Markets Week Ahead: Gold, Euro, British Pound, US Dollar

For all market-moving economic data and events, see the DailyFX Calendar

Download our Brand New Q4 Equities Forecast Below:

US equities continue to press against recently made multi-year highs despite growing geopolitical risk. The coordinated US/UK action against Houthi rebels in Yemen is set to provoke reprisals, yet despite this, US equities are booming. The US earnings season started on Friday with a group of US banks opening the proceedings. In Asia, the Nikkei 225 continues to print new multi-decade highs as the Bank of Japan looks set to keep monetary policy looser for longer.

Crude Oil Latest: Heightened Geopolitical Tensions Push Oil Prices Higher

DAX, Dow and Nasdaq 100 in Strong Form Ahead of US Inflation

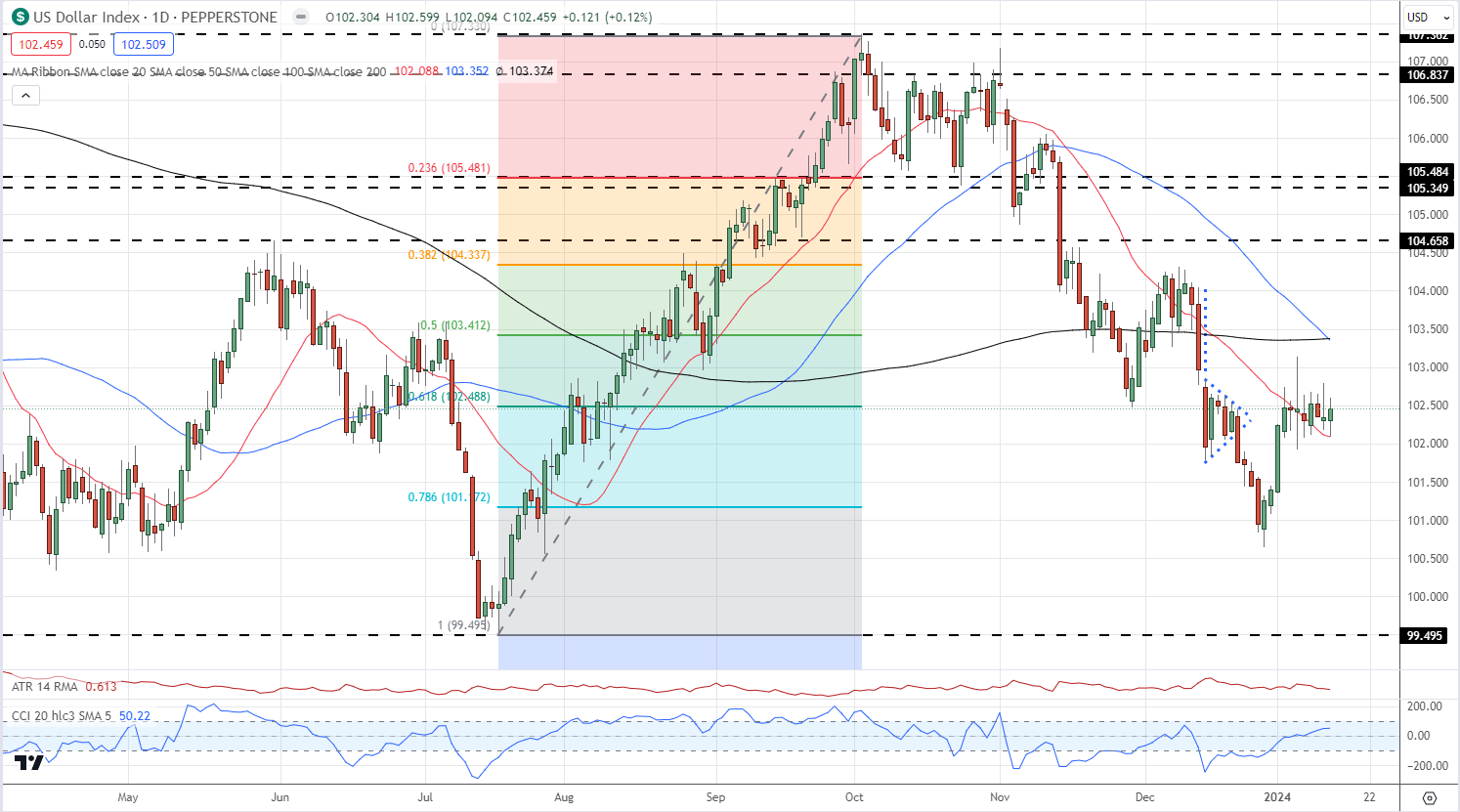

The US dollar has had a mixed few days and ends the week flat. Expectations remain that the Federal Reserve will cut rates six times this year for a total of 150 basis points, despite pushback from various Fed members, and this continues to weigh on the greenback. On the flip side, the dollar is getting a small bid due to the troubles in the Red Sea and surrounding area. In this environment, it is going to be difficult for the US dollar to make a concerted break, one way or another.

US Dollar at Critical Juncture After US CPI, Setups on EUR/USD, USD/JPY and GBP/USD

US Dollar Index

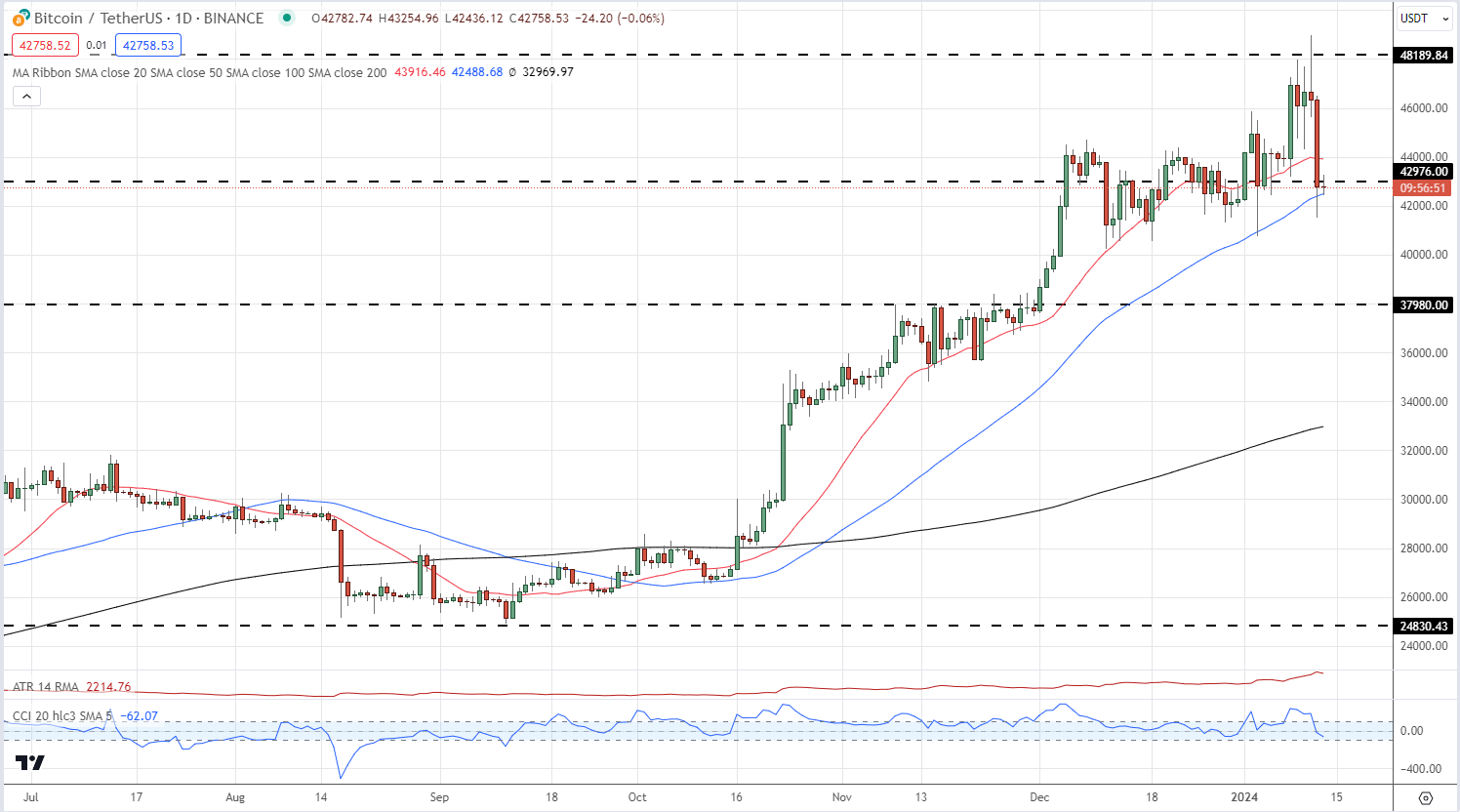

In the cryptocurrency space, eleven spot Bitcoin ETFs were finally approved by the SEC despite a week of mixed messages and fake tweets. Bitcoin traded just below $49k on Thursday before the market turned lower, leaving BTC/USD trading just below $43k. Despite the sell-off, Bitcoin retains a positive long-term outlook.

Bitcoin Daily Chart

Technical and Fundamental Forecasts – w/c January 15th

British Pound Weekly Forecast: Big UK Data Week May Not Mean Big Moves

Recent bullish price action, combined with unimpressive GDP figures, provides a very uncertain landscape for the pound in a big week for UK data.

Euro Weekly Forecast: Suppressed Weekly Range Emphasises Key Levels

The euro’s lack of volatility underscores key horizontal levels and the potential for range trading. EU inflation and updated sentiment data are unlikely to move the dial significantly.

Gold Price Weekly Forecast: Gold Rallies on US Rates, Geopolitical Worries

Escalating tensions in Yemen have boosted gold’s allure going into the weekend and with short-dated US Treasury yields falling further, XAU/USD may have more room to run.

US Dollar Forecast: Reversal Possible; Setups on EUR/USD, USD/JPY, GBP/USD

This article explores the week-ahead outlook for the U.S. dollar, examining important catalysts that could guide the performance of key currency pairs such as EUR/USD, GBP/USD and USD/JPY.

Learn How to Trade Gold with our Free Guide:

All Articles Written by DailyFX Analysts and Strategists