GOLD PRICE FORECAST:

- Gold prices rise following the Fed’s dovish hike at its March FOMC meeting

- The U.S. central bank raised rates by 25 basis points, but signaled its tightening cycle is coming to an end

- The fundamental outlook remains positive for gold

Most Read: Gold Trading - Three Top Tips for Trading Gold

Gold prices surged on Thursday amid U.S. dollar weakness after the FOMC delivered a dovish interest rate hike and signaled that its tightening campaign may be nearing its end. In late morning trading, XAU/USD was rallying about 1% to $1,986, inching ever closer to its 2023 highs, just above the psychological $2,000 level set this past Monday.

Recent banking sector turmoil has led the Fed to adopt a much more cautious stance and to project a less aggressive hiking cycle than telegraphed just a few weeks ago, when Powell dropped a hawkish bombshell before Congress. In fact, the FOMC only expects to raise borrowing costs one final time this year to 5.00-5.25%, well below the 5.70% peak rate anticipated by the market earlier this month.

The idea that the terminal rate is within reach, coupled with growing speculation that the central bank will ease policy shortly thereafter, is likely to be bullish for non-yielding assets, including precious metals. This means that gold could remain in an upward trajectory over the medium term, especially if financial turmoil resurfaces and threatens to create systemic risks.

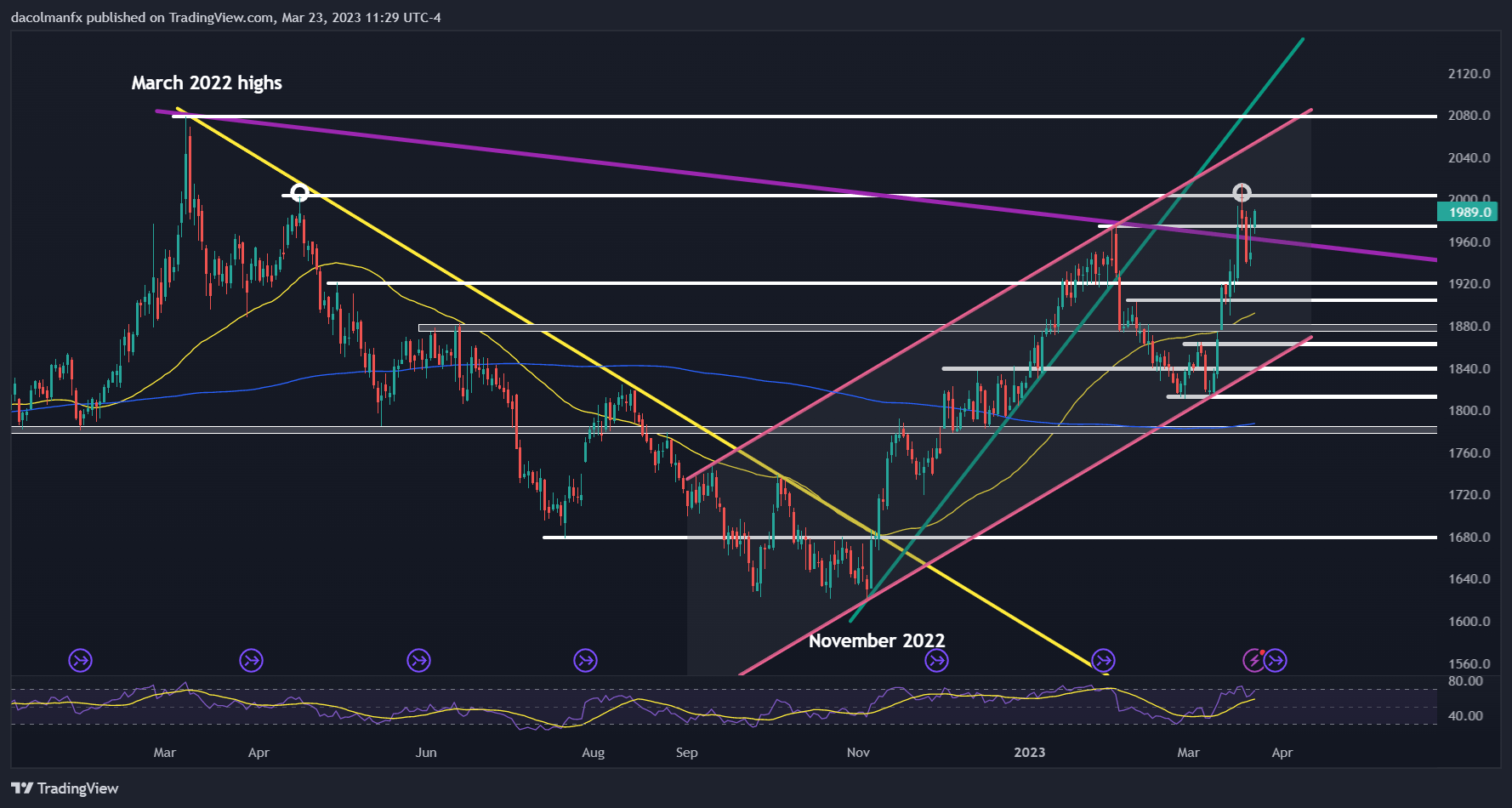

In terms of technical analysis, if gold extends its advance in the coming sessions, the first ceiling to consider appears in the $2,000/$2,015 region. On further strength and a decisive breakout, the focus shifts to channel resistance at $2,050, followed by $2,078, last year’s high. Conversely, if sellers return and spark a pullback, initial support comes at $1,975/$1,965. Below that, the next area of interest lies at $1,920 and $1,900 thereafter.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

GOLD PRICE TECHNICAL CHART