Gold Technical Price Forecast: XAU/USD Weekly Trade Levels

- Gold price updated trade levels - Weekly Technical Chart

- XAU/USD plunges through key support pivot; risk is lower sub-1708

- Get started with this Free How to Trade Gold -Beginners Guide

Gold prices are off nearly 0.7% since the start of the week with XAU/USD breaking to fresh yearly lows. Prices have plunged more than 21% off the yearly highs with a break of key support now threatening a much larger correction in the yellow metal. That said, a third weekly decline is now probing initial support objectives with key US inflation data on tap into the weekly / monthly / quarterly close. These are the updated targets and invalidation levels that matter on the XAU/USD weekly chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more.

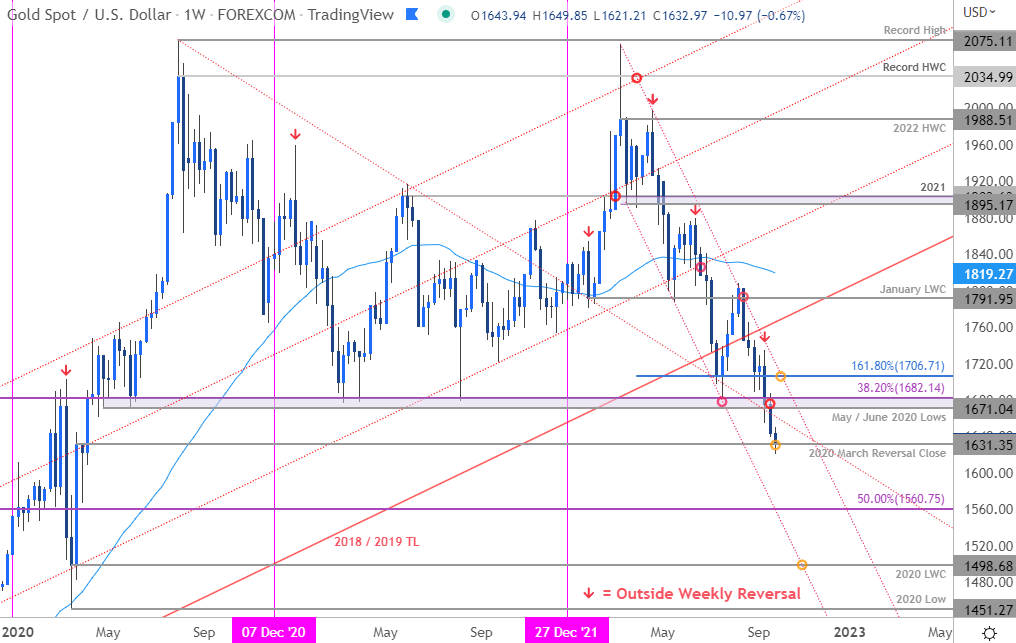

Gold Price Chart - XAU/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; Gold on Tradingview

Notes: In my last Gold Weekly Price Outlook we noted XAU/USD was trading just above critical support at, “1671/82- a region defined by the May / June 2020 lows, the 2021 lows and the 38.2% retracement of the 2015 advance. A break below this level would be extremely damaging from a technical standpoint with such a scenario exposing the 2020 March reversal close at 1631 and the 50% retracement at 1560.” Gold plunged through support just two-weeks later with the decline registering a low this week at 1621 before recovering back above 1631- the focus remains on possible inflection off this zone heading into the close of the month / quarter.

A break / weekly close below this threshold is needed to keep the immediate short-bias viable towards 1560 and the 2020 low-week close at 1498. It’s worth noting that a measured move of the proposed double-top formation break does highlight the threat for much deeper setback in gold (1287). That said, we’ll remain vigilant heading into the close of the quarter and respect the levels. Initial weekly resistance now back at 1682 with medium-term bearish invalidation lowered to the 1.618% Fibonacci extension of the yearly decline / July close-low at 1706/08.

Bottom line: The gold breakdown threatens significant losses heading into the fourth-quarter. From at trading standpoint, the outlook remains weighted to the downside while within the yearly channel- rallies should be limited to 1708 IF price is heading lower on this stretch with a break threatening another accelerated drop towards 1560 and beyond. Stay nimble heading into the close of the week with US Core PCE (Personal Consumption Expenditure) on Friday likely to fuel some volatility here. I’ll publish an updated Gold Price Short-term Technical Outlook once we get further clarity on the near-term XAU/USD trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

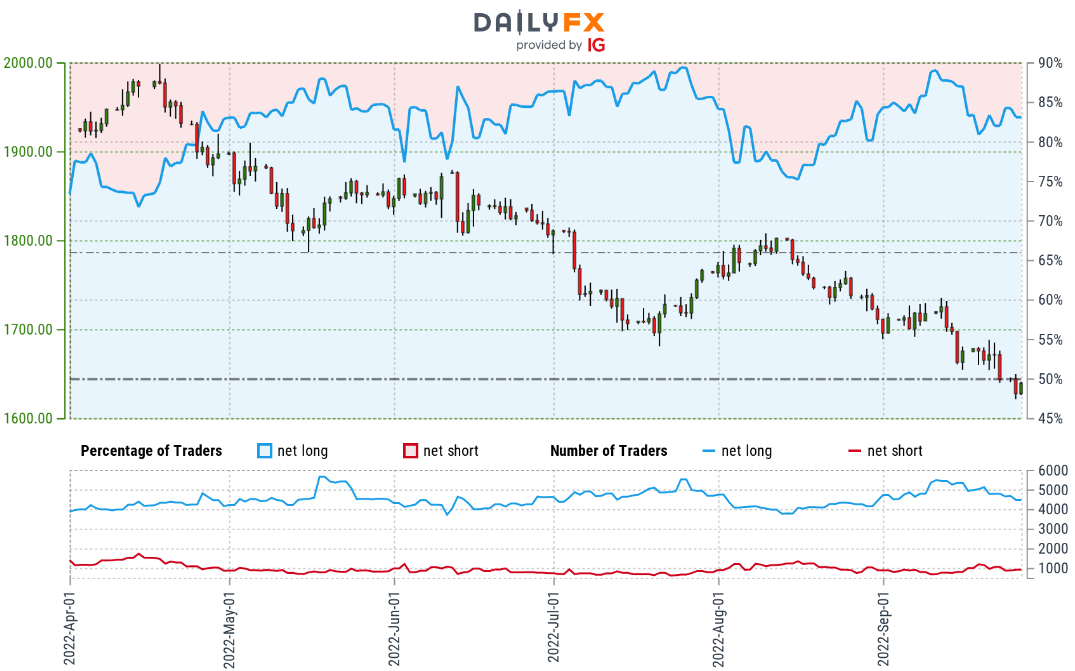

Gold Trader Sentiment – XAU/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-long Gold- the ratio stands at +4.36 (81.34% of traders are long) – typically bearish reading

- Long positions are 0.63% higher than yesterday and 10.25% lower from last week

- Short positions are 3.01% higher than yesterday and 21.88% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Traders are less net-long than yesterday but more net-long from last week. The combination of current positioning and recent changes gives us a further mixed Gold trading bias from a sentiment standpoint.

{{SENTIMENT|GC|Learn how shifts in Gold retail positioning impact trend}}

---

Active Weekly Technical Charts

- Crude Oil (WTI)

- British Pound (GBP/USD)

- Australian Dollar (AUD/USD)

- S&P 500, Nasdaq & Dow

- Canadian Dollar (USD/CAD)

- Japanese Yen (USD/JPY)

- US Dollar Index (DXY)

- Euro (EUR/USD)

- Written by Michael Boutros, Technical Strategist with DailyFX

Follow Michael on Twitter @MBForex