British Pound Forecast: Neutral

- GBP/USD remains biased higher

- US rates are expected to fall sooner and faster than those in the UK

- However, the UK economy’s performance doesn’t make Sterling a screaming buy

- Download our brand new Q1 Pound Sterling Forecast:

The British Pound has risen steadily against the United Stats Dollar since October last year, and, while its supports remain, there are clear signs that momentum is waning on both the technical and fundamental fronts. In short, some caution is warranted now, even if you’re still bullish.

Of course, the most obvious GBP/USD prop in this monetarist world lies in markets’ belief that the United States has won its long war against inflation and that interest rates there will start to come down this year, possibly quite sharply.

The inflation picture in the United Kingdom, meanwhile, is less rosy and more complicated. That said. growing signs that the domestic economy is flatlining, perhaps at best, surely also suggest that we’ve seen the peak for British borrowing costs. That’s even if they are likely to stay up longer and come down more slowly than those in the US.

So, that constructive monetary backdrop isn’t likely to change much in the coming few sessions. Still, Sterling hardly looks like a screaming buy on the UK economy’s own scant merits. Growth is sputtering, as it is across Europe. Moreover, a late-term government in London seems unable to revive much support among the electorate no matter what it does. This heightens the political risks in being long GBP/USD, as the opposition Labour Party has yet to flesh out what it’s main economic policies would be in office.

There’ll be some heavyweight economic data released this week, from official employment and earnings numbers for November on Tuesday, through to the all-important inflation numbers on Wednesday. December’s Consumer Price Index is forecast to have relaxed again. The headline rate is expected at 3.8%, with the more important core measure down to 4.9%, from 5.1% previously. Keep an eye on the wage data too though, as settlements remain high by recent historical standards and will feed through into the inflation numbers down the track.

Weaker-than-expected prints could do some damage to the Pound as they may well see rate-cut expectations brought forward. The markets have a couple of weeks to wait before the Bank of England weighs in though. Its next monetary policy meet Is not due until February 1.

In the meantime, some geopolitical clouds may gather over the Pound given the UK’s heavy involvement in airstrikes against rebel Houthis in Yemen, However, given the US’ lead role here, it seems unlikely that GBP/USD will be seriously undermined. This is not, however, a fundamental environment in which major moves are likely to be very trustworthy. So while GBP/USD’s upside bias looks safe enough, there seems little reason to expect a major leg higher anytime soon.

GBP/USD Technical Analysis

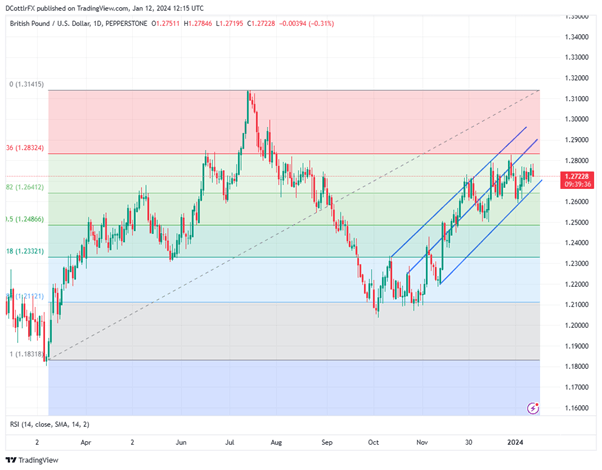

GBP/USD Daily Chart Compiled Using TradingView

GBP/USD bounced back in October around the fifth Fibonacci retracement level of its rise up to the peaks of last July from the lows of early March. Since then, the pair has gained strongly, to the point where the first retracement of that rise, at 1.2.8324 now offers near-term resistance.

Trendline support from November 13 comes in much closer to the market, however, at 1.26613 and, unless Sterling bulls can top the psychological 1.28 level shortly, that could see a renewed test. In fact the 1.28 handle seems to have become an increasingly tough hurdle for this market since it was last abandoned during the sharp daily falls seen on December 27 and January 2, falls which the market has yet to recover. If the bulls can’t top this level on a weekly closing basis soon then that may be a clear sign that momentum has faded, signaling a deeper reversal.

Still, the Pound still doesn’t look dramatically overbought according to the pair’s Relative Strength Index. That comes in at around 60. It has risen since early January but won’t indicate substantial overbuying until it tops the 70 level.

The near-term technical situation for GBP/USD looks remarkably aligned with fundamental one in that, while there seems to clear reason to suspect sharp falls, there are clear question marks over any sharper rises too.

That’s why it has to be a neutral call this week.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--By David Cottle for DailyFX