GOLD PRICE, GOLD VOLATILITY, JULY FED MEETING – SUMMARY POINTS

- Gold prices turn to the July Fed meeting for its next move

- Rising gold price volatility suggests XAUUSD could continue to climb

- Check out the Top Strategies and Tips on How to Trade Gold

Gold prices have soared well over 12% so far this year driven largely by safe-haven demand and plummeting interest rates amid trade war fears and slowing GDP growth. While gold traders will likely turn to the July Fed meeting for clues on where spot prices will head next, gold price volatility could be suggesting that the precious metal will continue its ascent.

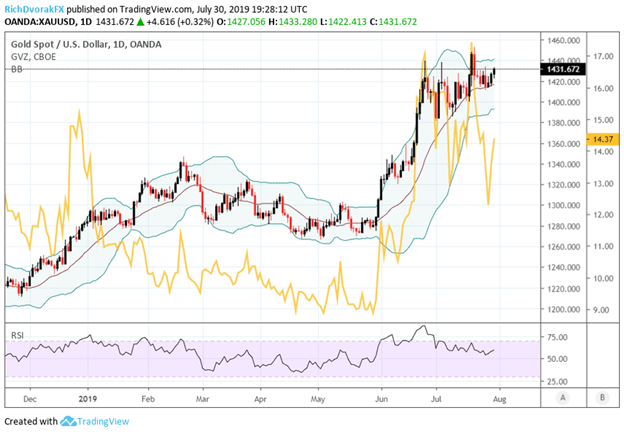

SPOT GOLD (XAUUSD) AND GOLD PRICE VOLATILITY (GVZ) CHART: DAILY TIME FRAME (NOVEMBER 20, 2018 TO JULY 30, 2019)

Gold price volatility – also referred to by its ticker symbol “GVZ” – is a measure of market’s expected 30-day price movement in the SPDR Gold ETF (ticker symbol GLD). Unlike most asset classes, spot gold prices typically benefit from rising volatility. This mostly-positive relationship between spot gold and gold price volatility is depicted in the chart above.

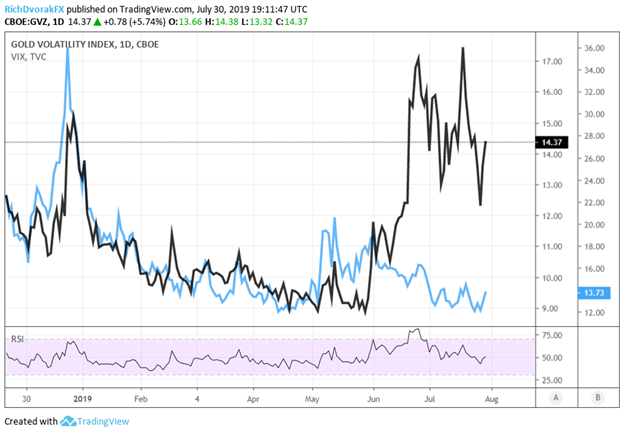

GOLD PRICE VOLATILITY (GVZ) AND VIX INDEX PRICE CHART: DAILY TIME FRAME (NOVEMBER 20, 2018 TO JULY 30, 2019)

Also, further gold price volatility is suggested by the recent rise in the VIX Index – Cboe’s 30-day implied volatility reading on the S&P 500 – due to their generally high degree of correlation. If the July Fed meeting disappoints markets with the central bank refusing to capitulate to the lofty rate cut expectations currently priced in, that could cause a jump in the VIX which would likely follow a selloff in risk assets. In turn, spot gold prices could catch a safe-haven bid. Accordingly, if volatility extends its climb following the July Fed meeting, measured via GVZ or VIX, it will likely bode well for spot gold prices.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight