Talking Points

- GBPUSD Outside day reversal breaks weekly opening range

- Updated targets & invalidation levels

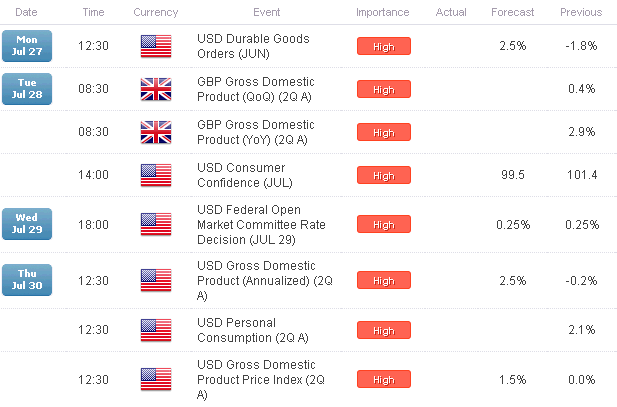

- Event Risk on Tap This Week

GBPUSD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- GBPUSD posts outside day reversal candle / false break above upper MLP

- Reversal takes out weekly opening range low / breaks below January median line- bearish

- Key support at highlighted region into 1.5359

- Resistance at 1.5673 backed by bearish invalidation at 1.57 & 1.5773

- Daily RSI break sub 50- bearish

- Event Risk Ahead: UK 2Q Advanced GDP & FOMC next week

GBPUSD 30min

Notes: An outside day reversal candle in the Sterling has broken below the weekly opening range low and shifts the focus to the short side of the pound. Note that price has also now broken back below the median-line extending off the January low with daily RSI also breaking below the 50-threhsold (bearish near-term). Interim support rests at 1.5502 with subsequent objectives eyed at 1.5462, 1.5420 & the July low-day close (LDC) at 1.5359.

Interim resistance stands at 1.5543 backed by our near-term bearish invalidation level upper MLP / 1.5582. A breach above the 1.57-handle would be needed to put the long-side back into focus with such a scenario eyeing the May HDC at 1.5774. A quarter of the daily average true range yields profit targets of 28-30pips per scalp. Event risk on the pair is limited until next week with release of UK 2Q GDP figures & the FOMC policy meeting likely to fuel added volatility in their respective crosses.

For updates on this scalp and more setups throughout the week subscribe to SB Trade Desk

Relevant Data Releases

Other Setups in Play:

- GBPJPY Defends Monthly Open- Weekly Range Break to Validate Long Bias

- Webinar: Euro Faces May Lows- USD Outlook Murky at Three Month Highs

- Key EURUSD Levels to Know Ahead of the ECB, US CPI

- AUDJPY Rebound Faces First Hurdle- Long Scalp Favored Above 91.24

- Webinar: EUR & JPY Struggle Post Greek Deal- Weekly Setups in Focus

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex,contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video