Talking Points

- NZDCAD posts reversal candle off key resistance- scalps favor shorts

- Updated targets & invalidation levels

- Event Risk on Tap This Week

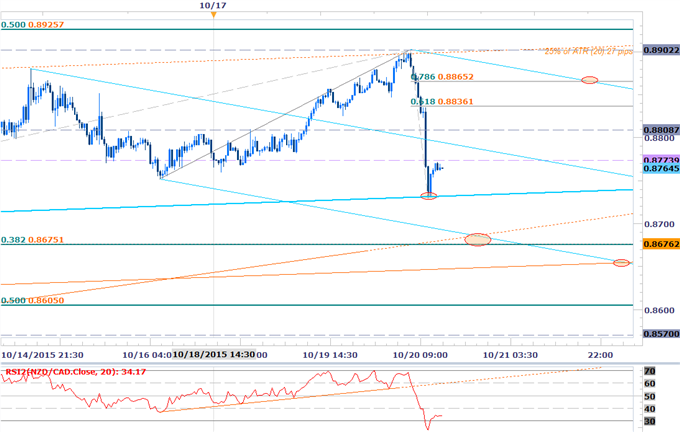

NZDCAD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- NZDCAD posts outside-day reversal off long-term resistance confluence- bearish

- Interim support at highlighted region into 8700- Break to mark larger correction lower

- Subsequent support objectives at 8605 & 8535

- Key resistance 8905/38 – bearish invalidation

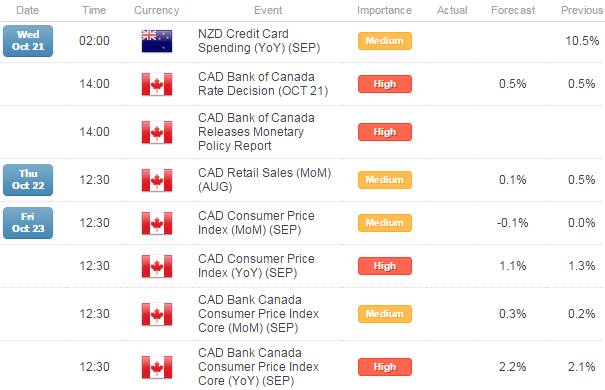

- Event Risk Ahead: Bank of Canada (BoC) Interest Rate Decision tomorrow, Retail Sales on Thursday and Canada Consumer Price Index (CPI) on Friday

NZDCAD 30min

Notes: NZDCAD has posted an impressive outside-day reversal candle off a key resistance confluence into 8900 - a region is defined by former trendline support extending off the 2011 low, the 200-day moving average and a near-term sliding parallel. Today’s decline rebounded off the median-line extending off the July before coming back to test the weekly opening-range low as resistance.

The focus is lower while within the pitchfork formation off last week’s high with a break of today’s low targeting trendline support dating back to September 23rd. Bottom line: look to sell rallies while below 8865 (bearish invalidation) targeting 8700, 8650/75 & 8605.

A quarter of the daily average true range (ATR) yields profit targets of 26-29pips per scalp. Caution is warranted heading into event risk out of Canada into the close of the week with the BoC, retail sales, & CPI release likely to fuel added volatility in CAD crosses.

For updates on this scalp and more setups throughout the week subscribe to SB Trade Desk

Relevant Data Releases Next Week

Other Setups in Play:

- Webinar: ECB/BoE Playbook- EUR/GBP Shorts Target Key Support Zone

- EURGBP Reverses Off Critical Resistance- Shorts Favored Sub 7386

- EURUSD Long Scalps Eye Key Resistance - Breakout Targets 1.18

- EURAUD Recovery Scalp- Rally to Offer Favorable Shorts

- Webinar: USD Weakness Targets Key Support- Comm Bloc Overstretched?

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

Struggling with your strategy? Here’s the number one mistake to avoid