CANADIAN DOLLAR PRESSURED AFTER BOC DECISION TO CUT RATES BY 50-BPS

- The Bank of Canada (BOC) has finally capitulated to dovish market expectations and cut its policy interest rate target by 50-bps to 1.25%

- USD/CAD price action ripped higher while spot CAD/JPY took a plunge as the Canadian Dollar comes under pressure following the latest BOC decision to cut rates

- The BOC has not lowered its benchmark interest rate since July 2015 but now joins the collection of global central banks providing accommodative monetary policy

The Canadian Dollar is crumbling in response to the latest BOC decision that just crossed the wires. The Bank of Canada, championed by Governor Stephen Poloz, announced that the central bank cut its benchmark interest rate by 0.5% from the previous 1.75% level.

This was the first time that the BOC cut rates since July 2015 and first 50-bps cut since March 2009. According to the press release accompanying this morning’s interest rate decision, the Bank of Canada acknowledged that “the first quarter of 2020 will be weaker than originally expected.”

The BOC also noted how the recent drag on economic activity across Canada – largely due to the novel coronavirus outbreak and widespread railroad traffic disruptions – could weigh on BOC outlook further if sustained.

Learn more: Impact of Virus Outbreaks on Markets

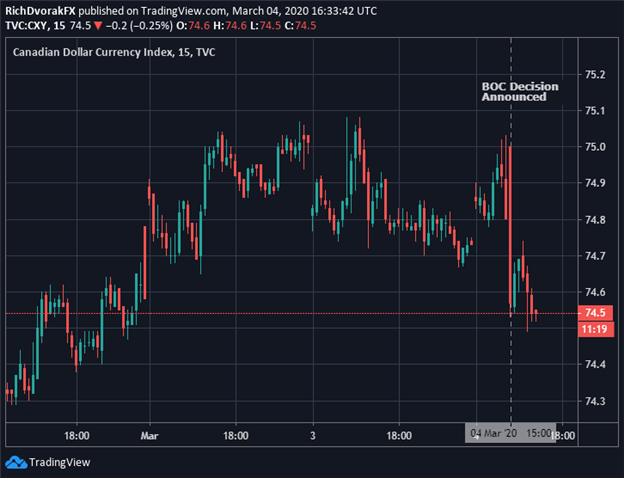

CANADIAN DOLLAR INDEX PRICE CHART: 15-MINUTE TIME FRAME (MARCH 04, 2020)

Chart created by @RichDvorakFX with TradingView

The move was largely expected by traders, however, considering that overnight swaps priced in 43-bps of easing prior to this morning’s rate decision from the BOC.

Nevertheless, the Canadian Dollar Currency Index (CXY) took a sharp drop immediately after the Bank of Canada announced that it cut rates by 50-bps, which was more than the median economist estimate calling for a less-aggressive 0.25% cut.

CAD price action has potential to slide further now that the BOC Governing Council has officially joinedother major central banks providingaccommodative monetary policy since capitulating to dovish market expectations.

This is seeing that the BOC decision today opens up the door to more interest rate cuts down the road, which is in consideration of the latest forward guidance provided by the Bank of Canada.

Specifically, Stephen Poloz and the BOC Governing Council noted in this morning’s press release that the central bank “stands ready to adjust monetary policy further if required to support economic growth and keep inflation on target.”

USD/CAD PRICE CHART: 1-HOUR TIME FRAME (MARCH 04, 2020)

USD/CAD price action spiked higher into the 1.3400 handle following the BOC rate cut. The Canadian Dollar might falter further against its US Dollar counterpart with spot USD/CAD showing potential of testing year-to-date highs around the 1.3460 mark.

| Change in | Longs | Shorts | OI |

| Daily | 9% | -20% | -8% |

| Weekly | 45% | -25% | -3% |

Another possible level of technical resistance could be around the 1.3439 price. This area is the upper barrier of the options-implied trading range for USD/CAD derived from overnight options contracts, which was outlined in this US Dollar forecast published yesterday.

CAD/JPY PRICE CHART: 1-HOUR TIME FRAME (MARCH 04, 2020)

Spot CAD/JPY took a 40-pip spill down to the 80.000 level immediately after the BOC interest rate decision, which completely erased gains notched earlier during Wednesday’s trading session. Likewise, the Canadian Dollar is now lower on the day relative to most other major currency pairs.

As such, spot CAD/JPY might look toward the October 03 and August 25 intraday swing lows printed last year, likely driven by a bogged down Canadian Dollar and inflated BOC rate cut bets, if Loonie bears can breach the 80.000 price level.

Keep Reading: US Dollar, Dow & Gold React as Fed Delivers Shock 50bps Cut

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight