- Technical trade setups we’re tracking into the start of the week, month & quarter

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

DXY, Euro, Oil at Key Technical Levels

FX market digestion has continued into Q2, and this week’s economic calendar brings a flurry of drivers on Wednesday with the release of FOMC minutes and the European Central Bank. This is the first interest rate decision since the bank triggered a fresh round of TLTROs at the March meeting. There are several Majors trading into key technical levels early in the month and the focus is on possible exhaustion of the recent moves. The In this webinar we review updated technical setups on DXY, EURUSD, GBPUSD, AUDUSD, USDCAD, Gold, Crude Oil (WTI), SPX, NZDUSD, AUDNZD, DAX and EURJPY.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Levels in Focus

DXY – Focus is on the 2018 high-week close at 97.42 and the key 61.8% retracement at 97.87 – looking for possible exhaustion off one of these levels. Support at 96.84 backed by 96.63.

EURUSD – Initial topside resistance objectives at 1.1285 backed by 1.13 – look for a bigger reaction there IF reached. Support along the lower parallel / weekly open at 1.1214. Critical support still 1.1186 and 1.1131. (ECB on tap on Wednesday)

Gold – Price testing resistance here at 1302. Constructive near-term while above the weekly open at 1291. A topside breach targets 1307 backed by 1313 (broader bearish invalidation)

Crude Oil – Focus is on key resistance confluence at 63.57/68–weekly close above is needed to keep the long-bias viable targeting 65 and beyond. Interim support at the 200DMA ~61.35 backed by bullish invalidation at 60.06.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

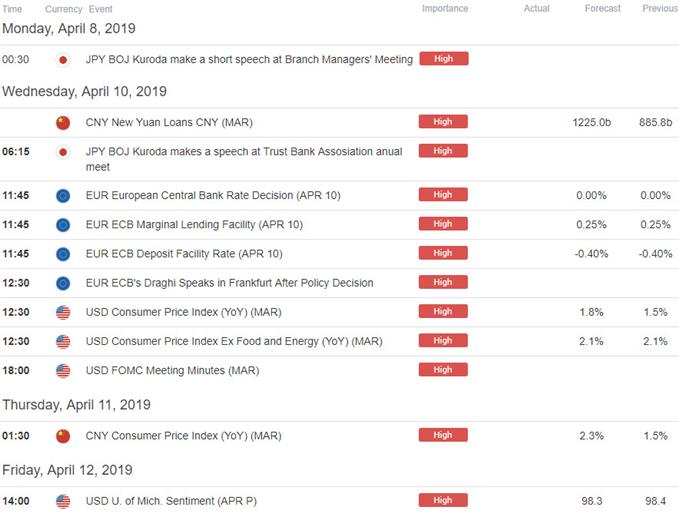

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- Gold Price Technical Outlook: GLD Targeting Yearly Open Support

- Euro Price Outlook: EUR/USD Sets Opening Range Above Critical Support

- Sterling Price Outlook: Pound at Key Support as Brexit Saga Continues

- Canadian Dollar Price Outlook: USD/CAD- Break or Bend, Monthly Highs

- Oil Price Outlook: Crude Breakout Battles 60- WTI Trade Levels

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex