MARKET DEVELOPMENT – Trade War Latest: China Pledges to Retaliate, JPY Rises

DailyFX 2019 FX Trading Forecasts

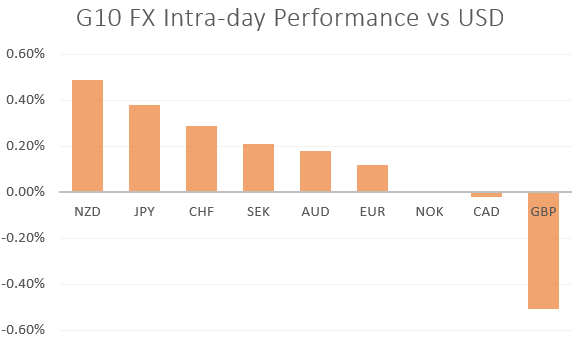

Risk sentiment has deteriorated as the likelihood of a US-China interim trade deal and a Brexit deal fades. Consequently, safe-haven flows have lifted JPY, CHF and Gold, while GBP is the notable underperformer. On the US-China trade front, optimism regarding constructive talks between the US and China had eased following China’s pledge to retaliate over the US placing 8 tech companies on the US blacklist. Alongside this, reports in SCMP highlighted that Chinese delegates had been planning to cut short their stay in the US, consequently toning down expectations ahead of the October 10-11th talks. Equity markets had taken a further hit on the back of reports that the Trump administration had been moving ahead with discussions around possible restrictions on capital flows in China.

GBP/USD faces a reality check as differences between the UK and EU risk sparking a collapse in Brexit talks with Chancellor Merkel stating that a deal if “overwhelmingly unlikely” if Northern Ireland is not staying in the customs union. As such, GBP has been on the defensive against its major counterparts, most notably the Japanese Yen.

New Zealand Dollar is the top performer despite the pullback in risk sentiment. As we have highlighted in the weekly speculative CFTC report, investor net shorts in the Kiwi are at extreme levels, thus leaving NZD/USD at risk of a snap-back higher. However, equity markets notably weak amid the concerns surrounding US-China trade talks, this may continue to bode well for an AUD/NZD pullback, in which support is seen at 1.0630.

Source: DailyFX, Refinitiv

WHAT’S DRIVING MARKETS TODAY

- “Gold Price Forecast: Bid Revived on US-China Trade Spat” by Nick Cawley, Market Analyst

- “Brexit Latest: GBP/USD Drops with Brexit Talks Close to Breaking Down” by Justin McQueen, Market Analyst

- “USD/CAD, EUR/CAD Price: In Limbo After Failing Nearby Reversal Zone” by Mahmoud Alkudsi, Market Analyst

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX