DAX 30 Technical Highlights

- DAX powering back into major long-term resistance

- Makes for a sticky spot of trading again

- CAC at t-line resistance, underside of channel

Fresh quarterly forecasts are out, to see where our team of analysts see the Euro, DAX, and other markets are headed in the coming weeks, check out the DailyFX Q2 Trading Forecasts.

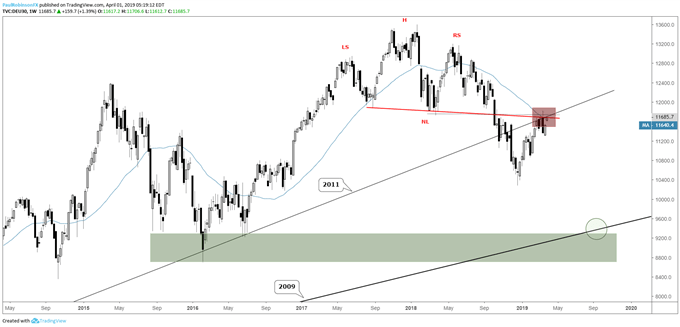

DAX powering back into major long-term resistance

In the last DAX technical update, I discussed the potential for the market to resume its broader trend lower after turning down sharply from long-term resistance and breaking intermediate-term trend support.

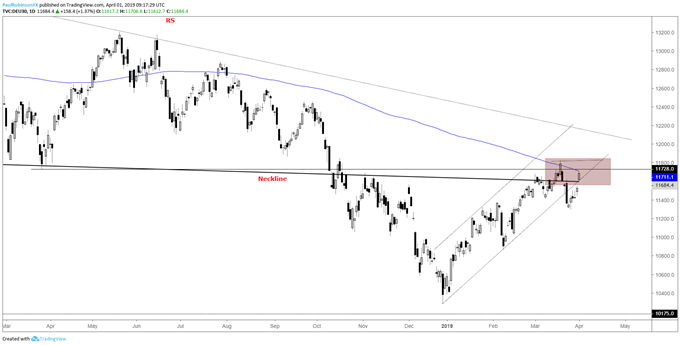

The resumption of lower prices from a big-picture standpoint could still certainly be in the works here soon, but that will depend on how this latest rally fares as once again long-term resistance is getting tested. The cross-road the DAX is at is quite important with it consisting of the neckline of the head-and-shoulders top, 2011 trend-line, 200-day MA, and March ’18 low.

Another turn lower will further fortify the 11700/900-area. To give it some legs though a new down-move will need to undercut last week’s low at 11300. If the DAX propels on through to the top-side, then the market will be invalidating resistance and possibly turning it into a source of strong support.

From a tactical standpoint, this is a tough spot. Running into a thicket of resistance gives longs little appeal and shorts have limited appeal in the absence of bearish price action suggesting sellers are ready to show up in earnest again. With a little more time, the market should offer better clarity and a scenario to work with…

DAX Weekly Chart (Major long-term resistance)

DAX Daily Chart (watch reaction here)

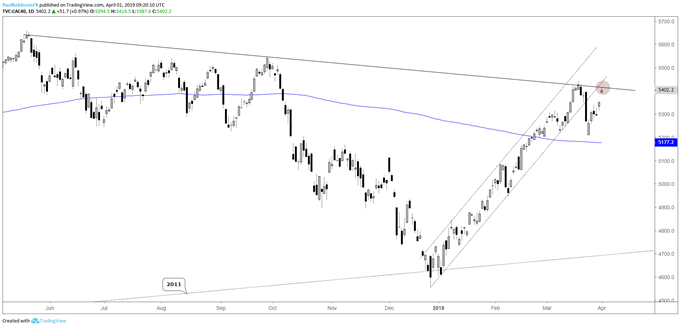

CAC trading at trend-line resistance, underside of channel

The CAC is back at trend-line resistance running lower from the May high that turned it down most recently. In conjunction with the t-line is the underside of the very tight channel that kept it guided higher off the December low. Resistance in the CAC along with where the DAX is trading may prove to at the least halt the current advance temporarily, if not turn into a meaningful high soon.

CAC Daily Chart (t-line/lower parallel resistance)

Want to learn more about trading the DAX? Check out ‘How to Trade the DAX’, and join me weekly for technical updates in the Indices and Commodities webinar.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX