USDCAD, EURCAD, CADJPY PRICE ACTION SETUPS

- The Canadian Dollar is beginning to show signs of technical weakness

- USDCAD and EURCAD are catching bid off critical support levels while CADJPY is edging lower after hitting a key area of resistance

- New to forex trading? Download this free Forex for Beginners educational guide covering all the basics you need to know

During Friday’s trading session, we highlighted how spot USDCAD price chart outlook seemed primed to test its critical support level above the 1.3000 handle. Canadian Dollar bulls have already begun to show signs of shying away from this major zone of confluence which dates back several years. In fact, spot USDCAD is already ripping higher to kick off the week as forex traders bid up the currency pair. Meanwhile, spot EURCAD is also gaining ground while spot CADJPY is starting to sink.

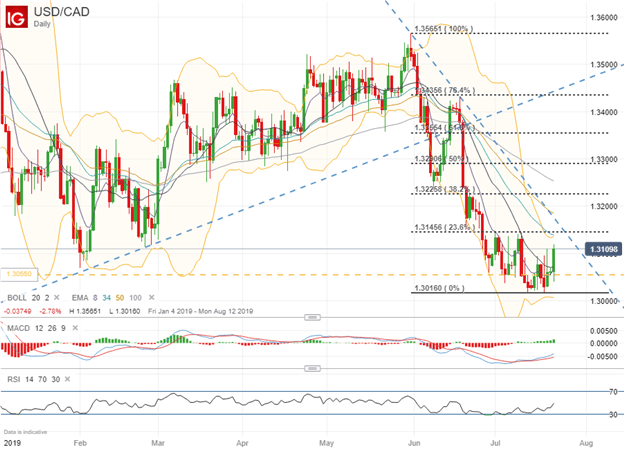

SPOT USDCAD PRICE CHART: DAILY TIME FRAME (JANUARY 04, 2019 TO JULY 22, 2019)

While spot USDCAD bulls could push the FX rate higher to test technical resistance posed by the 23.6% Fibonacci retracement of the recent slide lower since June, the overarching bearish downtrend line still appears unbroken. Yet, with the RSI and short-term moving averages turning higher, the risk of spot USDCAD continuing its climb off support remains. If the 23.6% Fib level can be overcome, however, the door to 1.3200 could open up quickly. Conversely, a rejection at this area of technical resistance could cue up a retest of the major support level around the 1.3000 handle.

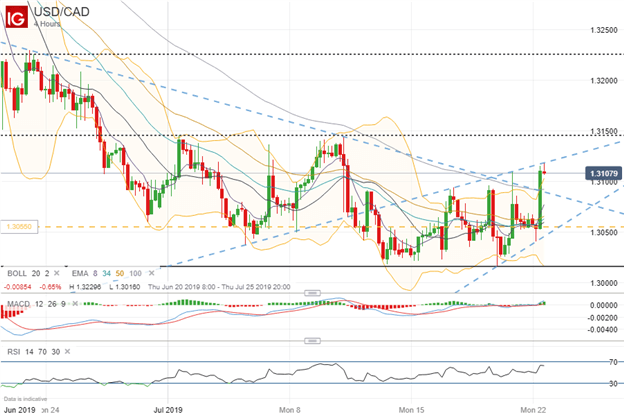

SPOT USDCAD PRICE CHART: 4-HOUR TIME FRAME (JUNE 20, 2019 TO JULY 22, 2019)

Zooming in a bit to 4-hour candles on the spot USDCAD price chart, a possible bearish rising wedge could be developing in the short-term as the currency rate approaches 1.3150 – the 23.6% Fib level highlighted above. If confirmed, a scenario where spot USDCAD retests the area of technical support around 1.3050 cannot be dismissed, which may serve constructive for a bullish reversal if price action fails to push spot prices below this area of confluence for a third time.

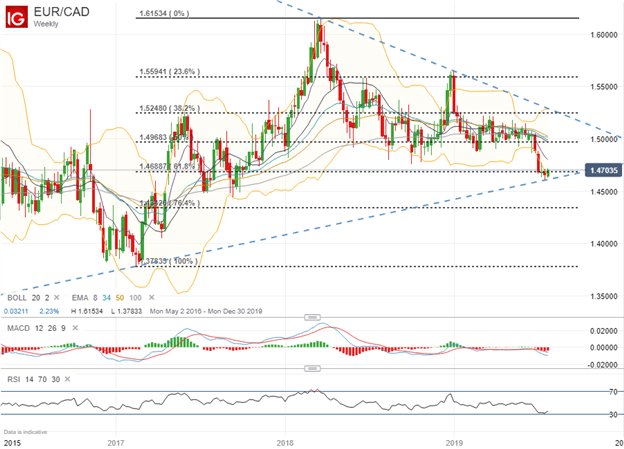

SPOT EURCAD PRICE CHART: WEEKLY TIME FRAME (MAY 1, 2016 TO JULY 22, 2019)

Spot EURCAD also is gaining noticeably as the currency pair catches bid off technical support from the 61.8% Fibonacci retracement level of its trading range dating back to 2017 – another noteworthy area of confluence which could keep spot EURCAD afloat. Holding this major price level will likely prove crucial for spot EURCAD bulls to maintain their bias.

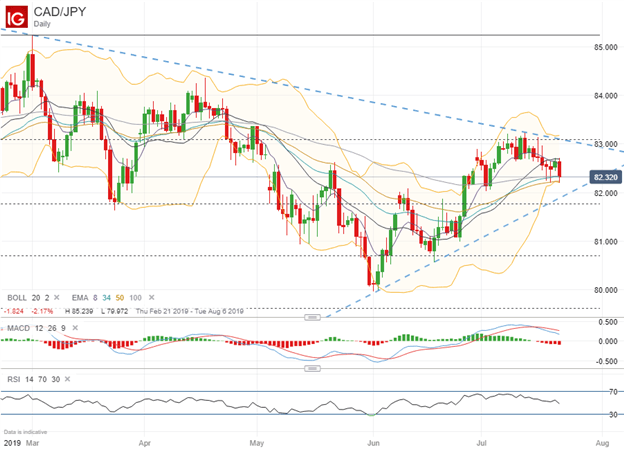

SPOT CADJPY PRICE CHART: DAILY TIME FRAME (FEBRUARY 21, 2019 TO JULY 22, 2019)

Meanwhile, spot CADJPY has already begun to drift lower with the Canadian Dollar weakening against the sentiment-geared Japanese Yen. A rejection at the 23.6% Fibonacci retracement level around the 83.000 handle earlier this month reiterates the broader downtrend in spot CADJPY. Spot CADJPY could continue to wedge between support from the short-term bullish trend line and resistance from the long-term bearish trend line.

FOREX TRADING RESOURCES

- Download the Q3 DailyFX Forecasts for comprehensive fundamental and technical analysis on major currencies like the US Dollar and Euro in addition to equities, gold and oil

- Sign up for Live Webinar Coverage of the financial markets hosted by DailyFX analysts where you can have all your trading questions answered in real time

- Find out how IG Client Sentiment data can be used to identify potential forex trading opportunities

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight