GBPUSD Talking Points:

- GBPUSD has been on a wild ride already this week and that looks set to continue as Brexit dynamics are continuing to get priced-in to short-term GBPUSD price action.

- The bigger question here is whether trend potential shows in the coming days, with points of interest around 1.2900 for bearish themes and 1.3350 for bullish scenarios.

- DailyFX Forecasts are available on a variety of currencies such as the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Do you want to see how retail traders are currently trading GBPUSD? Check out our IG Client Sentiment Indicator.

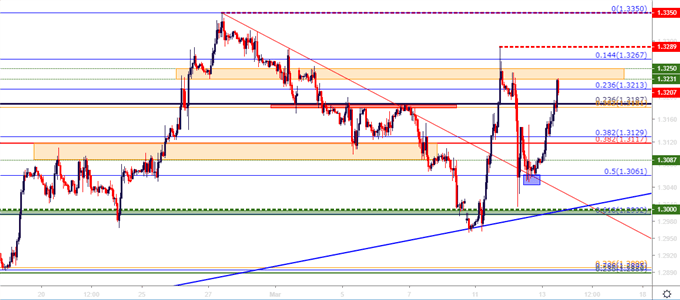

It’s been a busy week in the British Pound. GBPUSD found support at the 1.3000 handle to finish off last week, but after a quick-gap below support, prices ripped up to high of 1.3289 on Monday. That move soon fell flat as prices rushed back down towards 1.3000; followed by another topside push that’s currently seeing prices test above the 1.3200 handle again. All-in-all, it’s been a dizzying week so far for British Pound price action, and there isn’t yet an end in sight as another Brexit vote waits in the wings.

GBPUSD Hourly Price Chart

Chart prepared by James Stanley

GBPUSD Longer-Term Strategy

For traders looking to take directional stances in the currency, a bit of patience might be required as near-term price action is devoid of anything resembling a ‘clean’ trend.

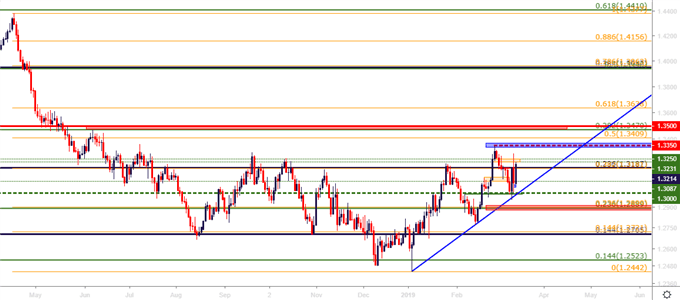

Taking a step back to look at the Daily chart can start to point to directional potential: The February high was a seven-month high and prices have held a series of higher-lows since the short-side spill that the pair put in to start this year’s trade. So, while many are likely ascribing bearish biases to the British Pound based on continued discord around Brexit, there may be a bullish case yet, especially considering dynamics in the US Dollar. Key for this theme will be prices re-engaging with the 1.3350 level that turned around last month’s bullish advance. There may be a bit of resistance overhead, however, as the 1.3500 level is a confluent zone that offers a multiple reasons for sellers to re-appear.

On the underside of price action, the 1.3000 zone remains key; however, given the fact that prices have been very recently testing-below this level, it may not be the best area to plot for starting bearish long-term strategies. Traders may instead want to wait for a test below the confluent support area around 1.2900, which was last in play four weeks ago, as this could be seen as greater proof that a larger bearish theme may soon follow.

GBPUSD Daily Price Chart

Chart prepared by James Stanley

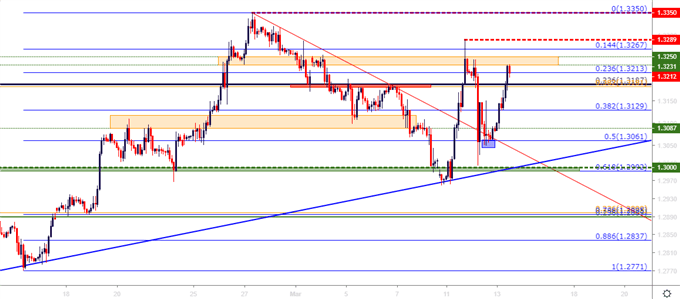

GBPUSD Near-Term

This will likely remain a difficult theme to work with given the sheer unpredictable nature of Brexit headlines and, in-turn, GBPUSD short-term price action. But, as mentioned in these pieces in the recent past, traders that do want to utilize short-term strategies on GBPUSD may want to focus on keeping time of exposure limited, using tight stops so that if wrong, the loss could be quickly mitigated. But, this is not a theme that should be taken lightly; as illustrated over the past few days, volatility is likely here in the near-term for GBPUSD.

GBPUSD Two-Hour Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a plethora of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX