EURO FORECAST:

EURO FORECAST: NEUTRAL

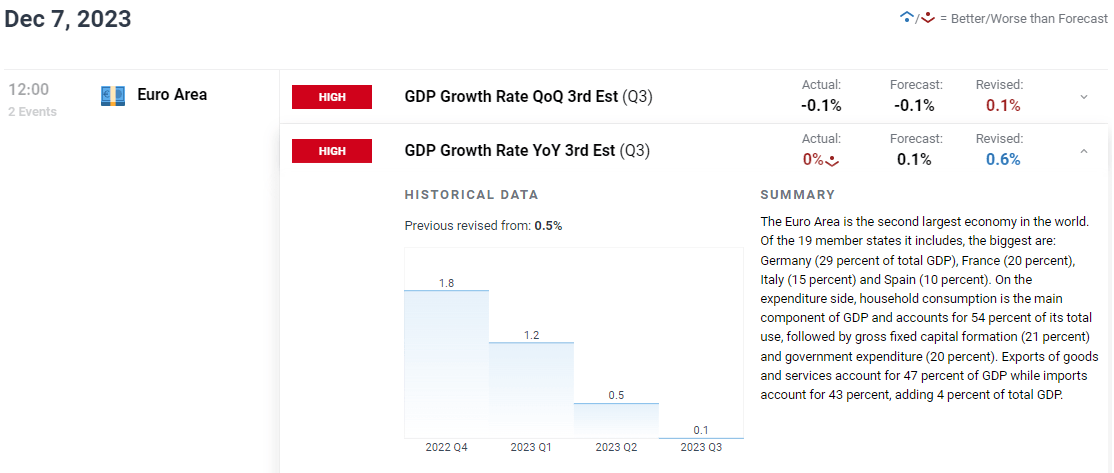

- ECB Expected to Hold Rates Steady but Economic Projections Will be the Key Driver.

- Early Week Recovery in the Euro May be Possible Ahead of the ECB Meeting.

- Market Participants Still Price in 125bps of Rate Cuts in 2024.

- To Learn More About Price Action,Chart PatternsandMoving Averages, Check out theDailyFX Education Series.

READ MORE: November Jobs Report: Unemployment Falls and NFP Print Beats Forecast, DXY Advances

WEEK IN REVIEW

The Euro struggled for the majority of the week thanks in part to poor Euro data and external factors hampering Euro pairs. EURUSD for its part remained resilient for the most part with Fridays stronger than expected jobs data giving the pair a push closer to the 1.0700 level. The initial gains by the US Dollar had largely been given back at the time of writing with EURUSD trading back above the key support area at 1.0750.

Looking at EURJPY and this is a pair that dropped quite significantly this week in line with most yen pairs. This was largely down to the Yen rather than the Euro following comments by the BoJ which hinted at a potential policy pivot. This saw the Yen roar to life with EURJPY falling as much as 3.6% for the week, around 670 pips. This narrative may change in the week ahead as we have the ECB meeting which is likely to dominate proceedings.

