AUSTRALIAN DOLLAR PRICE OUTLOOK: AUDUSD, AUDJPY & GBPAUD

- The Australian Dollar could be at risk of reversing gains recorded so far this month if the recent ‘phase 1’ US-China trade agreement fails to be finalized

- AUDUSD and AUDJPY might find buoyancy around major technical levels while GBPAUD has potential to pivot back toward trend support

- Check out our free Trading Guides & Forecasts available for download

I noted a week ago that the Australian Dollar hinged on US-China trade talks. Subsequently, AUD price action climbed broadly as markets digested the latest trade war headlines which pointed to improving trade relations between Washington and Beijing. Despite news of a ‘phase 1’ trade agreement detailed by President Trump, who will remove the 5% tariff tranche initially slated to go into effect on October 15, China has yet to match the US’ language of a “preliminary deal” or “phase 1 trade agreement.”

Also, stickier issues like Huawei licensing and intellectual property theft remain unresolved while the tariff hike scheduled for December is still on the table. As such, the Australian Dollar remains at risk of reversing lower considering the potential that US-China trade talk progress takes a turn for the worse like it has many times in the past.

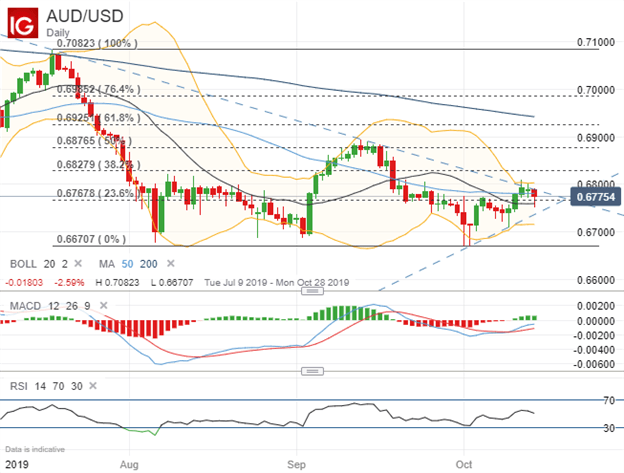

AUDUSD PRICE CHART: DAILY TIME FRAME (JULY 09, 2019 TO OCTOBER 14, 2019)

Spot AUDUSD price action is still gravitating around its bearish trendline extended from the lower intraday swing highs printed on July 18 and September 12. Over the last three trading sessions we see evidence of the 0.6800 price level proving to be a major level of technical confluence that could once again keep Australian Dollar upside at bay.

Although, AUDUSD trades above its 20-day and 50-day simple moving averages, which could provide a positive tailwind for spot prices. Nevertheless, breaking below uptrend support extended from the higher lows recorded so far this month and 23.6% Fibonacci retracement of the Australian Dollar’s trading range since mid-July could expose AUDUSD to fresh lows.

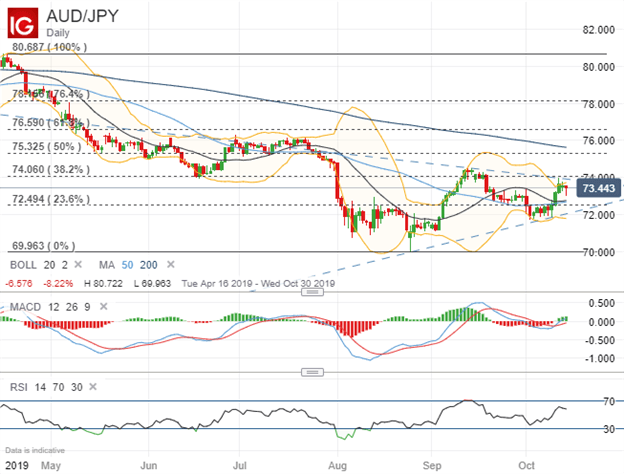

AUDJPY PRICE CHART: DAILY TIME FRAME (APRIL 15, 2019 TO OCTOBER 14, 2019)

The recent rebound in AUDJPY is also showing signs of subsiding as the Aussie-Yen turns lower after touching confluent resistance near the 74.000 handle. This price level is underscored by the 38.2% Fib retracement of AUDJPY’s trading range since April.

That said, the 20-day and 50-day SMA as well as the 23.6% Fib could provide support for the Australian Dollar. If the 72.000 price level gives way, however, a retest of the August 25 swing low could be in the cards. This bearish scenario likely warrants more credence if US-China trade deal hopes fail to last.

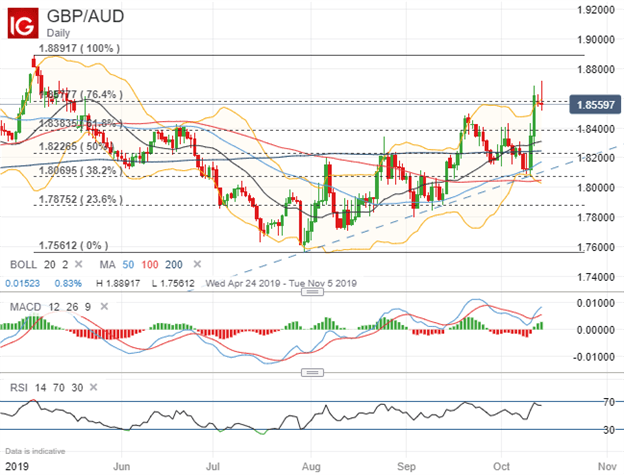

GBPAUD PRICE CHART: DAILY TIME FRAME (APRIL 24, 2019 TO OCTOBER 14, 2019)

The rally in the Australian Dollar is less observable when looking at spot GBPAUD price action owing to the British Pound’s surge as Brexit deal hopes rise. The jump in GBPAUD over the last few trading sessions has pushed spot prices above its upper Bollinger Band, which statistically speaking, should only occur 2.5% of the time. Yet, if spot GBPAUD can cling onto its 76.4% Fibonacci retracement of its trading range since May, prices could continue higher seeing that another Brexit delay is likely. This could open the door to potentially target fresh year-to-date highs.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight