Gold’s rally to six-year highs appears to be within the context of a terminal wave according to Elliott Wave Theory. DXY, EURUSD, and GBPUSD may be in the beginning stages of longer-term bear trend.

The video above is a recording of a US Opening Bell webinar from January 6, 2020. In this session, we covered the Elliott wave patterns for markets such as gold, DXY, EUR/USD, GBP/USD, USD/JPY, and S&P 500.

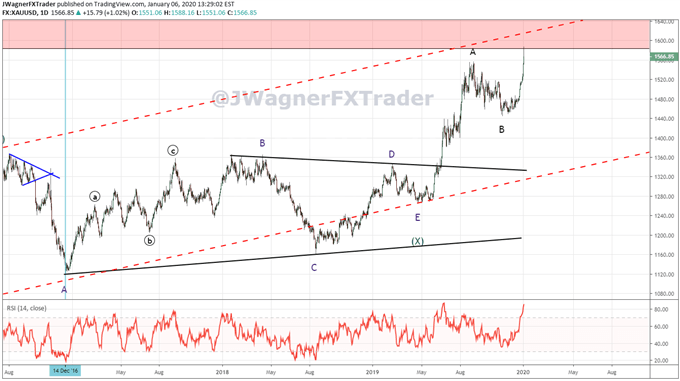

Gold Drives Higher into Elliott Wave relationships

Gold starts the new year by reaching up to six-year highs. Using Elliott Wave Theory as our guide, we believe this renewed strength will be temporary.

From 2015 to May 2019, gold grinded sideways in an Elliott Wave triangle pattern. Triangles tend to precede the last wave of a sequence. In this situation, we are viewing the rally as wave (Y) of a (W)-(X)-(Y) sequence. Therefore, this rally for the last part of 2019 is seen through the lense of a terminal rally.

We know that wave (Y) is subdividing as a Elliott wave zigzag pattern to be labeled A-B-C. The current rally in 2020 appears to be wave C. Therefore, the current Elliott wave in gold is best considered wave C of (Y), which are both terminal waves. A couple of price levels to watch out for include $1600, $1631 and $1731.

If this wave count is correct, then gold prices may soon reverse for a long correction back below $1,000.

You might be interested in…

Top gold trading strategies and tips

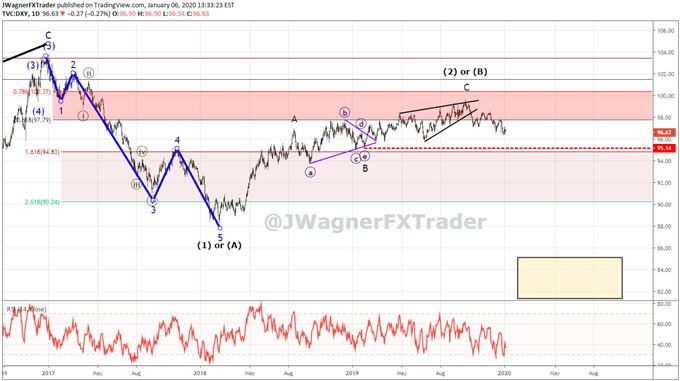

US Dollar Index in the early stages of larger correction?

US Dollar Index has weakened our previous webinar “US Dollar Progresses in Weaker Trend”. Using Elliott Wave Theory as our guide, it appears DXY is in the beginning stages of a longer-term downtrend that may have begun on October 1, 2019.

The initial targets in sight is around 94-95, though the potential for even lower levels at hand. The structure of the decline will tip its hand how large or a bounce to expect (if any). Longer-term, DXY might reach 80-85 while holding below 99.23.

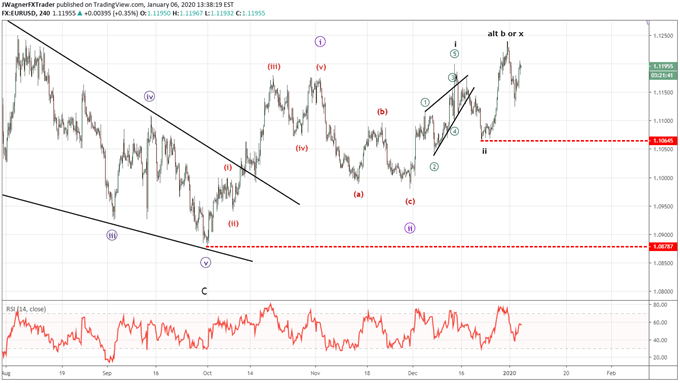

EUR/USD Technical Analysis: Rally Resumes

As most of the weighting of DXY is from EUR/USD, it makes sense for the EUR/USD price chart to have similar patterns to DXY. Indeed this is the case. On October 1, we issued a EUR/USD forecast for an eventual trade up to 1.18 and possibly higher levels. So far, this forecast is on schedule.

Wave ((ii)) appears to have ended on November 29. Therefore, the current advance has an impulsive structure to it and is likely the beginning stages of wave ((iii)). Evidence EUR/USD may be in wave ((iii)) is if the advance accelerates or rises in relentless fashion. With the holidays out of the way, the inability of EURUSD to rally relentlessly would be troubling.

Higher prices are still in view with EURUSD holding above 1.1065 on an near term scale and while holding above 1.0880 longer term.

---Written by Jeremy Wagner, CEWA-M

Jeremy Wagner is a Certified Elliott Wave Analyst with a Master’s designation. Jeremy provides Elliott Wave analysis on key markets as well as Elliott Wave educational resources. Read more of Jeremy’s Elliott Wave reports via his bio page.

Join Jeremy in his live US Opening Bell webinar where these markets and more are discussed through Elliott wave theory.

Learn more on Elliott wave including the rules and guidelines by grabbing these beginners and advanced Elliott Wave trading guides.

After reviewing the guides above, be sure to follow future Elliott Wave articles to see Elliott Wave Theory in action.

Follow Jeremy on Twitter at @JWagnerFXTrader .