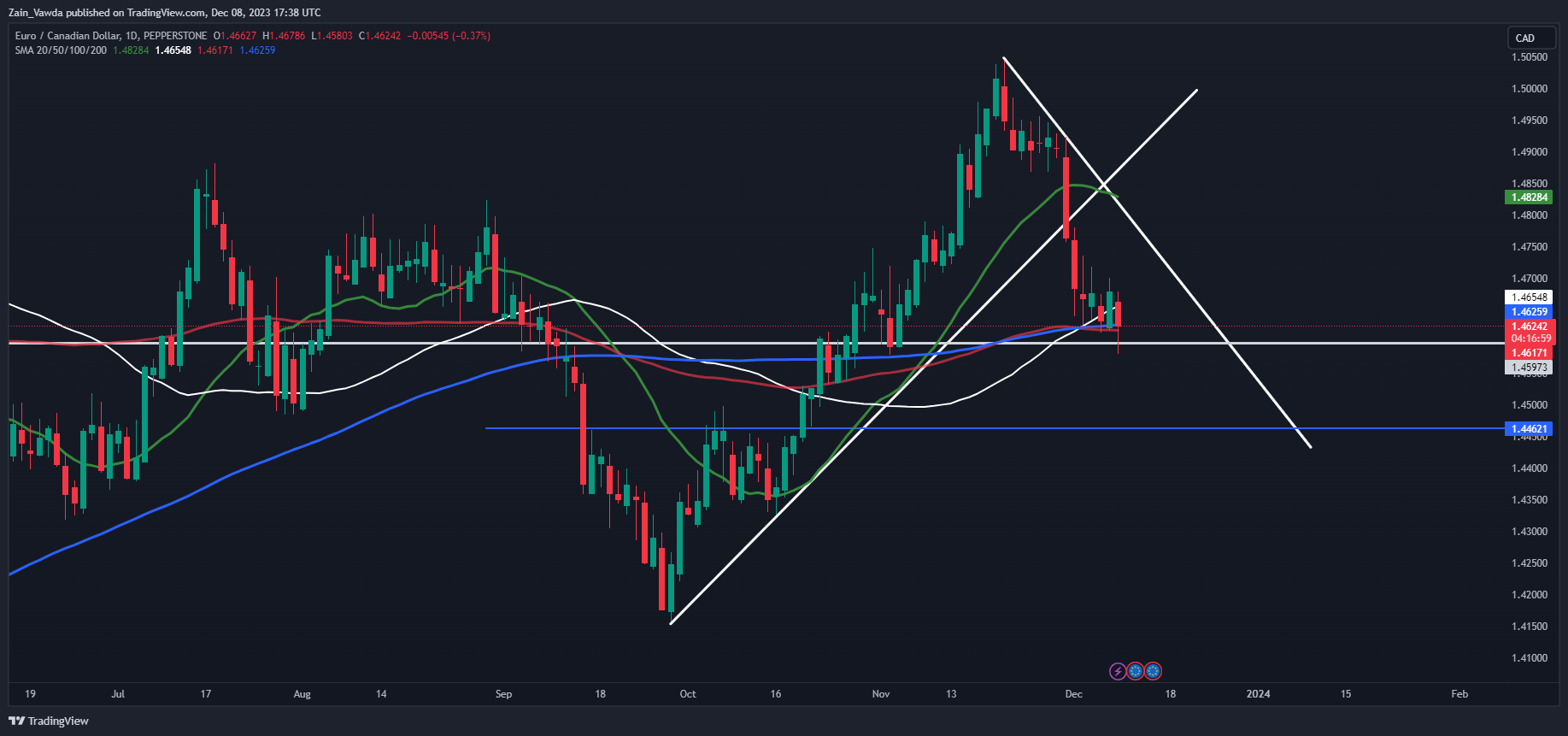

EURCAD also slid this week but not as much as its counterparts EURUSD and EURJPY. Surprising really given that it is an exotic pair and generally tends to move a lot. It is sitting at a key confluence area and this in part could explain the lack of significant movement this week. Let's hope the ECB meeting can shock the pair back to life.

The Euro faced challenges this week following a downward revision the Euro Area Q3 GDP print. This confirmed the stagnation in the Euro Area economy and keeps the overall outlook bleak heading toward the ECB meeting next week.

