- Technical trade setups we’re tracking into the start of the week

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

Euro, DXY, Aussie & Kiwi Testing Range Extremes

The majors have continued to hold broader consolidation / congestions patterns with numerous setups starting the week at-or-near range extremes. While the broader trends remain elusive, the levels are clear and heading into the start of the week the focus is on a reaction off these key thresholds. In this webinar we review updated technical setups on DXY, EUR/USD, AUD/USD, USD/CAD, EUR/NZD, NZD/USD, Gold, Crude Oil (WTI), GBP/USD, AUD/JPY and SPX.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Levels in Focus

DXY – Focus is on support at 96.84 backed by 96.63 (near-term bullish invalidation) Key resistance steady at the 2018 high-week close at 97.42 and the key 61.8% retracement at 97.87

EUR/USD – Initial resistance at 1.1321 backed by 1.1347- look for a bigger reaction there IF reached. Initial support at 1.1285 with near-term bullish invalidation at 1.1250.

USD/CAD – Focus is on a reaction at key support early in the week at 1.3298-1.3307. Initial resistance at 1.3384/87 with 1.3435/37 still critical. A downside break exposes 1.3234/48(broader bullish invalidation).

Gold – Price it is testing January trendline support (consolidation) – Near-term risk is lower sub-1291 with support eyed at 1280 backed by 1275/76- look for a bigger reaction there If reached. A topside breach looks to challenge 1300.

Crude Oil – Focus is on key critical confluence resistance at 63.68-64.40 –weekly close above is needed to keep the long-bias viable targeting 65 and beyond. Interim support at the 200DMA ~61.09backed by bullish invalidation at 60.06.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

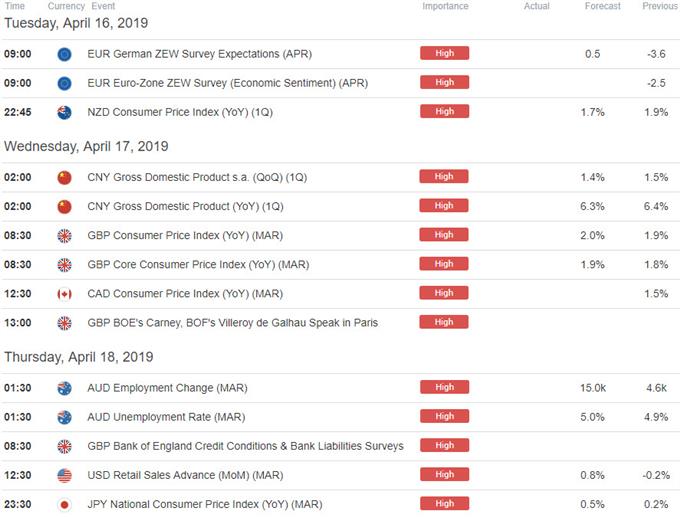

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- Aussie Price Outlook: Australian Dollar Breakout Faces First Test

- Canadian Dollar Price Outlook: USD/CAD Eyes Breakout as Loonie Coils

- Gold Price Outlook: XAU Reversal Targets Consolidation Resistance

- Euro Price Outlook: EUR/USD Trade Levels Ahead of ECB

- Sterling Price Outlook: Pound at Key Support as Brexit Saga Continues

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex

https://www.dailyfx.com/free_guide-tg.html?ref-author=Boutros