BOC Rate Decision Talking Points:

- BOC held rates following historical jobs report.

- The Canadian Dollar shows signs of weakness following this morning’s decision.

- USD/CAD breaks above trendline resistance and 1.4000 big level ahead of release.

Bank of Canada Hold Rates Steady in April

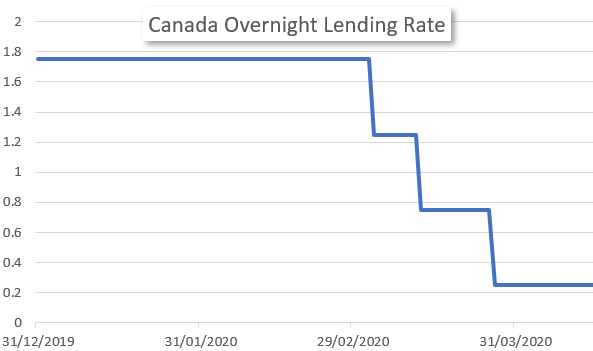

Canada’s central bank held the benchmark overnight lending rate steady at 0.25% this morning - in line with the expectation. Canada’s overnight rate is now 1.50% lower than it was prior to the initial cut in early March.

Chart Prepared by Austin Sealey; Canada Overnight Lending Rate

Following the emergency rate cut to close Q1, BOC has remained steady at 0.25% in a decision to avoid further approaching a negative rate. While rates have held, the much anticipated OPEC+ deal to cut some 20M B/D has done little to calm investor’s worries over the battered commodity. This could be a driver for CAD weakness as the month continues to unfold.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

USD/CAD Four-Hour Price Chart

Chart Prepared by Austin Sealey; USD/CAD on TradingView

Although the Canadian Dollar has been continuing to show strength since late March, certain markets such as CAD/JPY have begun to unravel. USD/CAD has been putting in lower highs and lower lows for the better portion of the past month; meanwhile, CAD/JPY has still remained nearly 2.5% off of March highs. That being said, the Canadian Dollar has nonetheless broken under much macro pressure. After retesting monthly lows, USD/CAD price action appeared to be forming a double bottom pattern, and is currently 1.70% above monthly lows.

--Written by Austin Sealey, Contributor for DailyFX.com