For all market-moving economic releases and events, see the DailyFX Calendar

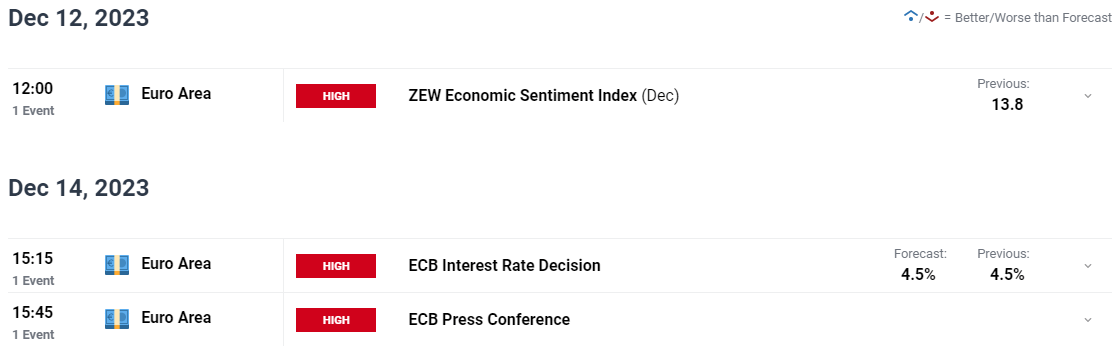

THE WEEK AHEAD: ECB AND EXTERNAL FACTORS THE KEY DRIVERS FOR EURO PAIRS

Following a week in which Euro pairs were largely affected by external factor and a revised GDP number. Next week is expected to be different and could be a big one for the Euro Area with the ECB meeting accompanied by updated economic projections. It is largely expected that the ECB will likely keep rates on hold. Given that assumption the biggest takeaway from the meeting will be the updated economic projections and rhetoric from the ECB. Markets are still pricing in 125bps of easing by the ECB in 2024 so interest will be on how much difference there is with the Central Banks projections.

A significant deviation from the ECB in comparison to market expectations could help the Euro regain some strength. Now this will also depend on how markets receive the ECB projections as we have seen market participants at times reject the Central Bank rhetoric. Will we see this again next week?

For all market-moving economic releases and events, see the DailyFX Calendar

POTENTIAL SCENARIOS THAT COULD PLAY OUT FROM THE ECB MEETING

Now looking at potential scenarios which could play out from next week’s ECB meeting.

Dovish narrative: If the ECB hints that inflation could fall quicker than expected, something mentioned by Goldman Sachs this week. Any confirmation regarding peak rates being reached and potential discussions around easing as well could have dovish implications for the Euro.

Hawkish Narrative: Any rhetoric around inflationary concerns and a delay in reaching the 2% target. If we hear any pushback from ECB President Lagarde on rate cuts than we could possibly see a rebound in the Euro.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

TECHNICAL OUTLOOK AND FINAL THOUGHTS

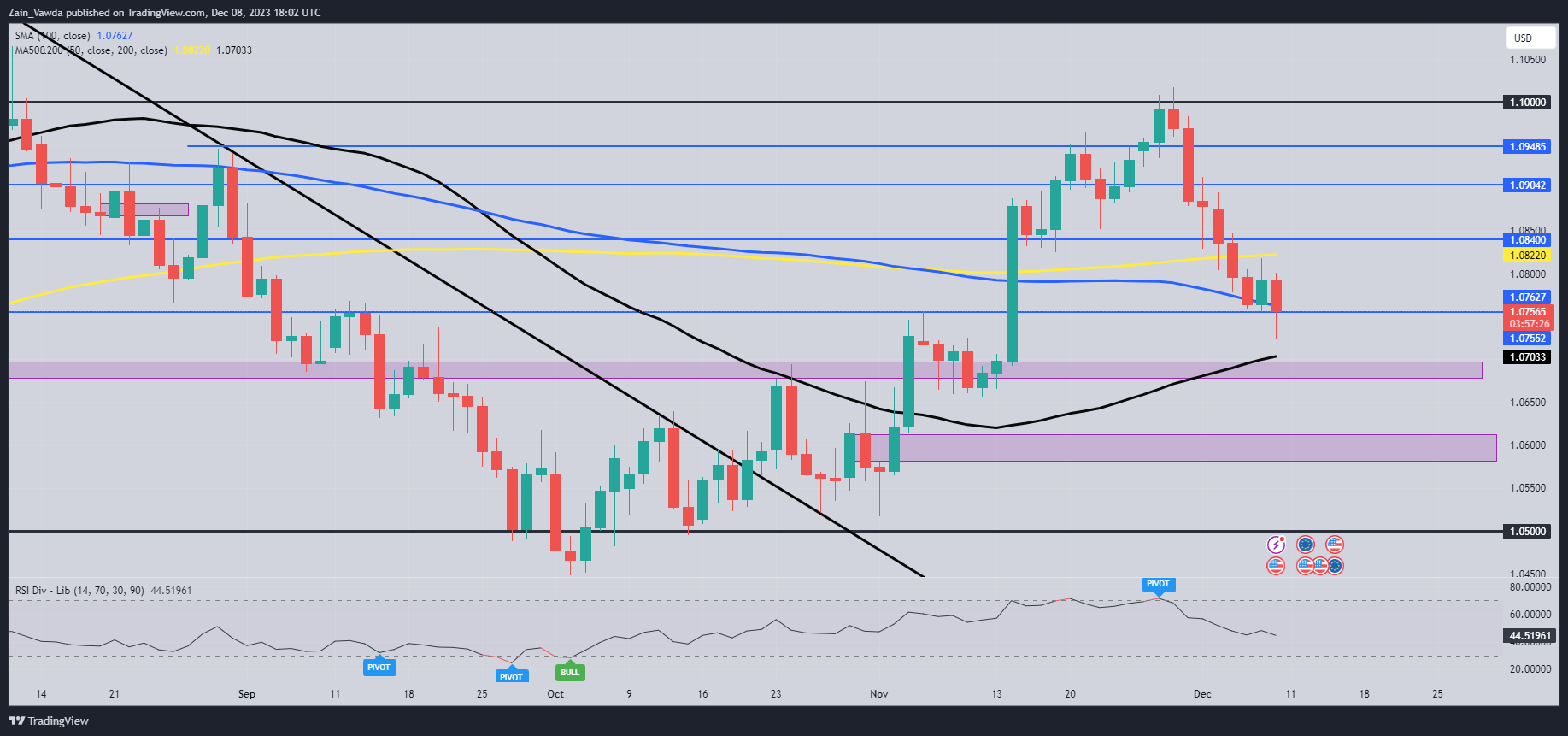

EURUSD

Looking at EURUSD and we remain resting at a key area of support with the weekly and daily candle closes key to what we can expect in the early part of the week. A close back below the support area could see the Euro lose further ground to the Greenback in the early part of the week. If we are to decline further, then immediate support rests at 1.0700 which also houses the 50-day MA. If we are to decline further there is a key area of support that rests around the 1.0600 handle.

A recovery in EURUSD next week faces immediate resistance provided by the 200-day MA resting at 1.0822 with another resistance level at 1.0840. A break higher brings the 1.0900 and potentially the psychological 1.1000 level into focus.

EUR/USD Daily Chart – December 8, 2023

Source: TradingView

EURCAD

EURCAD also rests at an interesting level which has a host of confluences. Heading into the new week and immediate support rests around the 1.4600-1.46200 area which houses both the 100 and 200-day MAs. As things stand, I am eyeing a potential bounce from here with a potential retest of the descending trendline my preferred destination in the early part of the week. Further supporting a bounce here is the golden cross pattern which happened this past week and hints at the potential for bullish momentum.

Alternatively, if we are to break below the 1.4600 handle we have some support around the 1.4520-1.4500 mark and further down at the 1.4462.

EUR/CAD Daily Chart – December 8, 2023

Source: TradingView

EURJPY

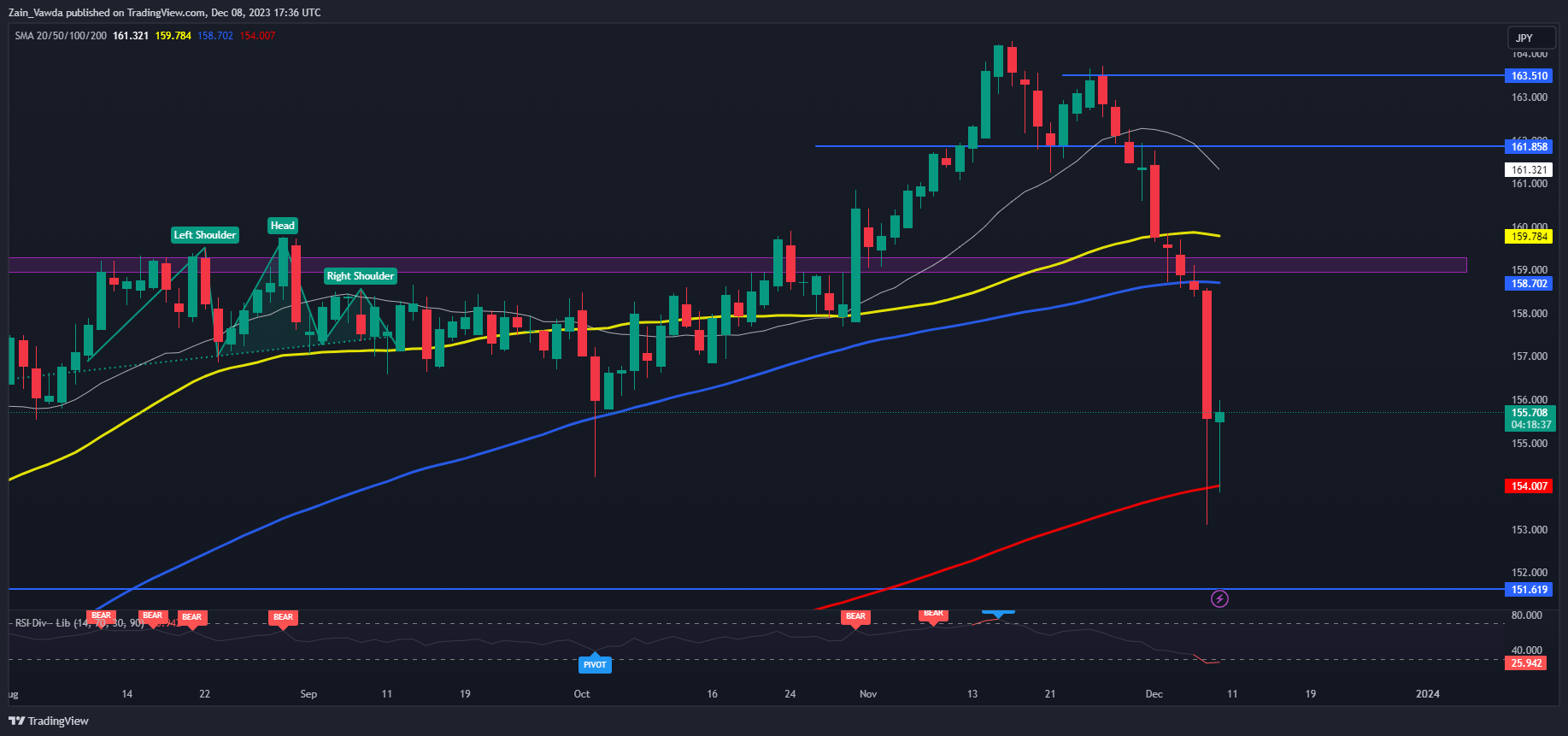

Looking at the technical perspective and EURJPY is at interesting level heading into next week. This week’s selloff brought EURJPY toward the 200-day MA at the 154.00 mark before bouncing quite aggressively and looking on course to end the day as a hammer candlestick.

This could lead to some early week gains ahead of the ECB meeting with the only risk to a recovery coming from any new comments from BoJ policymakers. Looking at key levels to keep an eye and immediate resistance rests at 156.72 before a retest of the 100-day MA around the 158.70 handle. There is a host of confluences resting between the 158.70-159.78 with the 100 and 200-day MA as well as the key resistance level at 159.00.

Alternatively, looking at the downside and support rests at the 154.00 handle with this week’s lows at 153.00 likely to prove a tough nut to crack. The last key area pf support I will be keeping an eye on will be the 151.61 area which served as support/resistance in both May and July.

EUR/JPY Daily Chart – December 8, 2023

Source: TradingView

| Change in | Longs | Shorts | OI |

| Daily | 21% | -14% | -10% |

| Weekly | -15% | -21% | -20% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda