Talking Points

- Weekly DailyFX Scalp Webinar archive covering featured setups

- Updated targets & invalidation levels

- Event Risk on Tap This Week

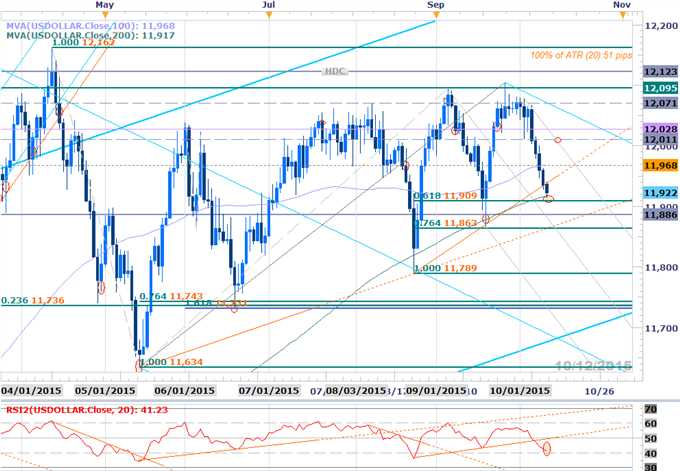

USDOLLAR Daily

Chart Created Using FXCM Marketscope 2.0

Notes: The Dow Jones FXCM U.S. Dollar Index (ticker: USDOLLAR) is working on is fourth consecutive day of losses. Interim support rests with the 61.8% retracement / 200DMA at 11909/17 with a break there targeting 118886 & confluence support into 11863. Four out of the past five times this happened, the index saw a small recovery before moving lower (except for the July instance which turned out to be the 2014 low. Resistance stands at 11968 backed by our bearish invalidation level at 12011. Bottom line, we could get a rebound off these levels, but we’d be looking to sell rallies below the upper median-line parallel. Keep an eye out for important economic data out of the U.S. this week with retail sales & CPI on tap.

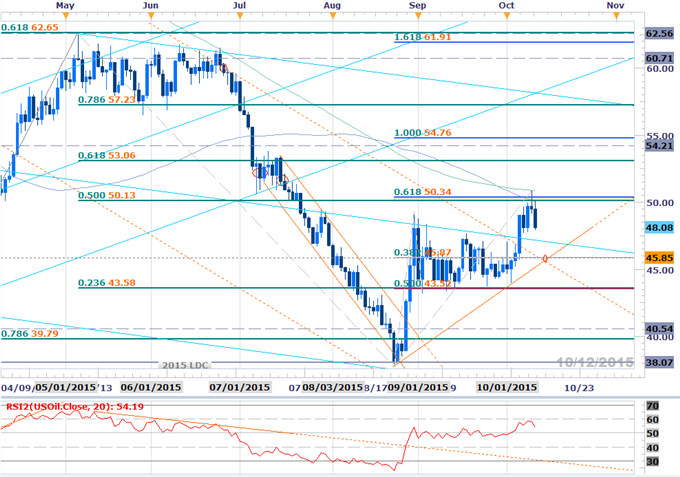

Crude Oil Daily

Notes: Crude oil has reacted to key resistance noted in today’s webinar at 50.13/34 (Friday’s stretch high went for a perfect tag of the 200DMA at 50.89). The immediate focus is to the downside targeting the median line extending off the February highs, backed by 45.85 (bullish invalidation). A break sub-43.52 is needed to put the short-side back in focus. A breach higher targets resistance objectives at 53.06 & 54.76.

Note that Brent oil failed to breach the September highs like WTI did. It’s too soon to tell which one of these is lying, but we’ll be looking for a low towards the latter part of the week.

For updates on these setups and more trades throughout the week subscribe to SB Trade Desk

Relevant Data Releases

Other Setups in Play:

- GBPUSD Rebound Testing First Resistance Barrier Ahead of BoE

- Webinar: Scalping Aussie Crosses post NFP - RBA, BOE, BoJ on Tap

- AUDJPY Rebound Off Slope Support Eyes 86.00 Resistance Ahead of NFP

- AUDNZD at Critical Inflection Point- Scalps Target Weekly Opening Range

- Scalping EURUSD Ahead of NFP- Long Bias Favored Above 1.12

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)

Struggling with your strategy? Here’s the number one mistake to avoid