Japanese Yen, BoJ Inflation Target, Talking Points:

- The Yen has risen as a counter-cyclical haven play

- Nothing unusual about that, but it has done so when inflation in Japan was already decelerating

- The Bank of Japan’s official target looks less and less plausible

Find out what retail foreign exchange traders make of the Japanese Yen’s chances right now at the DailyFX Sentiment Page

The Japanese Yen has played its customary haven role as the financial world frets US-China trade war and bond-market soothsayers see global recession in the yield curve.

Could Yen strengthnow be a headache too far for the Bank of Japan?

The currency has been the closest thing to a fixed point markets get in a shifting and volatile post-crisis landscape. That’s because it is perhaps uniquely immune to economic developments in its home country for one very clear reason; they have no bearing at all on monetary policy.

A strong manufacturing or consumer confidence number in their respective countries, say, may well lift the US Dollar, or the British Pound, as markets place bets that interest rates are more likely to rise as a result.

Not so in Japan. The Bank of Japan has been resolute in its policy stance: no change to extraordinary monetary accommodation until consumer price inflation sustainably hits 2%. Inflation is therefore the only variable which counts.

Japanese Inflation Just Won’t Play

The trouble is that, for its part, consumer price inflation has been utterly disinclined to respond.

It’s been below 2% now since 2015, and in ten years has only topped it for a brief period in that year and the one before. It’s latest showing, for July, was 0.4%. That’s an annualized rate. Prices have been decelerating for four months.

All the while the BoJ has deployed the full armament of stimulus: negative interest rates, control of bond yields and asset purchases to the point where its balance sheet tops Japan’s entire Gross Domestic Product.

In 2018 BoJ Governor Haruhiko Kuroda said there was a ‘high chance’ that inflation could hit the target this year.

In fact there’s no chance.

Officially of course all is well. That 2% inflation target stays and the BoJ insists that is has the tools to hit it.

The reality looks rather different. The target is getting further away, with reports occasionally filtering out of increasing disquiet in banking and academic at the side effects of even trying to hit it.

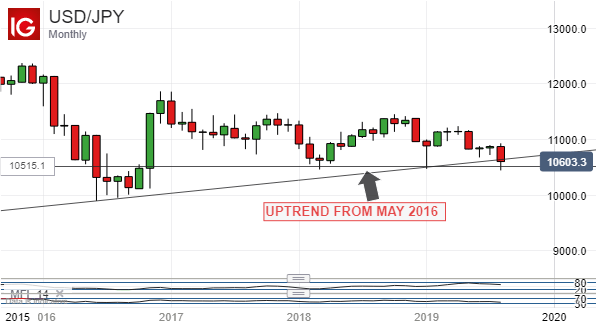

The US Dollar now looks set to break below an uptrend which has been clear on its monthly chart since May 2016. A sustained bout of Yen strength would see Japanese inflation head even lower, that inflation target look ever-more out of reach.

The Japanese Ministry of Finance said this week that it was watching Yen moves ‘with urgency.’

You bet it is.

Japanese Yen Resources For Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!