Australian Dollar Technical Price Outlook: AUD/USD Weekly Trade Levels

- Australian Dollar technical trade level update - Weekly Chart

- AUD/USD rally probing multi-year downtrend resistance at multi-month highs

- Aussie recovery vulnerable near-term sub-7329 – key support steady at 7016

The Australian Dollar rallied more than 0.60% against the US Dollar this week with AUD/USD trading just above the 73-handle in early US trade on Friday. The rally takes Aussie back into a key technical barrier we’ve been tracking for weeks now and while the broader focus remains constructive, the advance is vulnerable while below this resistance zone heading into the close of the month – we’re looking for inflection here. These are the updated targets and invalidation levels that matter on the AUD/USD weekly price chart. for an in-depth breakdown of this Aussie trade setup and more.

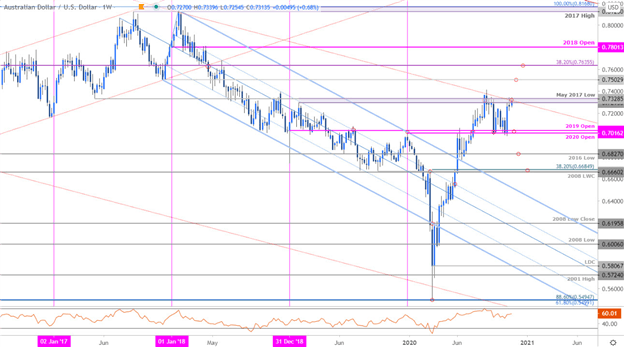

Australian Dollar Price Chart – AUD/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; AUD/USD on Tradingview

Notes:In my last Australian Dollar Weekly Price Outlook we noted that Aussie was, “testing a key technical confluence at multi-year downtrend resistance – elevated risk for inflection off this threshold with the post-election rally vulnerable while below.” AUD/USD has continued to trade into this critical resistance threshold with the rally capped by the 2019 high / May 2017 low at 7295-7329 – a breach / weekly close above this threshold is needed to keep the long-bias viable with such a scenario likely to fuel an accelerated breakout towards the yearly high at 7413 backed by 7503 and the 38.2% Fibonacci retracement of the 2011 decline at 7635.

Weekly support remains steady at the 2020/2019 objective yearly opens at 7016/42- a break /close below this threshold would be needed to shift the broader focus lower again towards the 2016 low at 6827 and key support at the 2008 low-week close / 2019 low / 38.2% retracement at 6660/84.

Bottom line: The Australian Dollar is once again testing a multi-year downtrend resistance confluence – bulls are vulnerable sub-7329. From a trading standpoint, a good zone to reduce long-exposure/ raise protective stop – be on the lookout for possible topside exhaustion while below this threshold with a break below the monthly open 7125 needed to shift the focus back towards the range lows. Ultimately, a pullback here may offer more favorable entries with a topside breach exposing the yearly highs. Review my latest Australian Dollar Price Outlook for a closer look at the near-term AUD/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

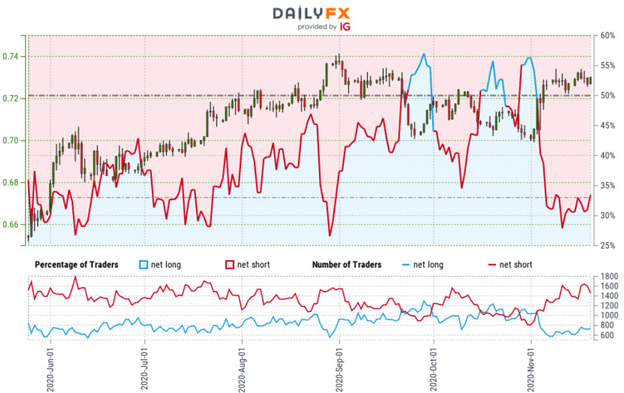

Australian Dollar Trader Sentiment – AUD/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-long AUD/USD - the ratio stands at -2.12 (32.03% of traders are long) – bullishreading

- Long positions are 0.41% lower than yesterday and 1.98% higher from last week

- Short positions are0.79% higher than yesterday and 5.09% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger AUD/USD-bullish contrarian trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

---

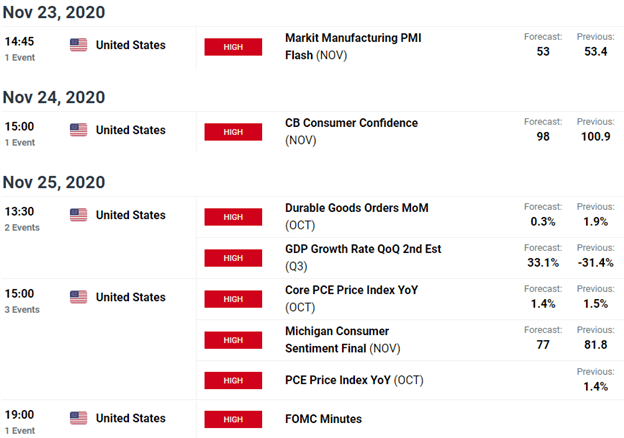

Key Australia / US Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

- Canadian Dollar (USD/CAD)

- Gold (XAU/USD)

- Sterling (GBP/USD)

- US Dollar (DXY)

- Euro (EUR/USD)

- Japanese Yen (USD/JPY)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex