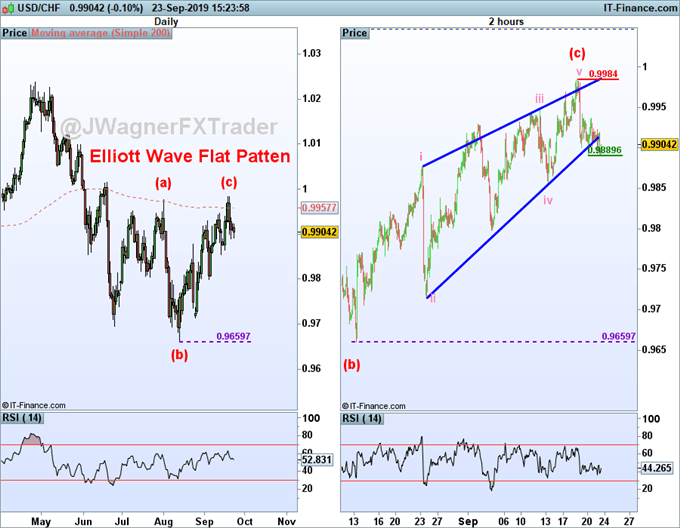

USD/CHF Elliott wave ending diagonal pattern finalized

Elliott wave ending diagonal patterns offer good risk to reward ratio opportunities. They are a wedge-shaped pattern consisting of five zigzags. USDCHF began carving this pattern on August 13, 2019 and it now appears finished. If this is the case, the USDCHF price high on September 18 of .9984 is the risk in this scenario. USDCHF is trying to break down briefly poking below the ii-iv blue trend line. A breakdown below Monday’s low would be a sign of further weakness may be coming.

Elliott wave ending diagonal patterns tend to be quickly retraced. The origination of this pattern was the August 13 low of .9660 so that becomes a target.

what is the current elliott wave for USDCHF?

Ending diagonals are just like they sound in that they are ending waves of a larger wave. Ending diagonal patterns appear in only two places of the Elliott wave sequence. They appear in the 5th wave of an impulse or ‘C’ wave of a flat or zigzag pattern.

In this case for USD/CHF, the ending diagonal pattern appears in the ‘C’ wave of a larger flat pattern. Therefore, the higher probability move for USDCHF is towards new lows below .9660.

USDCHF bottom line

So long as USDCHF holds below .9984, the Elliott wave pattern is bearish anticipating a multi-hundred pip move. The origination of the ending diagonal pattern at .9660 is a price zone to watch.

A rally above .9984 suggests the interpretation of the ending diagonal pattern was incorrect.

---Written by Jeremy Wagner, CEWA-M

Jeremy Wagner is a Certified Elliott Wave Analyst with a Master’s designation. These articles are designed to illustrate Elliott Wave applied to the current market environment. See Jeremy’s bio page for recent Elliott Wave articles to see Elliott Wave Theory in action.

How can I learn more about Elliott wave?

We have a beginners and advanced Elliott wave trading guides. Print off those guides and study the patterns. The two most comment patterns are impulse waves and zigzags. By understanding their structure and common Fibonacci relationships, you’ll have a great start to learning Elliott wave.

After reviewing the guides above, be sure to follow future Elliott Wave articles to see Elliott Wave Theory in action.

Not sure if Elliott wave is right for you? Believe it or not, when I first started trading I couldn’t understand why technical analysis worked. Now, I’m 100% technical through Elliott wave. Learn more about how Jeremy got started into Elliott wave from this podcast interview with DailyFX’s Global Markets Decoded.

Discuss this market with Jeremy in Monday’s US Opening Bell webinar.

Follow on twitter @JWagnerFXTrader .