EUR/USD Price Outlook and Sentiment Analysis

Learn How to Trade the News with our Expert Guide

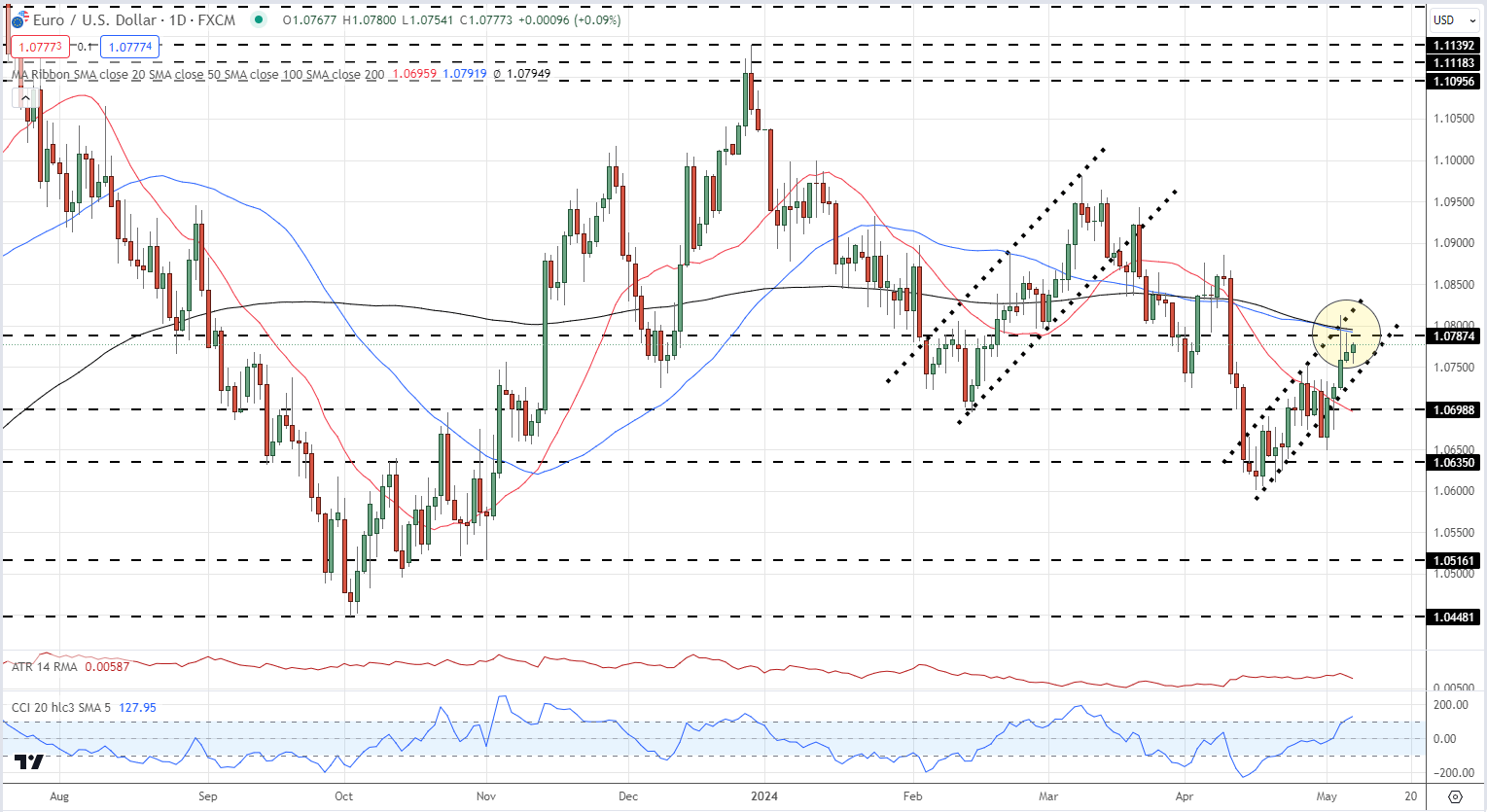

The Euro continues to push ahead against the dollar as rate cut expectations in the US grow after last week’s mildly dovish FOMC meeting and a weaker-than-expected US Jobs Report. The recent rally is now nearing a cluster of resistance points that may well temper further upside in the short term.

The cluster resistance seen on the EUR/USD daily chart includes prior a horizontal line of note at 1.0787, both the 50- and 200-day simple moving averages at 1.0792 and 1.0795 respectively, before 1.0800 big figure resistance and trend resistance currently around 1.0815. This block should hold any short-term move unless the US dollar weakens further. The CCI indicator at the bottom of the chart also shows the pair in overbought territory and at levels last seen just before the early March sell-off.

Trend support and a cluster of recent highs around the 1.0735/1.0740 level should act as first-line support ahead of 1.0700.

EUR/USD Daily Price Chart

EUR/USD Retail Trader Data Analysis

- 47.85% of retail traders are net-long EUR/USD, with a short-to-long ratio of 1.09 to 1

- The percentage of net-long traders is 3.17% higher than yesterday but 8.25% lower than last week

- The percentage of net-short traders is 7.05% higher than yesterday and 13.41% higher than last week

This shows that overall, retail traders are positioning more net-short EUR/USD compared to the previous day and previous week. Typically a contrarian view is taken to crowd sentiment. With retail traders more net-short, this implies a EUR/USD bullish bias from a contrarian perspective.

The data indicates the shift to a more net-short positioning by retail traders over the last day and week gives a stronger EUR/USD bullish contrarian trading bias currently.

In summary, the retail trader data suggests EUR/USD may continue rising based on the contrarian interpretation of the increasingly net-short positioning by these traders. The degree of net-short positioning has increased over the short term and compared to last week.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | -18% | 17% | 1% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.