GBPUSD Price, Volatility and Pivot Points

- GBPUSD underpinned but one-hour chart warns of overbought conditions.

- Sterling volatility slips lower but remains elevated.

Q1 2019 GBP Forecast and USD Top Trading Opportunities

Sterling remains relatively unfussed after UK PM May’s Brexit bill was voted down again in Parliament last night, by a lesser but still large margin of 149 votes. The prevailing view is that the UK will take No Deal off the table in tonight’s vote and ask the EU for an extension of Article 50, a request that is likely to be granted if the UK can show progress to the EU 27. The British Pound’s performance over the last two-and-a-half years has been predicated on Brexit fears and with fears receding of a hard Brexit, the fundamental background for GBP remains supportive.

GBPUSD Price: Brexit Deadline Extension Could be Good for Sterling.

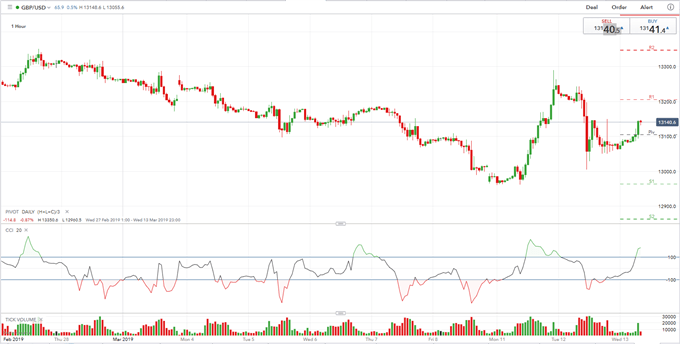

A look at the hourly chart shows that GBPUSD may be pushing a little bit ahead of itself with the CCI indicator in overbought territory, warning of a potential move lower. Pivot is currently at 1.3105 with first support (S1) at 1.2963 ahead of S2 at 1.2863. To the upside, initial resistance (R1) is at 1.3205 ahead of R2 at 1.3347.

GBP Fundamental Forecast: A Critical Week of Brexit Votes.

GBPUSD One-Hour Price Chart (February – March 13, 2019)

GBP one-week volatility has dropped after last night’s Brexit vote but remains elevated ahead of tonight’s and tomorrow’s votes. If No Deal is taken off the table, vol is expected to move lower but caution is advised moving forward, especially with UK PM May’s leadership looking increasingly untenable.

Retail traders are 61.1% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however currently suggest a stronger bearish trading bias for GBPUSD.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBPUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.