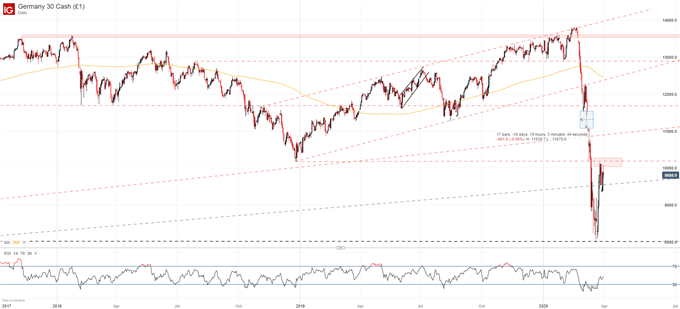

DAX 30 Forecast:

- The DAX 30 fell roughly -40% from the February 19 high to the March 19 low

- Bulls have been unable to break above resistance derived from the December 2018 lows

- How to Trade Dax 30: Trading Strategies and Tips

DAX 30 Price Outlook: Technical Traders Look to Overcome Resistance

After closely following technical developments on the DAX 30 chart for months, the abrupt and severe decline that occurred over the last thirty days was shocking to watch. Prior to the crash, significant price developments occurred in weeks or months – not minutes. However, given the unprecedented fundamental themes at play it is rather unsurprising – in hindsight – that volatility spiked, and price fell lower, although the pace of declines remains truly remarkable.

Nasdaq 100, DAX 30, Nikkei 225 Technical Forecasts

Nevertheless, recent price action on the DAX 30 and other equity indices has displayed a degree of normalcy that the market has not enjoyed since mid-February. Consequently, technical breaks may require more time to materialize than they did in the last few weeks and charting the levels at play may create opportunities for a range of trading styles. Still, volatility remains elevated and the unparalleled economic threat of coronavirus will see uncertainty persist which, in turn, creates a difficult backdrop for harboring directional biases.

DAX 30 Price Chart: Daily Time Frame (October 2017 – March 2020)

That being said, the DAX 30 price chart remains one of my favorites from a technical perspective and highlighting major levels may prove useful when looking to capitalize on attractive opportunities from a risk-reward standpoint. To that end, recent price action reveals the current attempt at a recovery has stalled out narrowly beneath the trendline originating from the December 2018 lows.

For the time being, it seems this area has become an early barrier to a continuation higher and surmounting it may allow bulls to target subsequent resistance around the rising trendline from 2011 – currently around 11,100. Critically, a significant gap exists directly north of the level which may allow for a quick surge higher if risk appetite continues and technical traders look to capitalize on the open air.

Conversely, a return of risk aversion may see the DAX retest support beneath – namely the trendline nearby which traces its origin to 2009. Since price action around the level has become rather messy, considering a possible zone of support from 9,360 to 9,530 may be more appropriate than a single mark. Secondary support will look to reside at 8,000 and has effectively become the “line in the sand” for warding off further losses. If crossed, sellers may look to pressure price lower. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX